Security Futures Risk

Disclosure Statement

June 2016

02

TOC

Risk Disclosure Statement For Security Futures

Contracts

This disclosure statement discusses the

characteristics and risks of standardized security

futures contracts traded on regulated U.S. exchanges.

At present, regulated exchanges are authorized to

list futures contracts on individual equity securities

registered under the Securities Exchange Act of 1934

(including common stock and certain exchange-

traded funds and American Depositary Receipts),

as well as narrow-based security indices. Futures

on other types of securities and options on security

futures contracts may be authorized in the future. The

glossary of terms appears at the end of the document.

Customers should be aware that the examples in

this document are exclusive of fees and commissions

that may decrease their net gains or increase their

net losses. The examples also do not include tax

consequences, which may differ for each customer.

FINRA and the National Futures Association

(NFA), require members to deliver this

Security Futures Risk Disclosure Statement

to customers at or prior to the time a

customer’s account is approved for trading

security futures. Customers also may receive

revisions from time to time.

This Security Futures Risk Disclosure

Statement has been prepared by FINRA

and NFA with significant assistance from

other futures and securities self-regulatory

organizations.

Additional copes of this document may be

obtained by contacting FINRA MediaSource

at (240) 386-4200, or the NFA Information

Center at (312) 781-1410, or from FINRA’s

Web Site at www.finra.org, or NFA’s Web Site

at www.nfa.futures.org.

TABLE OF CONTENTS

Risk Disclosure Statement For Security

Futures Contracts 1

Section 1 | Risks Of Security Futures 4

1.1. Risks of Security Futures Transactions 4

1.2. General Risks 4

Section 2 | Description Of A Security

Futures Contract 8

2.1. What Is a Security Futures Contract? 8

2.2. Purposes of Security Futures 10

2.3. Where Security Futures Trade 13

2.4. How Security Futures Differ from

the Underlying Security 14

2.5. Comparison to Options 16

2.6. Components of a Security Futures

Contract 18

2.7. Trading Halts 20

2.8. Trading Hours 21

Section 3 | Clearing Organizations And

Mark-To-Market Requirements 22

Section 4 | Margin And Leverage 25

5.1. Cash Settlement 29

Section 5 | Settlement 29

5.2. Settlement by Physical Delivery 30

Section 6 | Customer Account Protections 31

6.1. Protections for Securities Accounts 32

6.2. Protections for Futures Accounts 33

Section 7 | Special Risks For Day Traders 35

Section 8 | Other 36

8.1. Corporate Events 36

8.2. Position Limits and Large Trader Reporting 37

8.3. Transactions on Foreign Exchanges 39

8.4. Tax Consequences 39

Section 9 | Glossary Of Terms 40

August 2010 |Supplement To The Security

Futures Risk Disclosure Statement 47

April 2014 | Supplement To The Security

Futures Risk Disclosure Statement 48

4 5

TOC TOC

1.1. Risks of Security Futures Transactions

Trading security futures contracts may not be suitable

for all investors. You may lose a substantial amount of

money in a very short period of time. The amount you

may lose is potentially unlimited and can exceed the

amount you originally deposit with your broker. This

is because futures trading is highly leveraged, with a

relatively small amount of money used to establish a

position in assets having a much greater value. If you

are uncomfortable with this level of risk, you should

not trade security futures contracts.

1.2. General Risks

Trading security futures contracts involves risk and

may result in potentially unlimited losses that are

greater than the amount you deposited with your

broker. As with any high risk financial product, you

should not risk any funds that you cannot afford

to lose, such as your retirement savings, medical

and other emergency funds, funds set aside for

purposes such as education or home ownership,

proceeds from student loans or mortgages, or

funds required to meet your living expenses.

Be cautious of claims that you can make large

profits from trading security futures contracts.

Although the high degree of leverage in security

futures contracts can result in large and immediate

gains, it can also result in large and immediate

losses. As with any financial product, there is no

such thing as a “sure winner.”

