PrinciplesofHedgingLivestock

UsingFuturesMarkets

BrianCoffey

KSURiskandProfitConference

Manhattan,KS

August16Ŋ17,2018

HedgingConcepts

Hedgingallowssellersorbuyersofaproducttomanagetherisk

associatedwiththesaleorpurchaseofthatproduct

Ahedgeinvolvesequal andopposite positionsincash and

futures markets

Hedgingreducespriceriskbecausethesepositionsoffseteach

other—ifonegains,theotherloses

Forourpurposeskeep

inmind…hedgingispurelyarisk

managementstrategy

HedgingConcepts:Arbitrage

Whydofuturesandcashpositionsoffseteachother?

Arbitrage

HedgingConcepts:Arbitrage

FuturesandCashMarketsforacommodityareconnectedeither

bydeliveryoracashindexbasedonthecashcommodity

Tradersallovertheworldcanwatchthecashandfuturesprices

forarbitrageopportunities

Ifmarketsareefficient,allthistradingactivitywillbringtogether

cashandfutures

pricesforcommodityinasomewhat

predictableway

HedgingConcepts:Basis

Thedifferencebetweencashandfuturespriceisreferredtoas

basis

Basisisusuallydefinedascashminusfutures

Grainbasisisnormallyanegativenumber(futuresprice>cash

price)butisoftenreportedasapositivenumber

Forstorablecommoditiesthataredeliverable,basisshould

reflectcarry.

Carryismadeupofstoragecost,costof

transportationtotheterminalmarket,andriskofholdinggrain.

Basisreflectslocalsupplyanddemandconditions

HedgingConcepts:Basis

Livestockbasiscanbepositiveornegativeandhasstrong

seasonalcomponents

FornonŊstorable(orsemiŊstorable)commoditiesbasisisnotas

straightforward.Weagreethatitreflectslocalsupplyand

demandconditions.

Basisshouldalsoreflectdifferencesincashmarketlivestock

comparedtofuturescontractspecifications

CashPosition

Longposition isonewhereyouhave(orhaveinvestedsothat

yousoonwillhave)somequantityofthephysicalcommodity

thatyouplantosell.Youhaveanexcess.

AcowŊcalfoperatorwithcalvesoncowstobesoldas600Ŋpound

weanedcalveshaslongcashpositioninfeedercalves

Acattlefeederwhobuysfeedercattlewiththeintenttofinishandsell

themaslivecattlehaslongcashpositioninlivecattle

Ahog

finishingoperationwithweanedpigsonfeedwiththeintentof

sellingthemasmarkethogshasalongcashpositioninmarkethogs

(leanhogs)

CashPosition

Shortposition isonewhereyouneed(orhaveinvestedsothat

yousoonwillneed)tobuysomequantityofthephysical

commodity.Youhaveadeficit.

Acattlefeederwhoplanstobuyfeedercattletofillpensatsometime

inthefuture,withtheintenttofinishandsellthemaslivecattlehas

shortcashpositioninfeedercattle

Abeefpackerwhoplanstobuylivecattletobeslaughteredinthe

futureisshortinthelivecattlecashmarket

Aporkpackerwhoplanstobuymarkethogstobeslaughteredinthe

futurehasshortcashpositioninmarkethogs

FuturesMarketPosition

Youestablishafuturesmarketpositionbyenteringintoa

futurescontract

Afuturescontractisaveryspecificinstrumentthatallows

marketparticipantstocommittoeitherdeliveringoraccepting

deliveryofacommodityoryouagreetosettlethecontract

againstsomefinancialmeasure

Thecontractspecifiesa

deliverymonth,quantity,quality,

specifications,proceduresforsettlement,howdisputesare

arbitrated,etc.

Thecontractisalegallybindingdocument

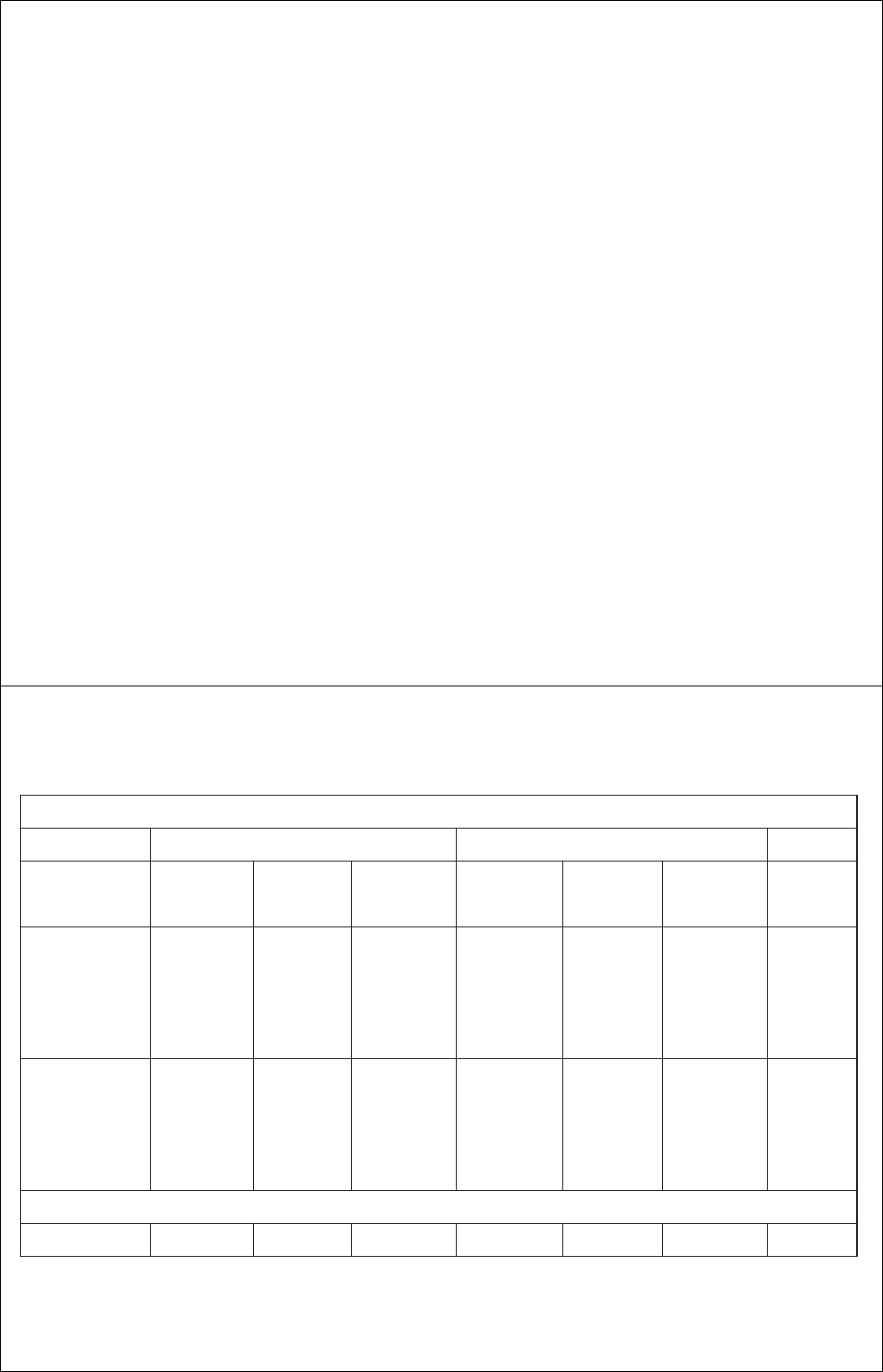

CMEGroup LivestockContracts

Commodity Quantity Settlement

FeederCattle 50,000lbs

live

weight

CashIndex:

700Ŋ899lb feedersteers,MedŊLarge#1andMedŊ

Large#1Ŋ2;8total weightdivisions

Directsales in12States

Availabledailyprices

LiveCattle 40,000lbs

live

weight

PhysicalDelivery:

Live steersorheifersORcarcasses

65%Choice,35%Select,YG3(after10/18)

1,050Ŋ1,500lbs live;600

Ŋ900lbs carcass

Beefbreeds

LeanHogs 40,000lbs

live

weight

CashIndex:

Basedonpriordayslaughteredswinereport

Average netprice

Twodays’data

FuturesMarketPosition

Apersonwhocommitstodeliveringissaidtohavesold a

contractorisshort acontract

Apersonwhocommitstoacceptingdeliveryissaidtohave

bought acontractorislong acontract

Everyfuturescontractthatistradedhasapersonwhoislong

andaperson

whoisshort.Itisazerosumgame.

FinancialSettlementandDelivery

Forcontractssettledagainstacashindexandthereisnochance

ofphysicaldelivery.

However,theconceptisexactlythesame

Underlyinglivestockcashindicesarebasedonnegotiatedcash

markettrade

Ifyourcontractexpiresyoumustoffsetitbasedonthecash

index(ratherthanwithactual

animals)