Because of the leverage involved and the nature

of security futures contract transactions, you

may feel the effects of your losses immediately.

Gains and losses in security futures contracts are

credited or debited to your account, at a minimum,

on a daily basis. If movements in the markets

for security futures contracts or the underlying

security decrease the value of your positions in

security futures contracts, you may be required to

have or make additional funds available to your

carrying firm as margin. If your account is under

the minimum margin requirements set by the

exchange or the brokerage firm, your position may

be liquidated at a loss, and you will be liable for the

deficit, if any, in your account. Margin requirements

are addressed in Section 4.

Under certain market conditions, it may be difficult

or impossible to liquidate a position. Generally,

you must enter into an offsetting transaction in

order to liquidate a 4 position in a security futures

contract. If you cannot liquidate your position in

security futures contracts, you may not be able

to realize a gain in the value of your position or

prevent losses from mounting. This inability to

liquidate could occur, for example, if trading is

halted due to unusual trading activity in either the

security futures contract or the underlying security;

if trading is halted due to recent news events

involving the issuer of the underlying security; if

systems failures occur on an exchange or at the

firm carrying your position; or if the position is on

an illiquid market. Even if you can liquidate your

position, you may be forced to do so at a price that

involves a large loss.

Under certain market conditions, it may also be

difficult or impossible to manage your risk from

open security futures positions by entering into

an equivalent but opposite position in another

contract month, on another market, or in the

underlying security. This inability to take positions

to limit your risk could occur, for example, if trading

is halted across markets due to unusual trading

activity in the security futures contract or the

underlying security or due to recent news events

involving the issuer of the underlying security.

SECTION 1

Risks Of Security Futures

6 7

TOC TOC

Under certain market conditions, the prices of

security futures contracts may not maintain their

customary or anticipated relationships to the prices

of the underlying security or index. These pricing

disparities could occur, for example, when the

market for the security futures contract is illiquid,

when the primary market for the underlying

security is closed, or when the reporting of

transactions in the underlying security has been

delayed. For index products, it could also occur

when trading is delayed or halted in some or all

of the securities that make up the index.

You may be required to settle certain security

futures contracts with physical delivery of the

underlying security. If you hold your position in a

physically settled security futures contract until

the end of the last trading day prior to expiration,

you will be obligated to make or take delivery of

the underlying securities, which could involve

additional costs. The actual settlement terms

may vary from contract to contract and exchange

to exchange. You should carefully review the

settlement and delivery conditions before entering

into a security futures contract. Settlement and

delivery are discussed in Section 5.

You may experience losses due to systems failures.

As with any financial transaction, you may

experience losses if your orders for security futures

contracts cannot be executed 6 normally due to

systems failures on a regulated exchange or at the

brokerage firm carrying your position. Your losses

may be greater if the brokerage firm carrying your

position does not have adequate back-up systems

or procedures.

All security futures contracts involve risk, and

there is no trading strategy that can eliminate it.

Strategies using combinations of positions, such as

spreads, may be as risky as outright long or short

positions. Trading in security futures contracts

requires knowledge of both the securities and the

futures markets.

Day trading strategies involving security futures

contracts and other products pose special risks.

As with any financial product, persons who seek

to purchase and sell the same security future in

the course of a day to profit from intra-day price

movements (“day traders”) face a number of special

risks, including substantial commissions, exposure

to leverage, and competition with professional

traders. You should thoroughly understand these

risks and have appropriate experience before

engaging in day trading. The special risks for day

traders are discussed more fully in Section 7.

Placing contingent orders, if permitted, such

as “stop-loss” or “stop-limit” orders, will not

necessarily limit your losses to the intended

amount. Some regulated 7 exchanges may permit

you to enter into stop-loss or stop-limit orders

for security futures contracts, which are intended

to limit your exposure to losses due to market

fluctuations. However, market conditions may

make it impossible to execute the order or to get

the stop price.

You should thoroughly read and understand the

customer account agreement with your brokerage

firm before entering into any transactions in

security futures contracts.

You should thoroughly understand the regulatory

protections available to your funds and positions

in the event of the failure of your brokerage firm.

The regulatory protections available to your funds

and positions in the event of the failure of your

brokerage firm may vary depending on, among

other factors, the contract you are trading and

whether you are trading through a securities

account or a futures account. Firms that allow

customers to trade security futures in either

securities accounts or futures accounts, or both, are

required to disclose to customers the differences in

regulatory protections between such accounts, and,

where appropriate, how customers may elect to

trade in either type of account.

8 9

TOC TOC

2.1. What Is a Security Futures Contract?

A security futures contract is a legally binding

agreement between two parties to purchase or

sell in the future a specific quantity of shares of a

security or of the component securities of a narrow-

based security index, at a certain price. A person

who buys a security futures contract enters into a

contract to purchase an underlying security and is

said to be “long” the contract. A person who sells a

security futures contract enters into a contract to sell

the underlying security and is said to be “short” the

contract. The price at which the contract trades

(the “contract price”) is determined by relative buying

and selling interest on a regulated exchange.

In order to enter into a security futures contract,

you must deposit funds with your brokerage firm

equal to a specified percentage (usually at least 20

percent) of the current market value of the contract

as a performance bond. Moreover, all security futures

contracts are marked-to-market at least daily, usually

after the close of trading, as described in Section 3

of this document. At that time, the account of each

buyer and seller reflects the amount of any gain or

loss on the security futures contract based on the

contract price established at the end of the day for

settlement purposes (the “daily settlement price”).

An open position, either a long or short position, is

closed or liquidated by entering into an offsetting

transaction (i.e., an equal and opposite transaction

to the one that opened the position) prior to the

contract expiration. Traditionally, most futures

contracts are liquidated prior to expiration through

an offsetting transaction and, thus, holders do not

incur a settlement obligation.

Security futures contracts that are not liquidated prior

to expiration must be settled in accordance with the

terms of the contract. Some security futures contracts

are settled by physical delivery of the underlying

security. At the expiration of a security futures

contract that is settled through physical delivery, a

person who is long the contract must pay the final

settlement price set by the regulated exchange or

the clearing organization and take delivery of the

underlying shares. Conversely, a person who is short

the contract must make delivery of the underlying

shares in exchange for the final settlement price.

Other security futures contracts are settled through

cash settlement. In this case, the underlying security

is not delivered. Instead, any positions in such security

futures contracts that are open at the end of the last

trading day are settled through a final cash payment

based on a final settlement price determined by the

exchange or clearing organization. Once this payment

is made, neither party has any further obligations on

the contract.

Physical delivery and cash settlement are discussed

more fully in Section 5.

SECTION 2

Description Of A Security Futures Contract

Examples:

Investor A is long one September XYZ Corp.

futures contract. To liquidate the long position

in the September XYZ Corp. futures contract,

Investor A would sell an identical September

XYZ Corp. contract.

Investor B is short one December XYZ Corp.

futures contract. To liquidate the short position

in the December XYZ Corp. futures contract,

Investor B would buy an identical December

XYZ Corp. contract.

10 11

TOC TOC

2.2. Purposes of Security Futures

Security futures contracts can be used for speculation,

hedging, and risk management. Security futures

contracts do not provide capital growth or income.

Speculation

Speculators are individuals or firms who seek to

profit from anticipated increases or decreases in

futures prices. A speculator who expects the price of

the underlying instrument to increase will buy the

security futures contract. A speculator who expects

the price of the underlying instrument to decrease

will sell the security futures contract. Speculation

involves substantial risk and can lead to large losses

as well as profits.