Ifyouareshortfutures…youmustbuybackthecontract

quantityattheindexprice

Ifyouarelongfutures…youmustsellbackthecontractquantity

attheindexprice

HedgingConcepts:Arbitrage

Futuresmarkettraderscanformabiasconcerningwhether

priceswillmoveonewayoranother,relativetocashprices

Theythentradebasedonthisbias

Traderswhoareactiveinamarketforthesolepurposeof

makingmoneyontheirtradesareknownasspeculators

Thougha

bitmorecomplicatedthanourexample,theiractions

tocapitalizeonarbitrageopportunitiesconnectfuturesandcash

pricesforagivencommodity

HedgingConcepts:FunctionofFutures

Markets

Theabilitytotradefuturescontractsallowsfortwoimportant

activitiestooccur

1. PriceDiscovery

2. TransferofRisk

Speculatorstakeonpriceriskwiththehopesofmakingmoney

Hedgerspaytoavoidpricerisk

Speculatorsarenecessaryforhedgingtotakeplace

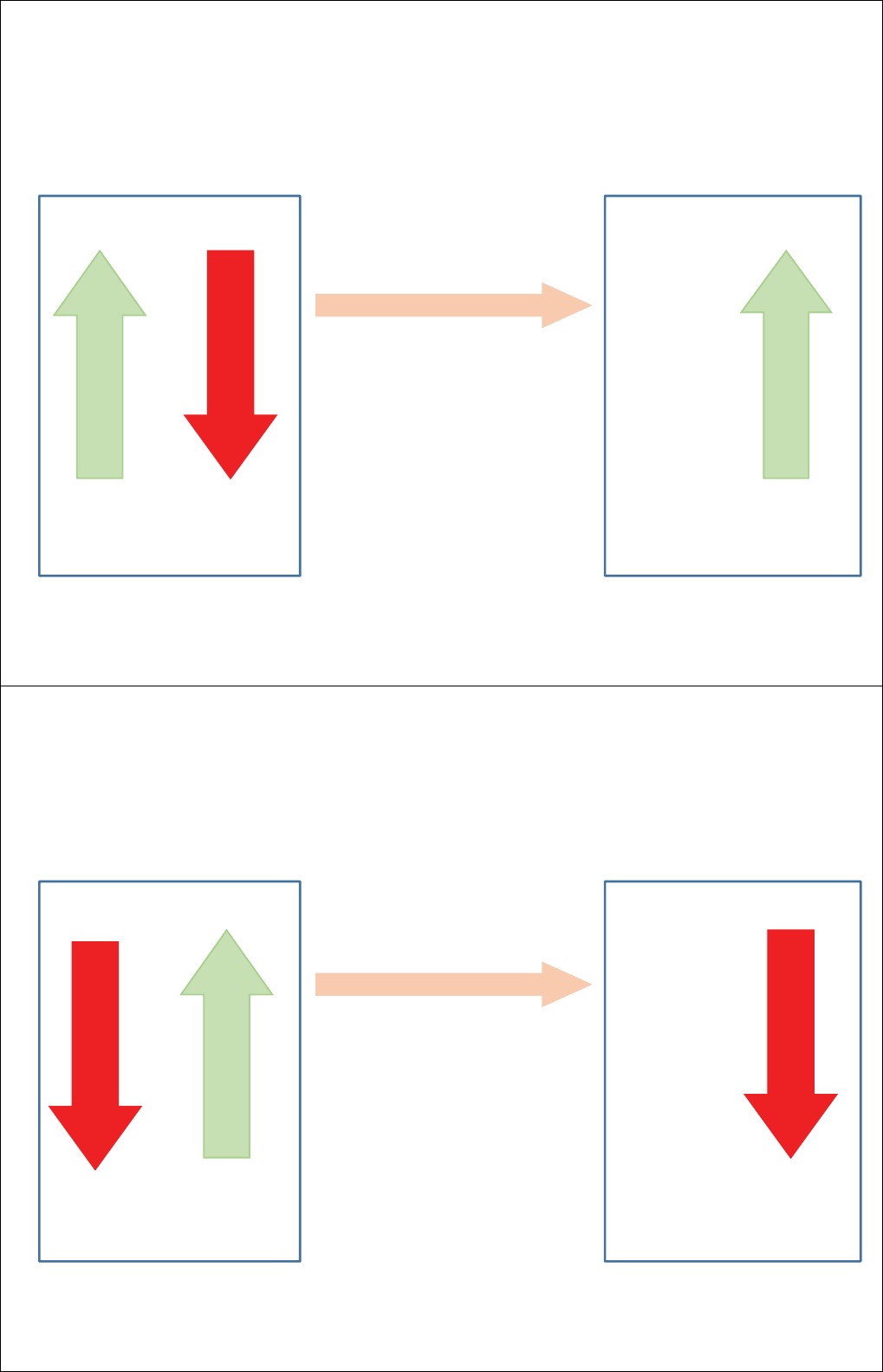

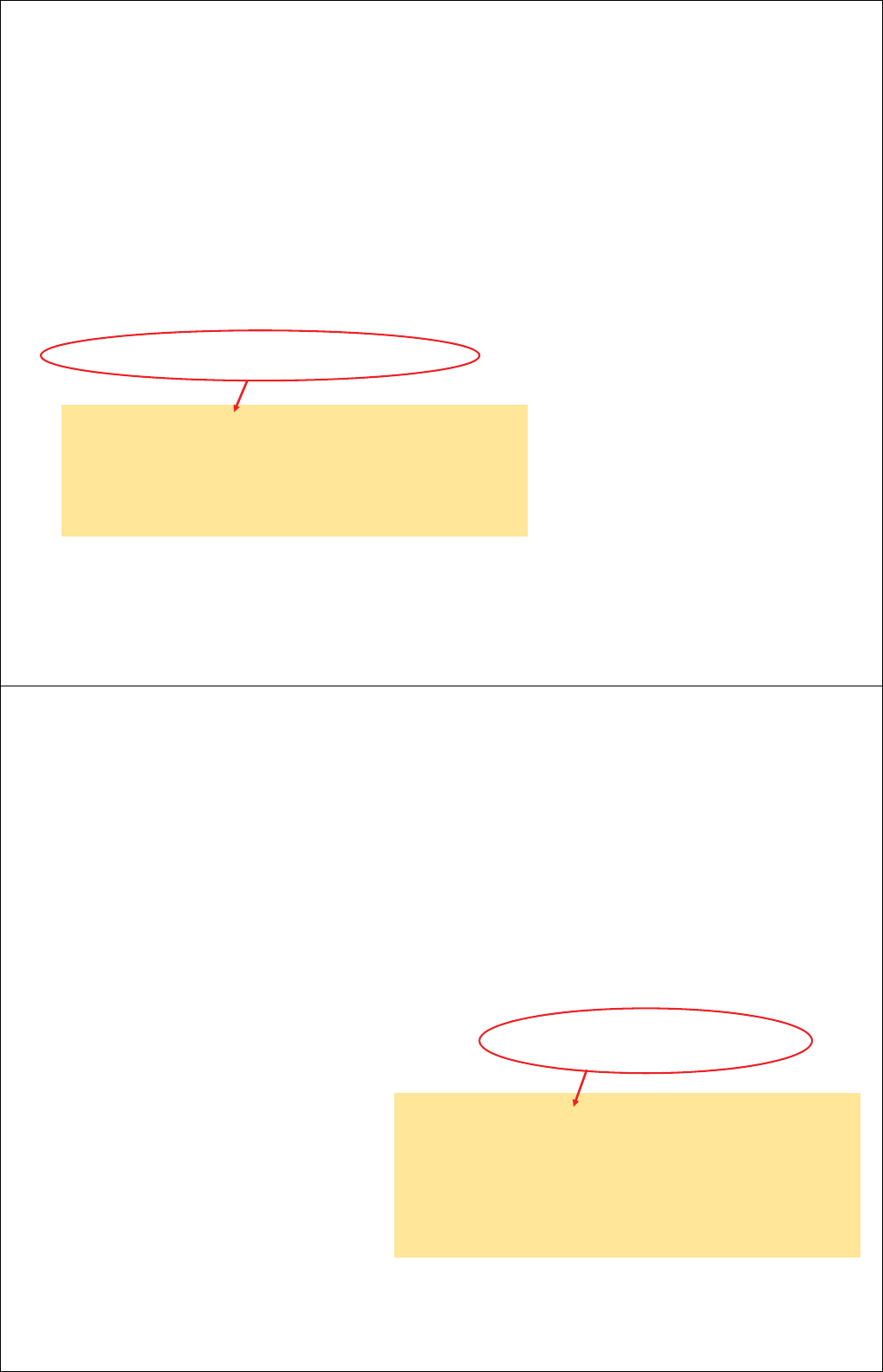

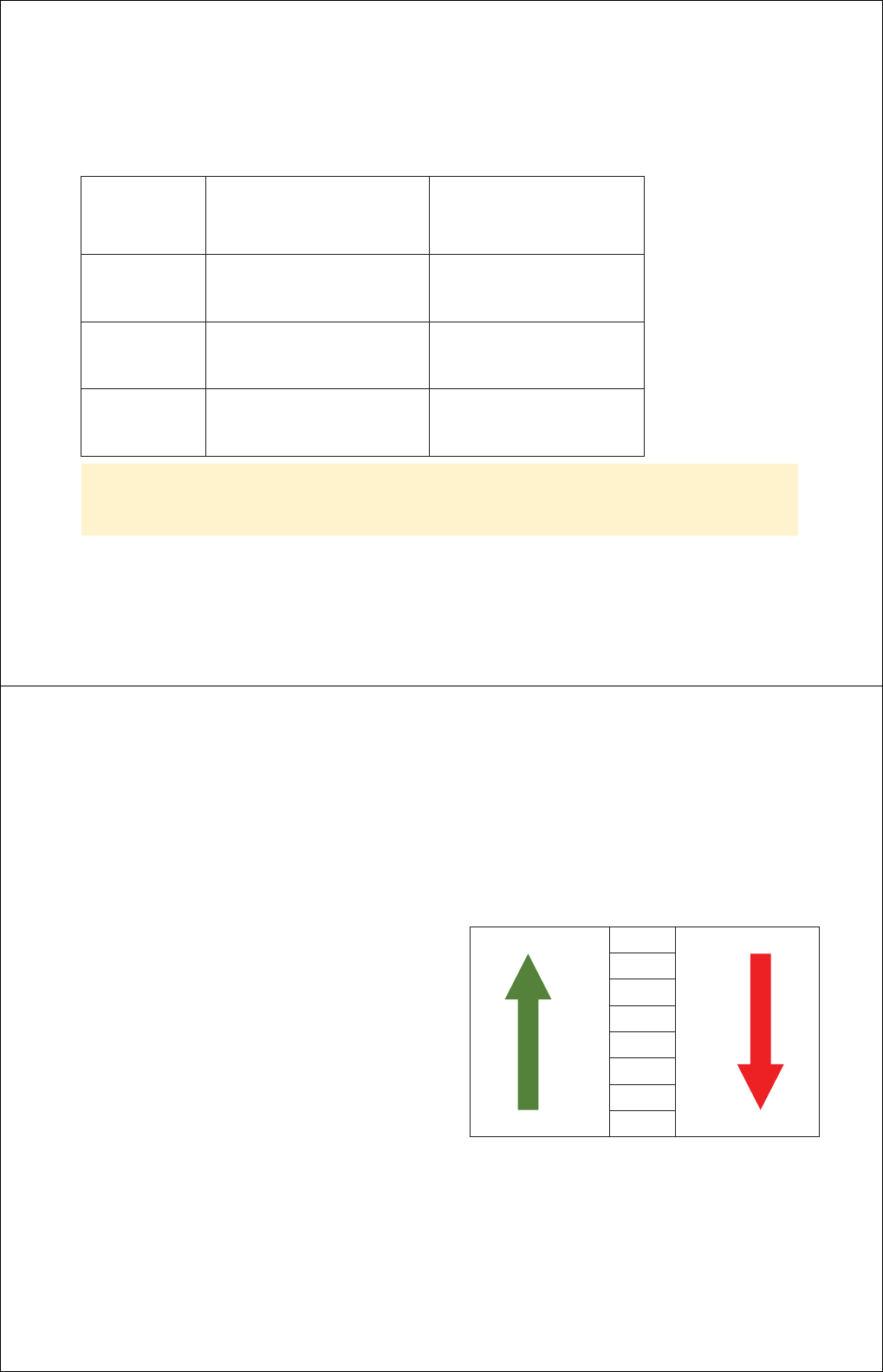

dƌĂŶƐĨĞƌŽĨZŝƐŬ͗ZŝƐŝŶŐWƌŝĐĞƐdžĂŵƉůĞ

ŚĂŶŐĞŝŶ

sĂůƵĞŽĨĂƐŚ

WŽƐŝƚŝŽŶ

ŚĂŶŐĞŝŶsĂůƵĞ

ŽĨ&ƵƚƵƌĞƐ

WŽƐŝƚŝŽŶ

ŚĂŶŐĞŝŶsĂůƵĞ

ŽĨ&ƵƚƵƌĞƐ

WŽƐŝƚŝŽŶ

EŽĂƐŚ

WŽƐŝƚŝŽŶ

^ŚŽƌƚ,ĞĚŐĞƌ͛ƐKĨĨƐĞƚƚŝŶŐ

/ŶǀĞƐƚŵĞŶƚƐ

^ƉĞĐƵůĂƚŽƌ͛Ɛ/ŶǀĞƐƚŵĞŶƚ

dŚĞƐŚŽƌƚŚĞĚŐĞƌŐŝǀĞƐƵƉƵƉƐŝĚĞƌŝƐŬ

ĂŶĚŐĂŝŶĨƌŽŵƌŝƐŝŶŐƉƌŝĐĞƐƚŚƌŽƵŐŚ

ŽĨĨƐĞƚƚŝŶŐŝŶǀĞƐƚŵĞŶƚƐ

dŚĞƐƉĞĐƵůĂƚŽƌƚĂŬĞƐŽŶƚŚĞƌŝƐŬ

/ŶƚŝŵĞƐŽĨƌŝƐŝŶŐƉƌŝĐĞƐ͕ƚŚĞůŽŶŐ

ƐƉĞĐƵůĂƚŽƌŐĂŝŶƐĨƌŽŵƚŚĞŝŶǀĞƐƚŵĞŶƚ

WZ/Z/^<

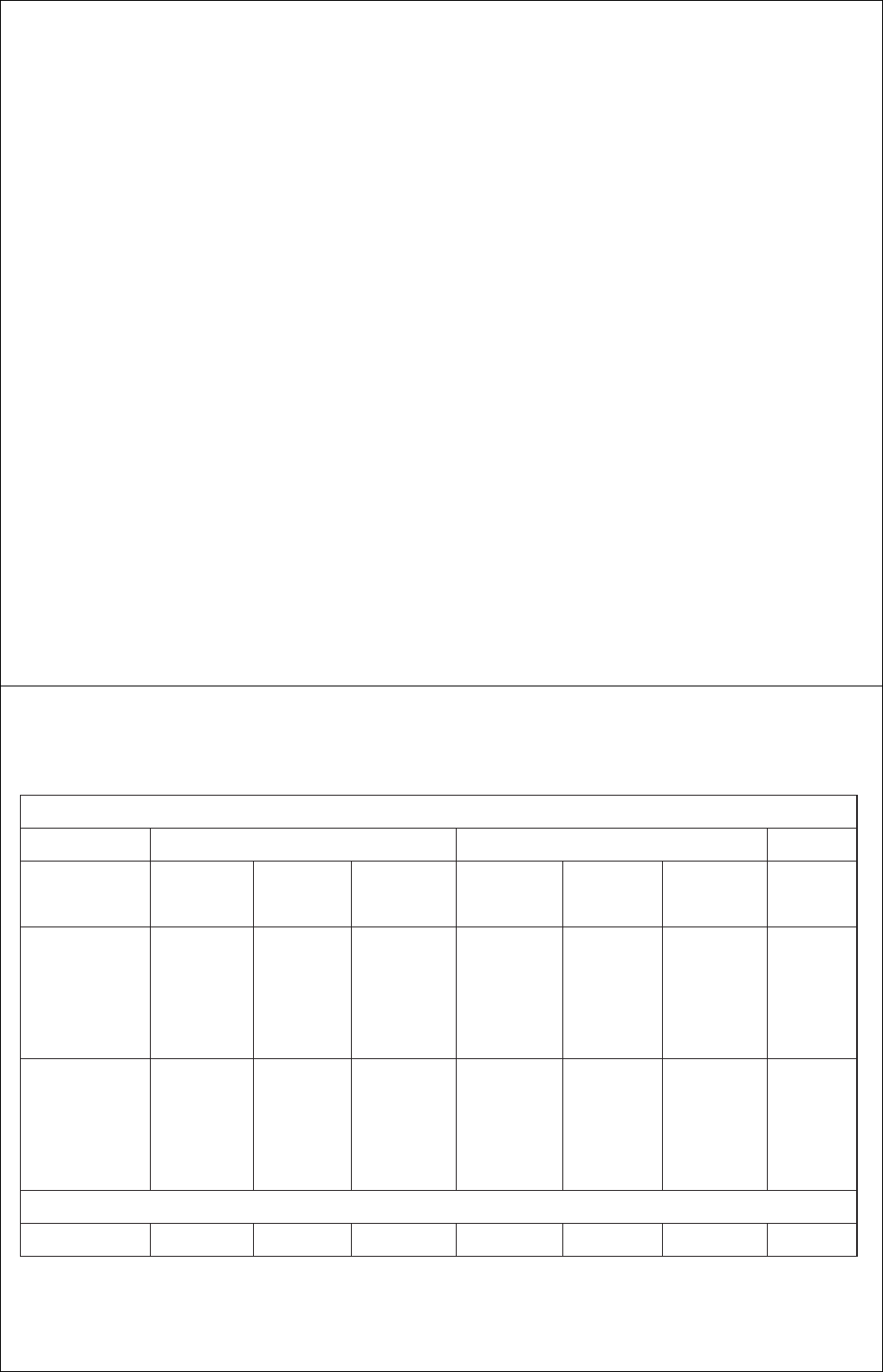

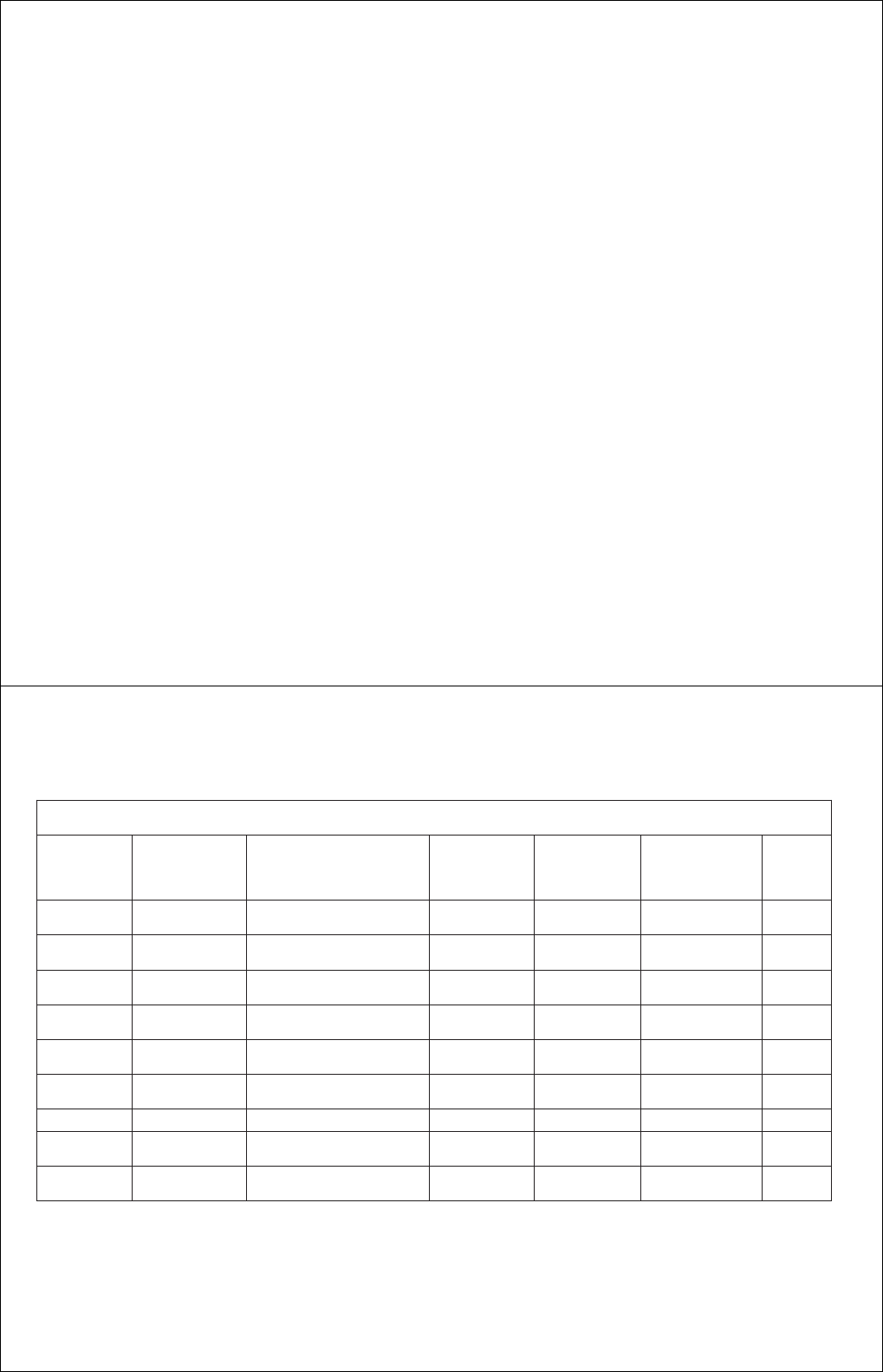

dƌĂŶƐĨĞƌŽĨZŝƐŬ͗&ĂůůŝŶŐWƌŝĐĞƐdžĂŵƉůĞ

ŚĂŶŐĞŝŶ

sĂůƵĞŽĨĂƐŚ

WŽƐŝƚŝŽŶ

ŚĂŶŐĞŝŶsĂůƵĞ

ŽĨ&ƵƚƵƌĞƐ

WŽƐŝƚŝŽŶ

ŚĂŶŐĞŝŶsĂůƵĞ

ŽĨ&ƵƚƵƌĞƐ

WŽƐŝƚŝŽŶ

EŽĂƐŚ

WŽƐŝƚŝŽŶ

^ŚŽƌƚ,ĞĚŐĞƌ͛ƐKĨĨƐĞƚƚŝŶŐ

/ŶǀĞƐƚŵĞŶƚƐ

^ƉĞĐƵůĂƚŽƌ͛Ɛ/ŶǀĞƐƚŵĞŶƚ

WZ/Z/^<

dŚĞƐŚŽƌƚŚĞĚŐĞƌĂǀŽŝĚƐĚŽǁŶƐŝĚĞĂŶĚ

ůŽƐƐĨƌŽŵĚĞĐůŝŶŝŶŐƉƌŝĐĞƐƚŚƌŽƵŐŚ

ŽĨĨƐĞƚƚŝŶŐŝŶǀĞƐƚŵĞŶƚƐ

dŚĞƐƉĞĐƵůĂƚŽƌƚĂŬĞƐŽŶƚŚĞƌŝƐŬ

/ŶƚŝŵĞƐŽĨĨĂůůŝŶŐƉƌŝĐĞƐ͕ƚŚĞůŽŶŐ

ƐƉĞĐƵůĂƚŽƌůŽƐĞƐĨƌŽŵƚŚĞŝŶǀĞƐƚŵĞŶƚ

dŚĞĂƌƌĂŶŐĞŵĞŶƚĨŝƚƐƚŚĞƌŝƐŬƉƌŽĨŝůĞŽĨ

ďŽƚŚ

,ĞĚŐŝŶŐdžĂŵƉůĞƐ

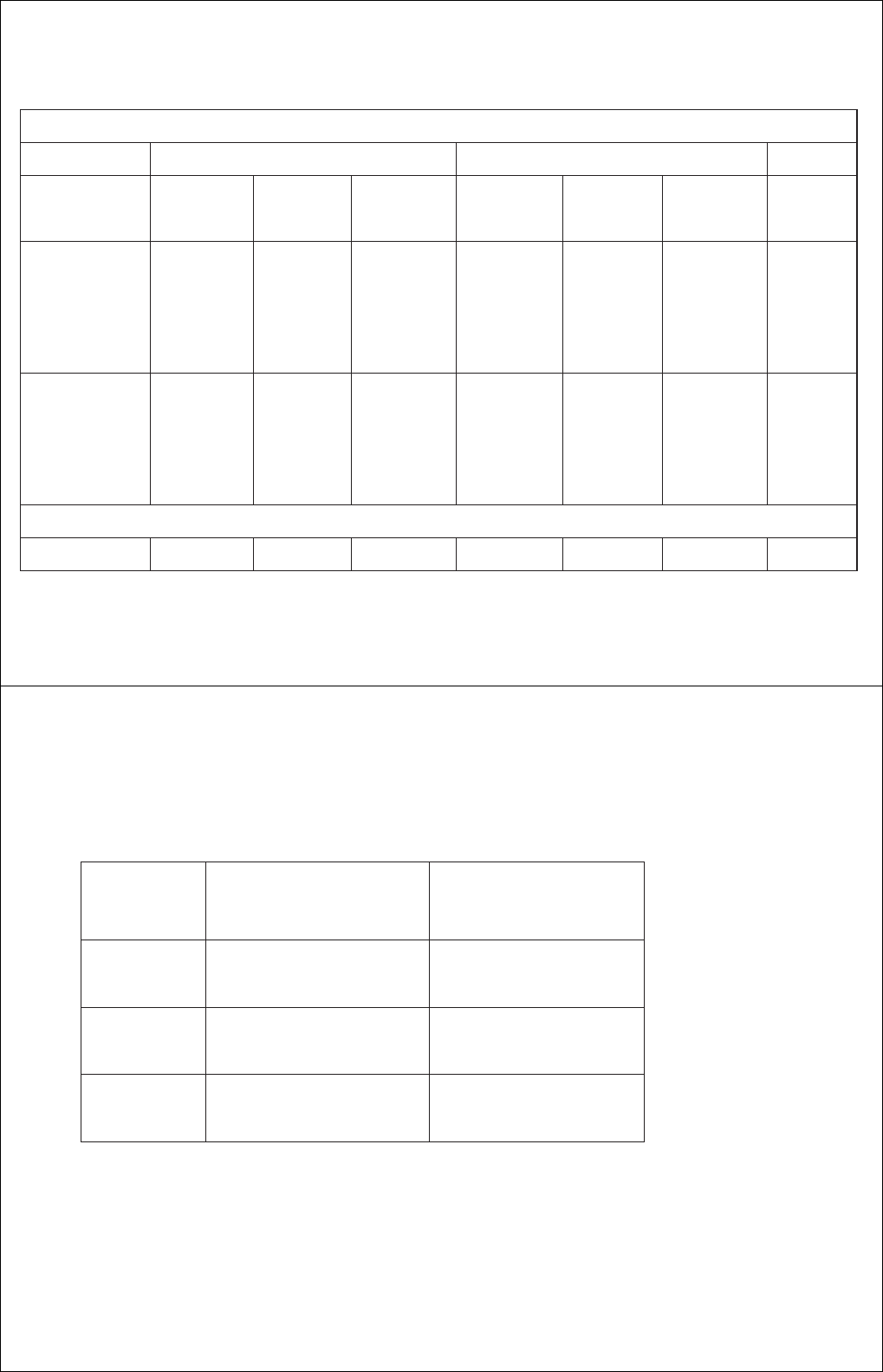

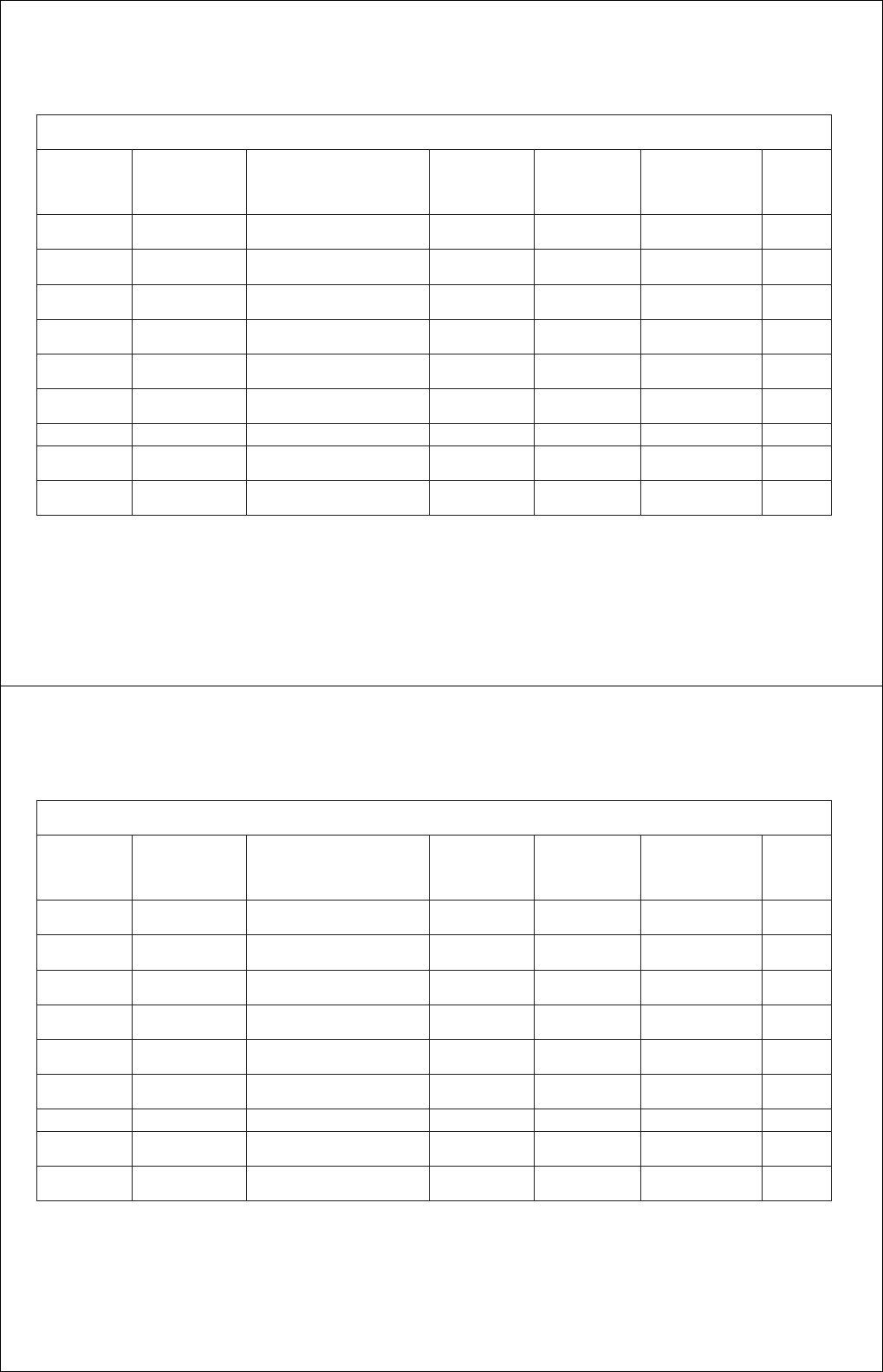

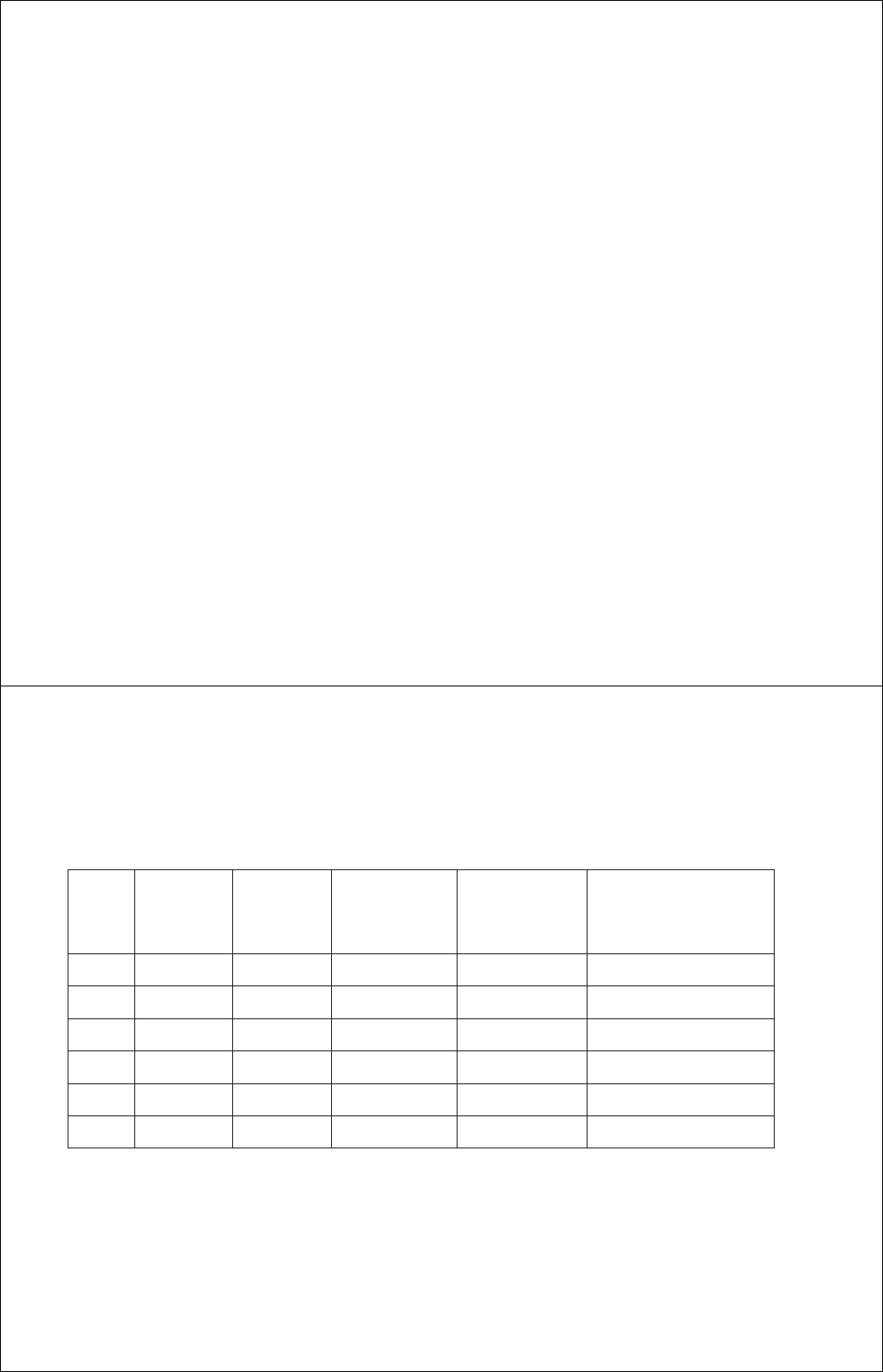

Example:LongFeederCattleHedgebyaCattleFeeder

Time CashFeederCattle FeederCattleFutures Basis

Action

Priceper

cwt

Position Action

Priceper

cwt

Position

January18,

2018

Planningto

place

feeder

cattlein

March.

BuyMarch

feeder

cattle

futures

contracts

March15,

2018

Purchase

feeder

cattle

SellMarch

feeder

cattle

futures

contracts

Net

Example:LongFeederCattleHedgebyaCattleFeeder

Time CashFeederCattle FeederCattleFutures Basis

Action