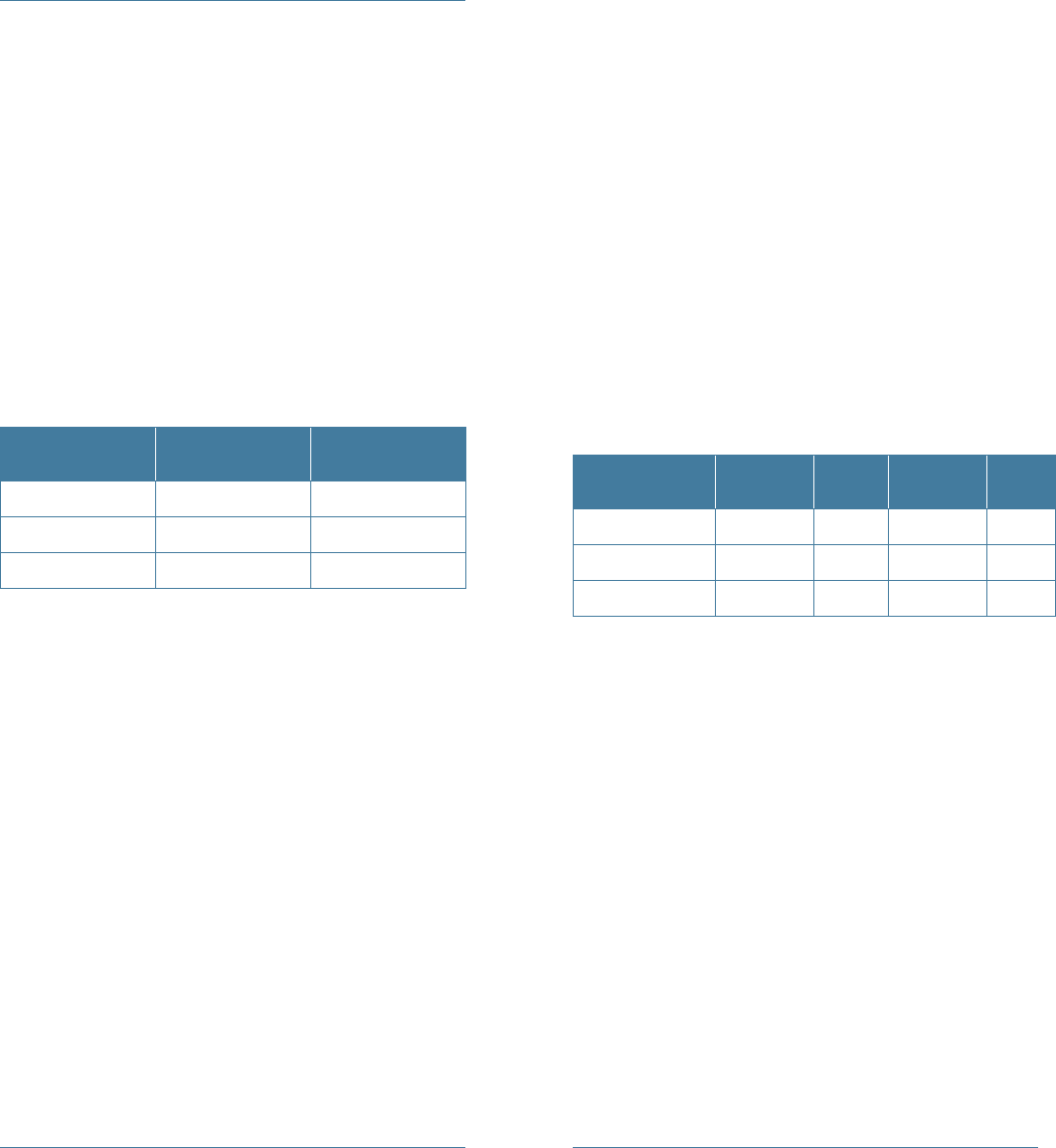

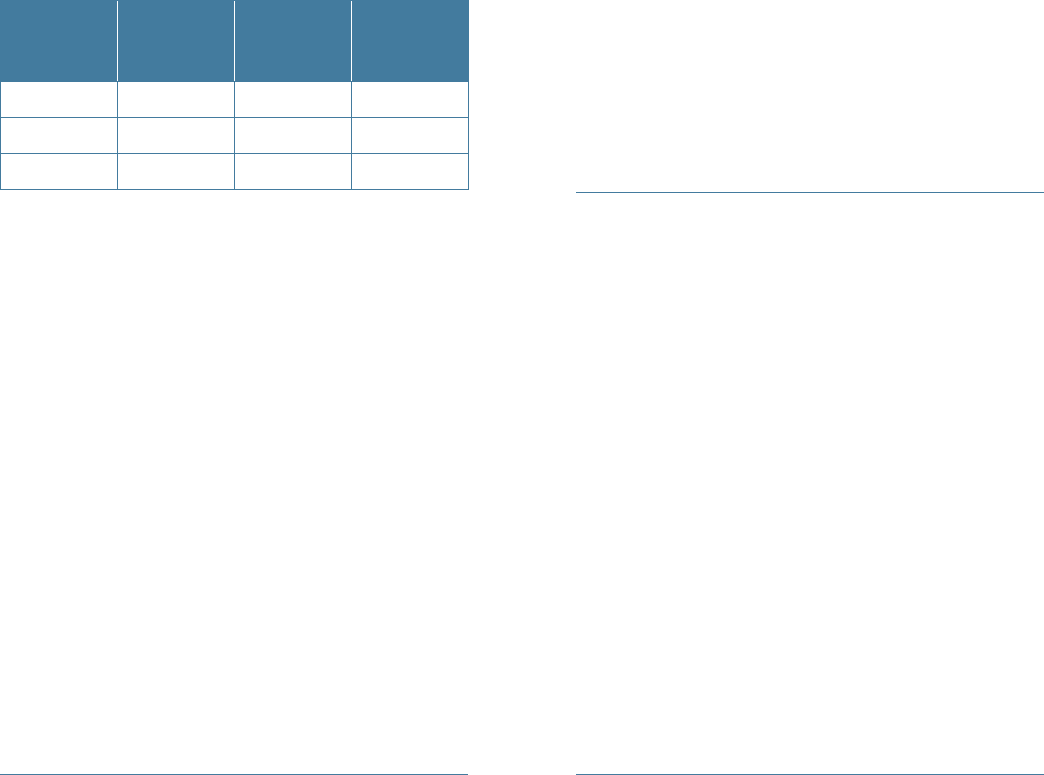

Price of XYZ

at Liquidation

Customer A

Profit/Loss

Customer B

Profit/Loss

$55 $500 - $500

$50 $0 $0

$45 - $500 $500

The most common trading strategies involving

security futures contracts are buying with the hope

of profiting from an anticipated price increase and

selling with the hope of profiting from an anticipated

price decrease. For example, a person who expects

the price of XYZ stock to increase by March can buy

a March XYZ security futures contract, and a person

who expects the price of XYZ stock to decrease by

March can sell a March XYZ security futures contract.

The following illustrates potential profits and losses

if Customer A purchases the security futures contract

at $50 a share and Customer B sells the same contract

at $50 a share (assuming 100 shares per contract).