Priceper

cwt

Position Action

Priceper

cwt

Position

January18,

2018

Planningto

place

feeder

cattlein

March.

$146 Short

BuyMarch

feeder

cattle

futures

contracts

$147 Long Ŋ$1.00

March15,

2018

Purchase

feeder

cattle

SellMarch

feeder

cattle

futures

contracts

Net

HedgingExamples

Whatdoesthelonghedgerexpecttopayforthefeeders?

ExpectedPrice=CashPricePaid+Gain/LossinFuturesPosition

+[Commission/lbs purchased]

ExpectedPrice=FuturesPricewhenHedgeisLifted+Basis

whenHedgeisLifted+[Commission/lbs purchased]

Forourexample,wewillignorecommission

HedgingExamples

Whatdoesthelonghedgerexpecttopayforthefeeders?

ExpectedPrice=

FuturesPricewhenHedgeisLifted+BasiswhenHedgeisLifted

Howtopredict?

Simplestistousefuturesatthetimethehedgeis

placed

Canconsiderseasonalpatterns,analysts’predictions,

etc.

HedgingExamples

Whatdoesthelonghedgerexpecttopayforthefeeders?

ExpectedPrice=

FuturesPricewhenHedgeisLifted+BasiswhenHedgeisLifted

Howtopredict?

Simplestistouseaseasonalaverage.Forexample,the

calendarweekyouplantoliftthehedge.

Regionalbasischartsareavailableatnocharge

Themorespecifictoyouroperation,thebetter

Thinkaboutwhatinformationyoucancollect

HedgingExamples

Whatdoesthelonghedgerexpecttopayforthefeeders?

ExpectedPrice=

FuturesPricewhenHedgeisLifted+BasiswhenHedgeisLifted

Inourexample…let’susecurrentfuturesandanexpectedbasisof

+$2.00:

ExpectedPrice= $147+(+$2.00)=$149

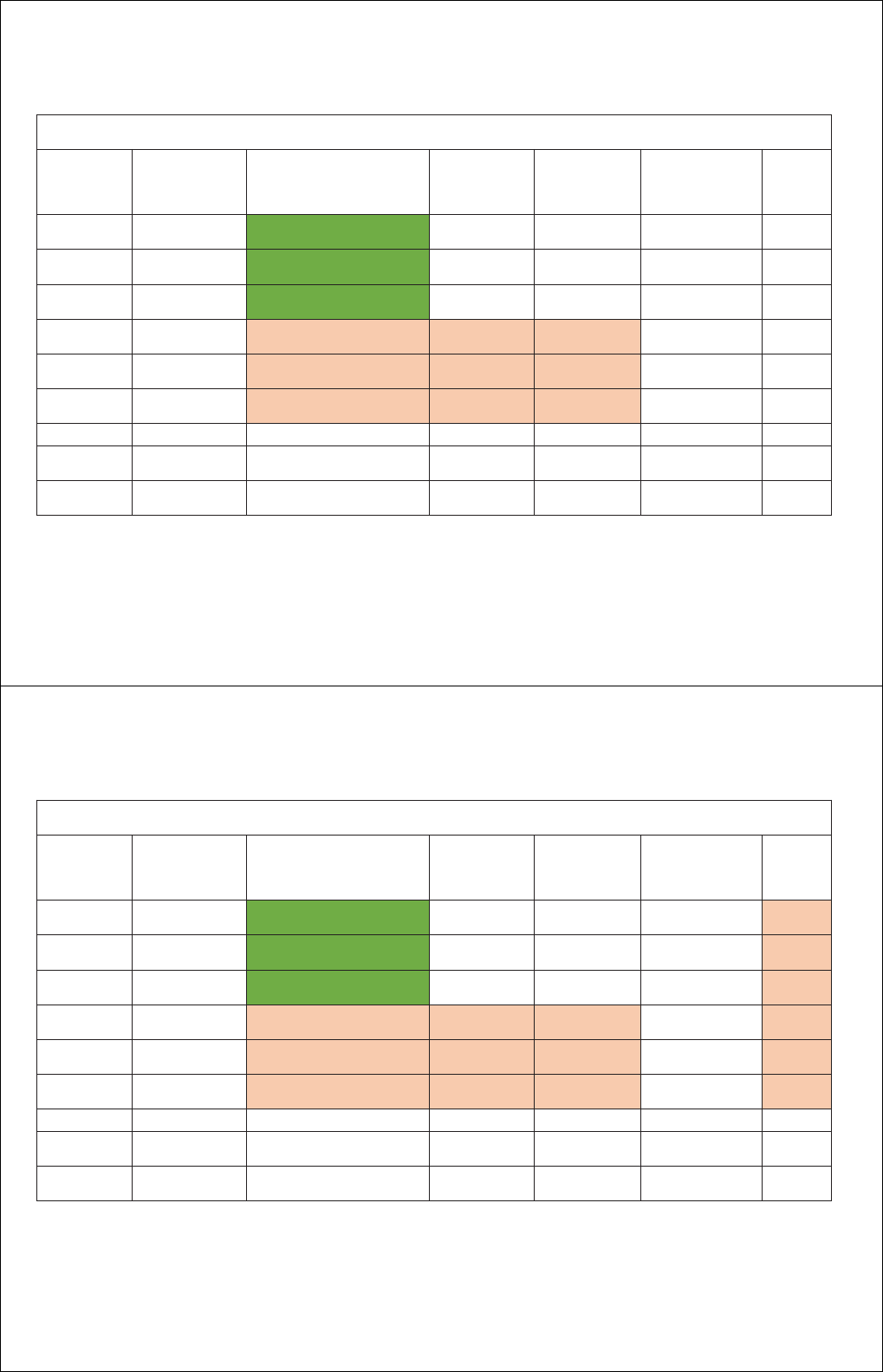

Example:LongFeederCattleHedgebyaCattleFeeder

Time CashFeederCattle FeederCattleFutures Basis

Action

Priceper

cwt

Position Action

Priceper

cwt

Position

January18,

2018

Planningto

place

feeder

cattlein

March.

$146 Short

BuyMarch

feeder

cattle

futures

contracts

$147 Long Ŋ$1.00

March15,

2018

Purchase

feeder

cattle

$148 Long

SellMarch

feeder

cattle

futures

contracts

$141 Short +7.00

Net

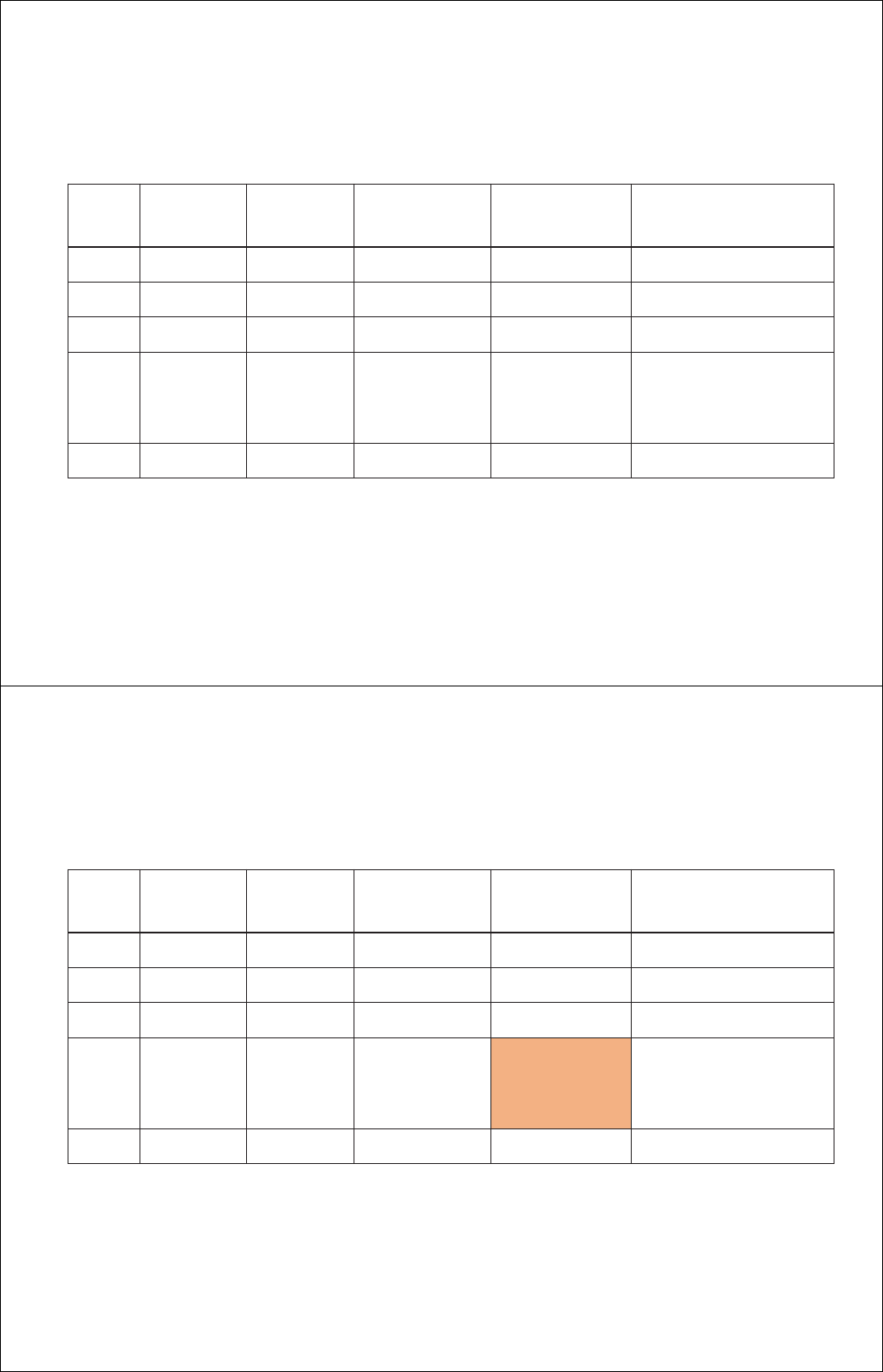

Example:LongFeederCattleHedgebyaCattleFeeder

Time CashFeederCattle FeederCattleFutures Basis

Action

Priceper

cwt

Position Action

Priceper

cwt

Position

January18,

2018

Planningto

place

feeder

cattlein

March.

$146 Short

BuyMarch

feeder

cattle

futures

contracts

$147 Long Ŋ$1.00

March15,

2018

Purchase

feeder

cattle

$148 Long

SellMarch

feeder

cattle

futures

contracts

$141 Short +7.00

Net $148 None Ŋ$6.00 None

NetPricePaid per

cwt

Basis

Expected $149 +$2.00

Actual $154 +$7.00

Error

NetPricePaid per

cwt

Basis

Expected $149 +$2.00

Actual $154 +$7.00

Error Ŋ$5.00 Ŋ$5.00

Basispredictionwaslow,actualbasiswasmorepositivethanexpected

Thelonghedgerpaidahigherthanexpectedprice

Abilitytopredictbasisdeterminesabilitytopredictnetprice

HedgingConcepts:Basis

StrongBasis

Cashishigher,relativeto

futures

Indicatesahigherlocaldemand

and/orlowerlocalsupplyofthe

cashcommodity

WeakBasis

Cashislower,relativeto

futures

Indicatesalowerlocaldemand

and/orhigherlocalsupplyof

thecashcommodity

StrongerBasis Basis

+$0.05

$0.00

Ŋ$0.05

Ŋ$0.15

Ŋ$0.25

Ŋ$0.30

Ŋ$0.35 WeakerBasis

HedgingConcepts:Basis

StrongerBasisThanExpected

Shorthedgersbenefit

Longhedgersfareworse

WeakBasisThanExpected

Shorthedgersfareworse

Longhedgersbenefit

Didthehedgework?

Howdoyoudetermineifthehedgewaseffective?

Temptingtolookatthecashpricewithouthedging:$148vsnet

pricedpaidwiththehedge:$154

Relevanttothebottomlinebutnotawaytoevaluatethehedge

Compareexpectedpricetonetpricepaid:

$149vs.$154

Notgreat,inthiscase…

Youshouldbecomfortablewiththereturnsfromtheexpected

price

Achievingtheexpectedpriceisthegoalofthehedge…evenifit

meansgivinguppotentialcashgains

HedgingConcepts:Options

Afuturespositionisanobligation

Youcanalsobuyorselloptionsonfuturescontracts

Anoptionistherightbutnotobligationtotakeacertainfutures

positionwithinacertaintime

PutOption—theoptiontotakeashortpositioninafutures

contractataspecifiedprice

duringacertaintime

CallOption—theoptiontotakealongpositioninafutures

contractataspecifiedpriceduringacertaintime

HedgingConcepts:Options

Anoptionisdescribedbyafewthings:

Strikeprice—Priceoftheunderlyingfuturescontractatwhichthe

holdercanestablishafuturesposition

Premium—amountthatapersonpaysforanoption(ortheamountfor

whichthesellersellsanoption);quotedinpriceperunit

Put/Call—whatpositiontheholderhasarighttoestablish

HedgingConcepts:Options

Afewnotes…

Brokersdifferinhandlingoptionfees.Somechargetwofeesup

front.SomechargeonefeeandthenanotherIFtheoptionis

exercised

Theholderofanoptioncanalsosimplysellitback.Theresultis

notthesameasexercisingbutitisthe

sameidea.

Asfuturesmovesintheholder’sfavorthepremiumwillincrease

anditcanbesoldbackatahigherpricethanitwaspurchased

for

Optionsfordeliverablecontracts(likeLiveCattle)expireatthe

BEGINNINGofexpirationmonth.Cashsettledoptionsexpireat

theexpirationofthe

contract

HedgingConcepts:Options

Understandingbasisisstillimportant,justaswhenhedgingwith

futures

Optionseliminateundesirablepricevariabilitybutallowfor

beneficialvariability

Sellersofthecashcommoditycanbenefitfromrisingprices

Buyersofthecashcommoditycanbenefitfromfallingprices

Youpayforthisconvenience

Whenahedgerbuysanoption,someoneoutinthemarketsold

thatoption…justlikewithfuturescontracts,riskistransferred

KƉƚŝŽŶƐdžĂŵƉůĞ

OptionExample:UsingaPutOptionto

ManagethePriceRiskofSellingMarketHogs

StrikePrice=$49.000/cwt

Premium=$4.625/cwt

ThesepricesareontheDecembercontractfrom8/13/18

Remember…thismeansanoptionon1contractwillcost$1,850

Onecontractwillcoveraround140markethogs

Putoptionstocoverapproximately1,000head=$12,950

OptionExample:UsingaPutOptionto

ManagethePriceRiskofSellingMarketHogs

StrikePrice=$49.000/cwt

Premium=$4.625/cwt

Aputgivestherighttosellatthestrikepriceand,ifoffsetbya

cashposition,willsetanapproximatepricefloor

ApproximatePriceFloor=Strike–Premium+ExpectedBasis

Let’suseŊ$3asanexpectedbasis

ApproximatePriceFloor

=$49Ŋ$4.625+(Ŋ$3)=$41.375

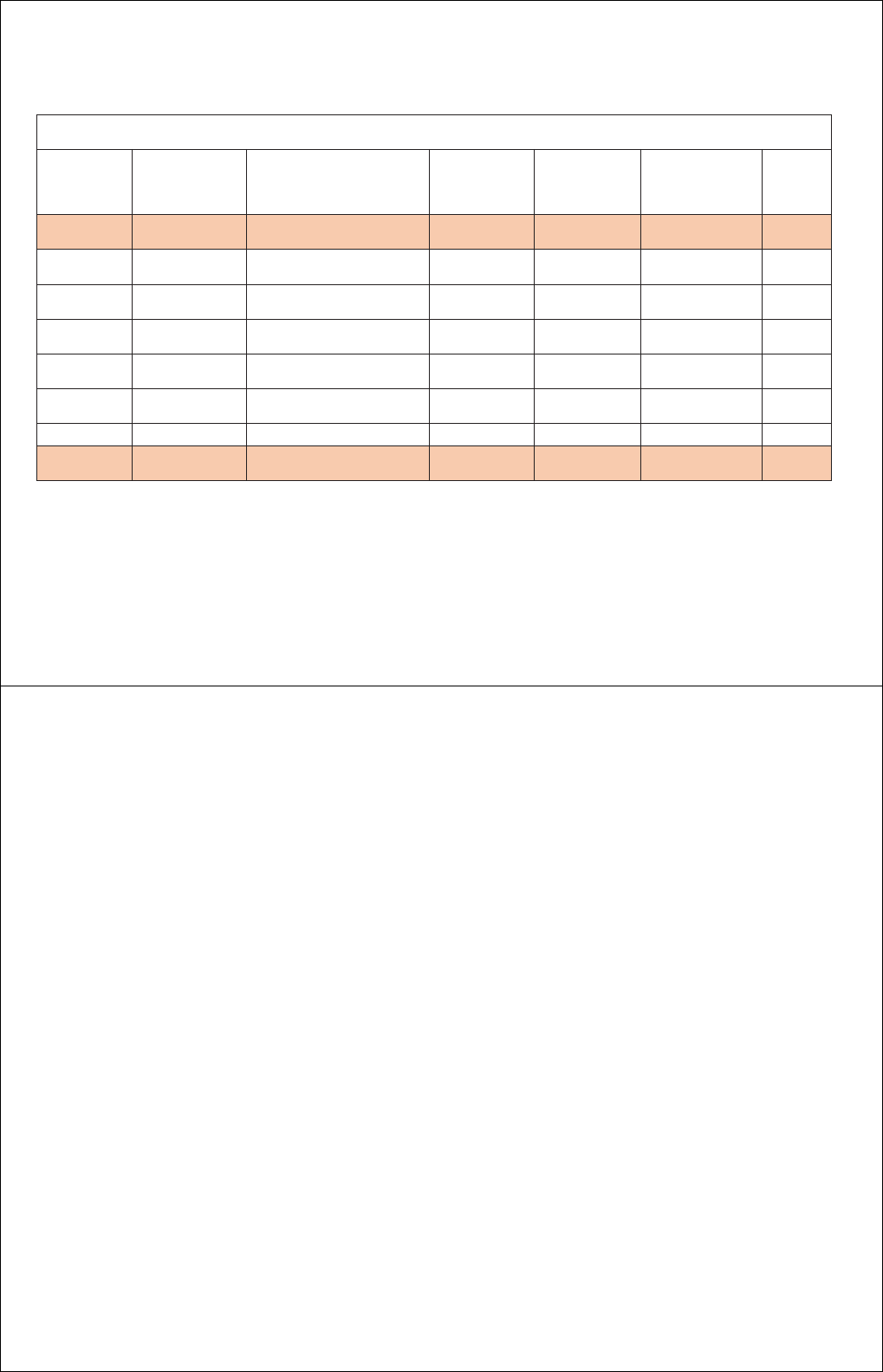

PutOptiontoManagePriceRisk ofSellingMarketHogs

CashPrice

atSale

($/cwt)

FuturesPrice

atSale

($/cwt)

ValueoftheOption

($/cwt)

Premium

($/cwt)

NetImpact

($/cwt)

EffectivePrice

Received

($/cwt)

Basis

($/cwt)

$46.00 $49.00 $0.00 $4.625 Ŋ$4.63 $41.375 Ŋ3.00

StrikePrice=$49/cwt

PutOptiontoManagePriceRisk ofSellingMarketHogs

CashPrice

atSale

($/cwt)

FuturesPrice

atSale

($/cwt)

ValueoftheOption

($/cwt)

Premium

($/cwt)

NetImpact

($/cwt)

EffectivePrice

Received

($/cwt)

Basis

($/cwt)

$45.00 $48.00 $1.00 $4.625 Ŋ$3.63 $41.375 Ŋ3.00

$46.00 $49.00 $0.00 $4.625 Ŋ$4.63 $41.375 Ŋ3.00

StrikePrice=$49/cwt

PutOptiontoManagePriceRisk ofSellingMarketHogs

CashPrice

atSale

($/cwt)

FuturesPrice

atSale

($/cwt)

ValueoftheOption

($/cwt)

Premium

($/cwt)

NetImpact

($/cwt)

EffectivePrice

Received

($/cwt)

Basis

($/cwt)

$38.00 $41.00 $8.00 $4.625 $3.375 $41.375 Ŋ3.00

$41.38 $44.38 $4.63 $4.625 $0.00 $41.375 Ŋ3.00

$45.00 $48.00 $1.00 $4.625 Ŋ$3.625 $41.375 Ŋ3.00

$46.00 $49.00 $0.00 $4.625 Ŋ$4.625 $41.375 Ŋ3.00

StrikePrice=$49/cwt

PutOptiontoManagePriceRisk ofSellingMarketHogs

CashPrice

atSale

($/cwt)

FuturesPrice

atSale

($/cwt)

ValueoftheOption

($/cwt)

Premium

($/cwt)

NetImpact

($/cwt)

EffectivePrice

Received

($/cwt)

Basis

($/cwt)

$38.00 $41.00 $8.00 $4.625 $3.375 $41.375 Ŋ3.00

$41.38 $44.38 $4.63 $4.625 $0.000 $41.375 Ŋ3.00

$45.00 $48.00 $1.00 $4.625 Ŋ$3.625 $41.375 Ŋ3.00

$46.00 $49.00 $0.00 $4.625 Ŋ$4.625 $41.375 Ŋ3.00

$47.00 $50.00 $0.00 $4.625 Ŋ$4.625 $42.375 Ŋ3.00

$48.00 $51.00 $0.00 $4.625 Ŋ$4.625 $43.375 Ŋ3.00

StrikePrice=$49/cwt

PutOptiontoManagePriceRisk ofSellingMarketHogs

CashPrice

atSale

($/cwt)

FuturesPrice

atSale

($/cwt)

ValueoftheOption

($/cwt)

Premium

($/cwt)

NetImpact

($/cwt)

EffectivePrice

Received

($/cwt)

Basis

($/cwt)

$38.00 $41.00 $8.00 $4.625 $3.375 $41.375 Ŋ3.00

$41.38 $44.38 $4.63 $4.625 $0.000 $41.375 Ŋ3.00

$45.00 $48.00 $1.00 $4.625 Ŋ$3.625 $41.375 Ŋ3.00

$46.00 $49.00 $0.00 $4.625 Ŋ$4.625 $41.375 Ŋ3.00

$47.00 $50.00 $0.00 $4.625 Ŋ$4.625 $42.375 Ŋ3.00

$48.00 $51.00 $0.00 $4.625 Ŋ$4.625 $43.375 Ŋ3.00

StrikePrice=$49/cwt

PutOptiontoManagePriceRisk ofSellingMarketHogs

CashPrice

atSale

($/cwt)

FuturesPrice

atSale

($/cwt)

ValueoftheOption

($/cwt)

Premium

($/cwt)

NetImpact

($/cwt)

EffectivePrice

Received

($/cwt)

Basis

($/cwt)

$38.00 $41.00 $8.00 $4.625 $3.375 $41.375 Ŋ3.00

$41.375 $44.375 $4.625 $4.625 $0.00 $41.375 Ŋ3.00

$45.00 $48.00 $1.00 $4.625 Ŋ$3.625 $41.375 Ŋ3.00

$46.00 $49.00 $0.00 $4.625 Ŋ$4.625 $41.375 Ŋ3.00

$47.00 $50.00 $0.00 $4.625 Ŋ$4.625 $42.375 Ŋ3.00

$48.00 $51.00 $0.00 $4.625 Ŋ$4.625 $43.375 Ŋ3.00

$38.00 $42.00 $7.00 $4.625 $2.375 $40.375 Ŋ4.00

StrikePrice=$49/cwt

HedgingConcepts:Options

Onceyoupayapremium,itisgoneforever

Thenegativeimpactonsellingpricewillneverbemorethanthe

premium

Ifpricesmoveinyourfavoryoucancapturesomeoftheupside

riskinthecashmarket

Ifpricesmoveagainstyou,apricefloorisestablished,

subjectto

basisrisk

HedgingConcepts:Options

Acalloptionistheoppositeofaput

Itestablishesanapproximatepriceceiling

ApproximatePriceCeiling=

StrikePrice+Premium+ExpectedBasis

Youareprotectedagainstrisingpricesandcanstillpartially

benefitfromdecliningprices,subjecttobasisrisk

Youcanalsoselloptionsback

insteadofexercisingthem.The

conceptsremainthethesame.

HedgingConcepts:Basis

Whenusingfuturesandoptionstohedge,basismatters

Really,onlybasismatters

Howtodetermineabasisprojection?

3Ŋyearaveragesarereadilyavailable—thisisagoodstarting

point

CooperativeExtensionservicesthroughuniversities

BeefBasis

PrivateFirms

HedgingConcepts:Basis

Worktogetabasistailoredtoyouroperation

Geography

Type/qualityofanimals

Seasonalpatterns

Reliablecashpriceswhenyoudon’tsell(ormaybewhenthereis

notrade)

Overtime,keepingyourownrecordscanhelp

Usinghistoricalbasis—considertherangeaswellasaverage

ƌŽƐƐ,ĞĚŐŝŶŐ

Howoppositeandhowequal?

Timing

Choosingacontractmonth

Matchyoursellingorbuyingtimewindow

Consideropeninterestandvolume

Basis

SizeofPosition

Getascloseaspossibletointendedpurchaseorsalevolumeaspossible

Noexactmatch

Overhedged:futuresposition>cashposition,youarespeculatinginthe

futuresmarket

Underhedged:futuresposition<cashposition,youarespeculatingin

thecashmarket

Howoppositeandhowequal?

ContractMatch

Manylivestockhedgesarecrosshedges,inthatlivestockdonotexactly

matchthecontractspecifications

Closecrosshedges

UsingtheFeederCattleContracttohedgeheifers

UsingLiveCattleContracttohedgebeefsteersnotbornintheUS

Crosshedgesabitfartherfromthecontracts

UsingLiveCattleContracttohedgelivedairybreedsteers/heifers

UsingtheFeederCattleContracttohedge500lb weanedcalves

Justlikehedges,crosshedgesworkifcashandfuturesmovetogether

inapredictableway

Seasonalpatternscandifferwithcrosshedges

Ifthecrosshedgeisnotaclosematch,a1to1hedgeratiomightnotbe

thebeststrategy

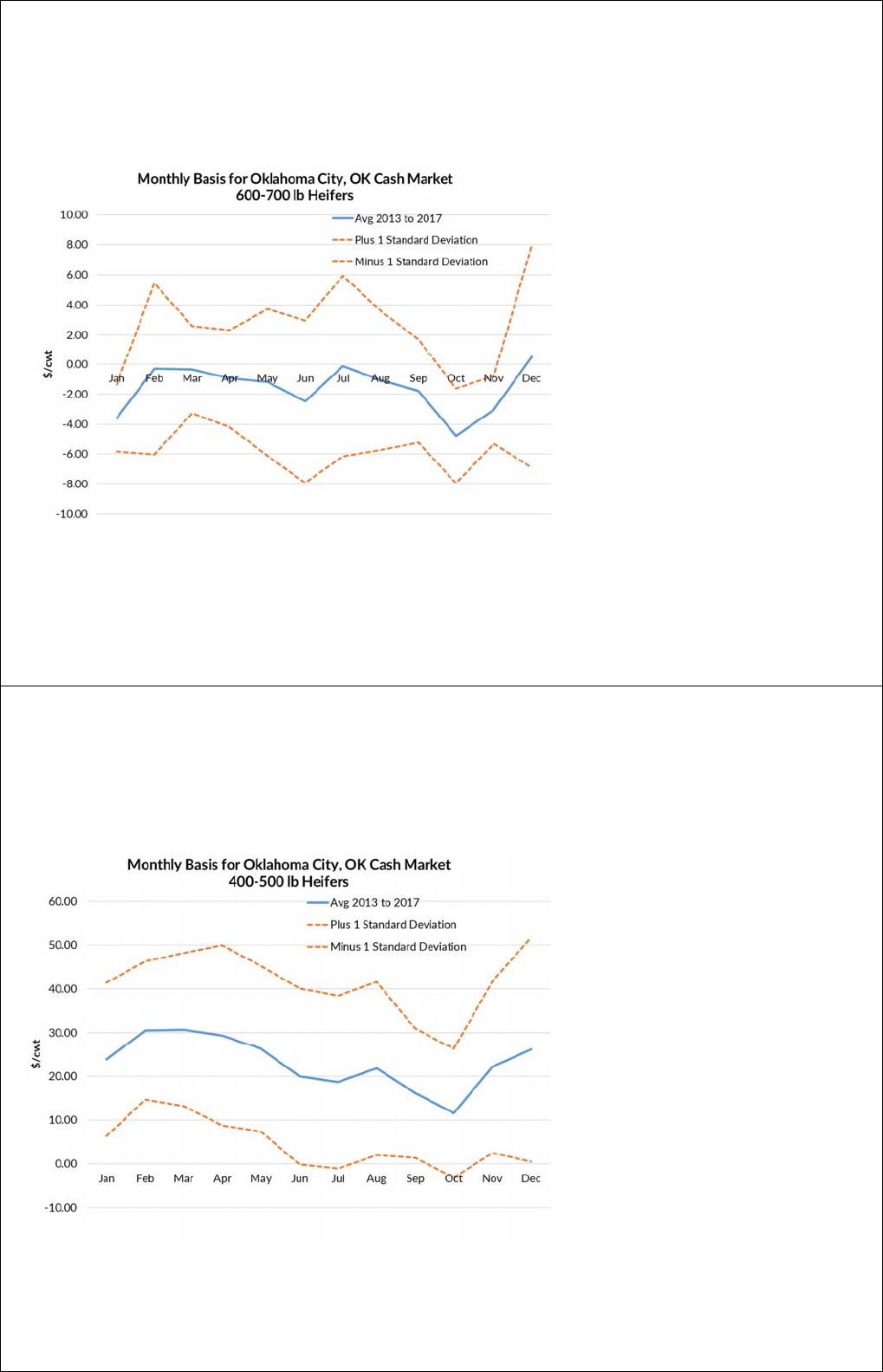

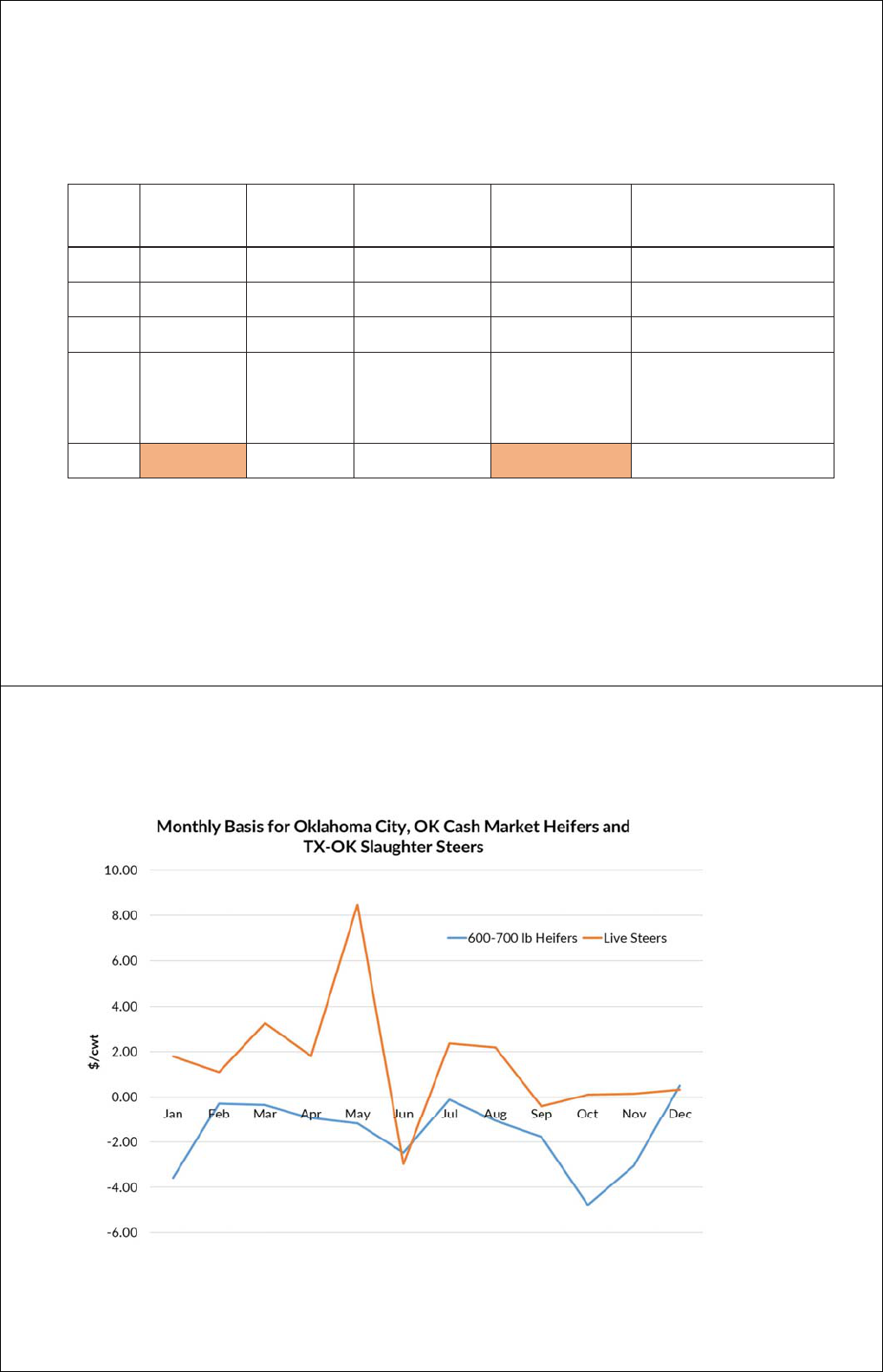

Example:BasisforCrossHedges

Technically,hedgingfeeder

heifersisacrosshedge

Avg monthlybasisbetween

Ŋ$5/cwtand$1/cwt

Standarddeviationsof

monthlybasisbetween

$2/cwtand$8/cwt

Example:BasisforCrossHedges

Astheweightmoves

outsidecontractspecs,

basisvariabilitychanges

Avg monthlybasisbetween

$11/cwtand$31/cwt

Standarddeviationsof

monthlybasisbetween

$14/cwtand$26/cwt

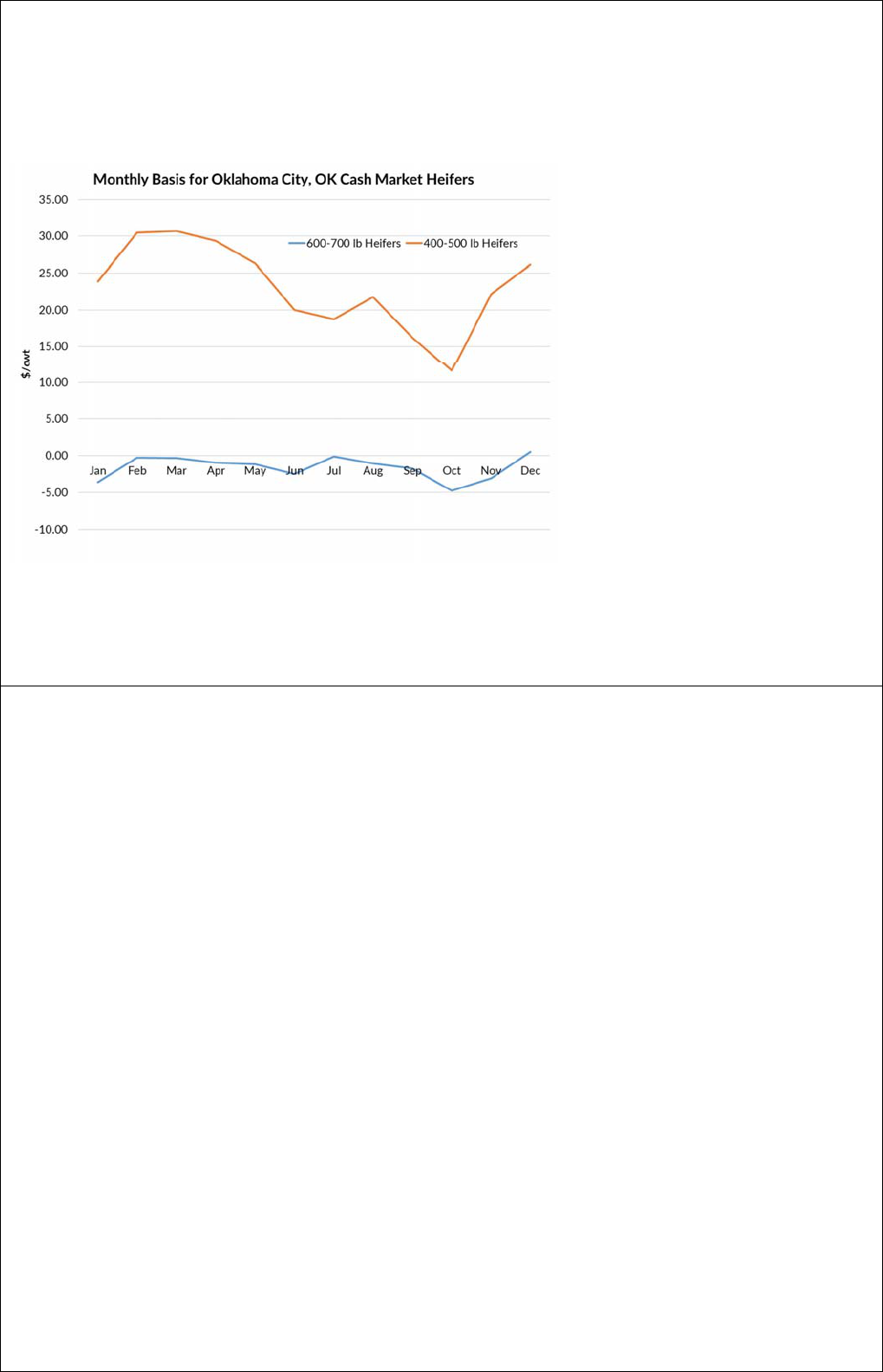

Cashmarketsfor6Ŋ7and4Ŋ

5weightfeedersareclosely

relatedbutnotidentical

Example:BasisforCrossHedges

Cashmarketsfor6Ŋ7and4Ŋ

5weightfeedersareclosely

relatedbutnotidentical

Similarseasonalpatterns

buttypicallybigger

movementsinthebasisfor

lightercalves

HedgingConcepts:CostsofHedging

BrokerFees

NFAfees($0.02pertransaction)

Opportunitycostofcapitalinthemarginaccount

Opportunitycostofresearching/projectingbasisand

determiningstrategies

HedgingConcepts:MarginAccounts

Toopenafuturesposition,youmustdepositanamountequalto

theinitialmarginneededforeachcontracttimesthetotal

numberofcontractstraded

Thereisamaintenancemarginlevelforeverycontract.Thiscan

varyamongbrokers.

Thebalanceofyourbrokeraccountisthemoneydeposited

plus

theequityinyourposition(s)

Ifthisbalanceisbelowmaintenancemarginlevel,youmust

depositcashtobringthebalanceuptoinitialmarginlevel

HedgingConcepts:MarginAccounts

Marginaccountsrequiresubstantialcapital

MarginforoneCMEFeederCattleContractis$2,800

$8,400margintohedgeabout200head(800lb animals)

Capitalisrequiredtobeheldaslongasyourpositionisopen

FuturesExchange

(e.g.,CME)

FuturesClearing

Merchant

(FCM)

Broker

FuturesMarket

Traders

ShortHedgers

LongHedgers

Speculators

MechanicsofTradingFuturesandOptions

Anyonewishingtotradefuturesoroptionswillworkwithabroker.Abrokeris

licensedtoplacetradeswithanFCM.FCMshaveaseatonagivenfutures

exchangeandhavetherighttotradeonthatexchange.It istheFCMthat

executesthetradeswithanexchange.

ItispossiblethatthebrokerandFCMare

thesameorganization.

Therelationshipwiththebrokermaybecompletelyelectronic,overŊtheŊphone,

inŊperson,orsomecombination.

Givethebroker

instructionstoliquidate

theposition.Thiscanbe

basedonsome

predeterminedruleora

spontaneousdecision.

Thegain/lossforthetrade

iscredited/debitedfrom

yourbrokeraccount.

Note:Foroptions,this

stepmightnotbe

necessary.

Maintainmargin

account

Iftheequityin

theaccountfalls

below

maintenance

margin,youmust

replenishitupto

initialmargin

level

Givethetrade

ordertothe

broker,whowill

havethetrade

executed

Thiscanbe

electronicallyor

byphone,

dependingon

thebroker

Findabroker

andestablishan

account

Depositatleast

theinitial

margin

requirementsin

theaccount

MechanicsofTradingFuturesandOptions

Youmustpayabrokerfeeforeverytrade.Feesaregenerallyintherangeof$5to

$40.Higherfeescomewithmoreaccesstothebrokerforadviceandguidance.

Lowerfeesareforelectronicplatformswherethetradersimplypointsandclicks

toaccomplishtheabovesteps.Choosing

abrokerisanimportantdecision.Put

sometimeandresearchintoit.

HedgingConcepts

Aproducerishedging(orhedged)ifandonlyifshehasequal

andoppositepositionsincashandfutures

Takingcaretomatchcontractsizeandcashpositionisimportant

Anydeviationfromthisinvolvesspeculatingineitherthecashor

futuresmarket

Ahedgetradesflatpricerisk

forbasisrisk

Understandingyourownbasisisessentialforaneffective

hedgingstrategy

HedgingConcepts

Hedgingisonepossibleriskmanagementtoolthatcanfitintoa

producer’sbigpictureplan…butisnotasubstituteforgood

management

Producersshouldevaluatetheirfinancialsituationandtheirown

personalitiesthendecidewhetherhedgingmakessense

Ingeneral,aproducercanhedgetotargetanacceptablereturn

Knowingperunitproductioncostsisnecessaryforthistowork

HedgingConcepts

Ifyouarehappyenoughwithatargetreturntohedgeit,thenbe

happytotakeit…evenifyourhedgeinayearmeansyougave

uppotentialcashmarketgains

Ahedgeiseffectiveifitallowsyoutoachievethistarget

Whatwehavediscussedtodayisbasic,disciplinedhedgingfor

managingrisk

Manyproducersusemorecomplexstrategiesthatinvolve

markettimingandcombinationsofinstruments

HedgingConcepts

Whatwehavediscussedtodayisbasic,disciplinedhedgingfor

managinglivestockpricerisk

Planhowusingfuturesoroptionswillmeshwithotherpricerisk

strategieslikeinsurance,cashcontracts,etc.

Don’tforgetotherrisks

Feedprice

Fuelprice

Weather

Disease

Resources

Agmanager.info

https://www.agmanager.info/grainŊmarketing/publications

https://www.agmanager.info/grainŊmarketing/publications#priceŊriskŊ

publications

https://www.agmanager.info/livestockŊmeat/marketingŊextensionŊ

bulletins/priceŊrisk

IowaStateExtensionandOutreach

https://www.extension.iastate.edu/agdm/ldmarkets.html

https://www.extension.iastate.edu/agdm/cdmarkets.html

CMEGrouphasexcellenteducationalmaterialsatnocharge

www.cmegroup.com

Resources

BeefBasis

MixofnoŊchargeandfeeŊbasedmaterialsanddata

https://beefbasis.com/

LivestockMarketingInformationCenter(LMIC)

www.lmic.info

Marketpricereportdata,productiondata

Livestockandmeatdata

Accesstomostusefuldatarequiresamembership

BrianK.Coffey

AssistantProfessor

DepartmentofAgriculturalEconomics

KansasStateUniversity

785Ŋ532Ŋ5033

@BrianKCoffey

^ƵƉƉůĞŵĞŶƚĂů^ůŝĚĞƐ

HedgingConcepts:MarginCalls

Asanexampleofhowmargincallswork,considerapositionof

onefeedercattlecontract

InitialMargin=minimumrequiredtoopentheposition=$2,800

MaintenanceMargin=amountatwhichamargincallisinitiated

=$2,800(initialandmaintenancecanbedifferent)

Ashorthedgersells

acontractatthecurrentfuturespriceof

$145/cwt

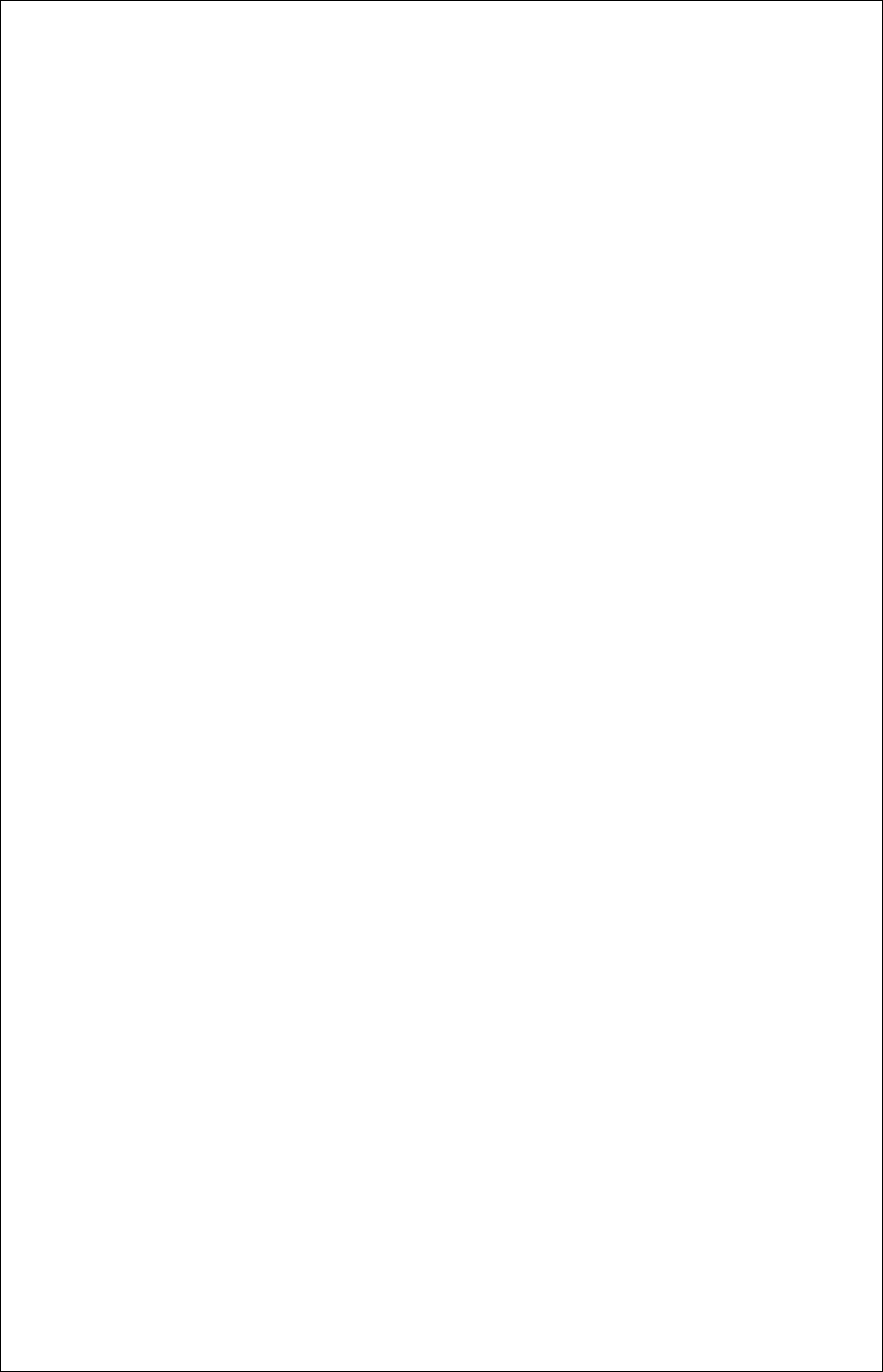

HedgingConcepts:MarginCalls

Date Cash

Balance

Futures

Price

Position

Equity

Net

Account

Value

MarginCall

7/30 $2,800 $145 $0 $2,800

7/31

8/1

8/2

8/3

8/4

InitialRequirement=$2,800 Position=short@$145

MaintenanceMargin=$2,800

HedgingConcepts:MarginCalls

Date Cash

Balance

Futures

Price

Position

Equity

NetAccount

Value

MarginCall?

7/30 $2,800 $145 $0 $2,800

7/31 $2,800 $143 $1,000 $3,800 No

8/1 $2,800 $144 $500 $3,300 No

8/2

8/3

InitialRequirement=$2,800 Position=short@$145

MaintenanceMargin=$2,800

HedgingConcepts:MarginCalls

Date Cash

Balance

Futures

Price

Position

Equity

NetAccount

Value

MarginCall?

7/30 $2,800 $145 $0 $2,800

7/31 $2,800 $143 $1,000 $3,800 No

8/1 $2,800 $144 $500 $3,300 No

8/2 $2,800 $147 Ŋ$1,000 $1,800 Yes,$1,000—must

restorenetacct

valuetoinitial level

8/3

InitialRequirement=$2,800 Position=short@$145

MaintenanceMargin=$2,800

HedgingConcepts:MarginCalls

Date Cash

Balance

Futures

Price

Position

Equity

NetAccount

Value

MarginCall?

7/30 $2,800 $145 $0 $2,800

7/31 $2,800 $143 $1,000 $3,800 No

8/1 $2,800 $144 $500 $3,300 No

8/2 $2,800 $147 Ŋ$1,000 $1,800 Yes,$1,000—must

restorenetacct

valuetoinitial level

8/3 $3,800 $147 Ŋ$1,000 $2,800 No

InitialRequirement=$2,800 Position=short@$145

MaintenanceMargin=$2,800