Speculators may also enter into spreads with the

hope of profiting from an expected change in price

relationships. Spreaders may purchase a contract

expiring in one contract month and sell another

contract on the same underlying security expiring in

a different month (e.g., buy June and sell September

XYZ single stock futures). This is commonly referred to

as a “calendar spread.” Spreaders may also purchase

and sell the same contract month in two different but

economically correlated security futures contracts. For

example, 12 if ABC and XYZ are both pharmaceutical

companies and an individual believes that ABC will

have stronger growth than XYZ between now and

June, he could buy June ABC futures contracts and

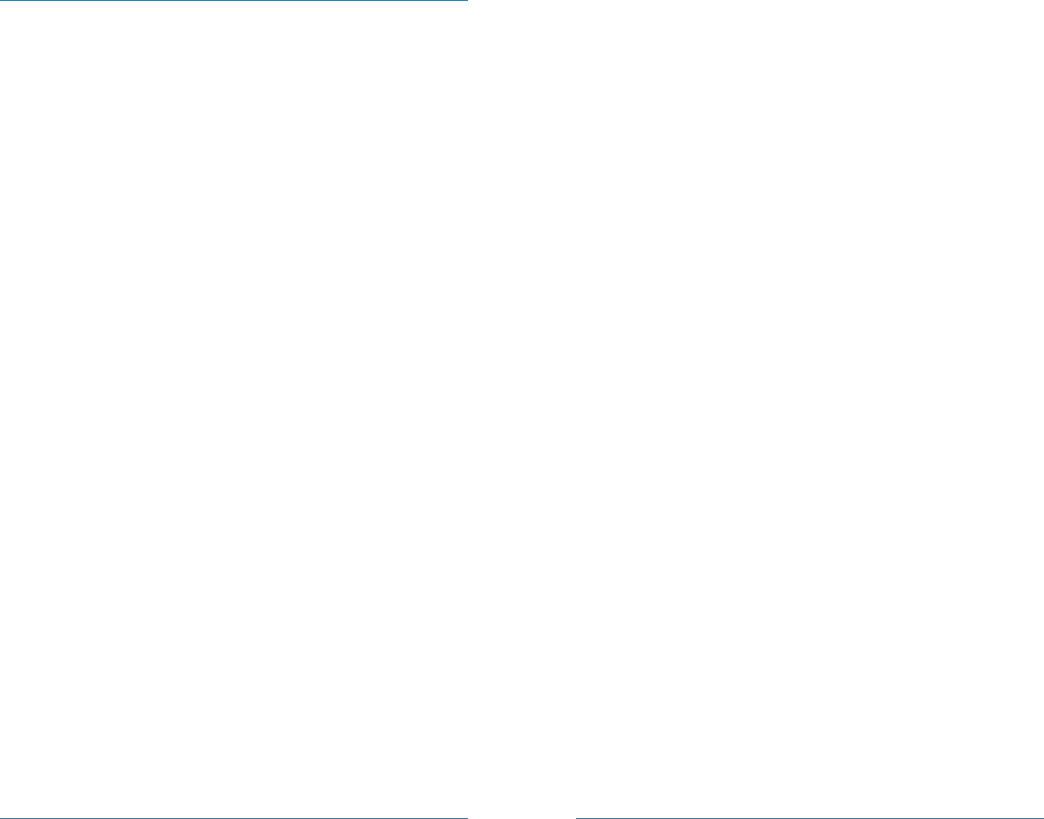

sell June XYZ futures contracts. Assuming that each

contract is 100 shares, the following illustrates how

this works.

Opening

Position

Price at

Liquidation

Gain or

Loss

Price at

Liquidation

Gain or

Loss

Buy ABC at 50 $53 $300 $53 $300

Sell XYZ at 45 $46 -$100 $50 -$500

Net Gain or Loss $200 -$200

Speculators can also engage in arbitrage, which is

similar to a spread except that the long and short

positions occur on two different markets. An arbitrage

position can be established by taking an economically

opposite position in a security futures contract on

another exchange, in an options contract, or in the

underlying security.

Hedging

Generally speaking, hedging involves the purchase

or sale of a security future to reduce or offset the risk

of a position in the underlying security or group of

securities (or a close economic equivalent). A hedger

gives up the potential to profit from a favorable

price change in the position being hedged in order

to minimize the risk of loss from an adverse price

change.

12 13

TOC TOC

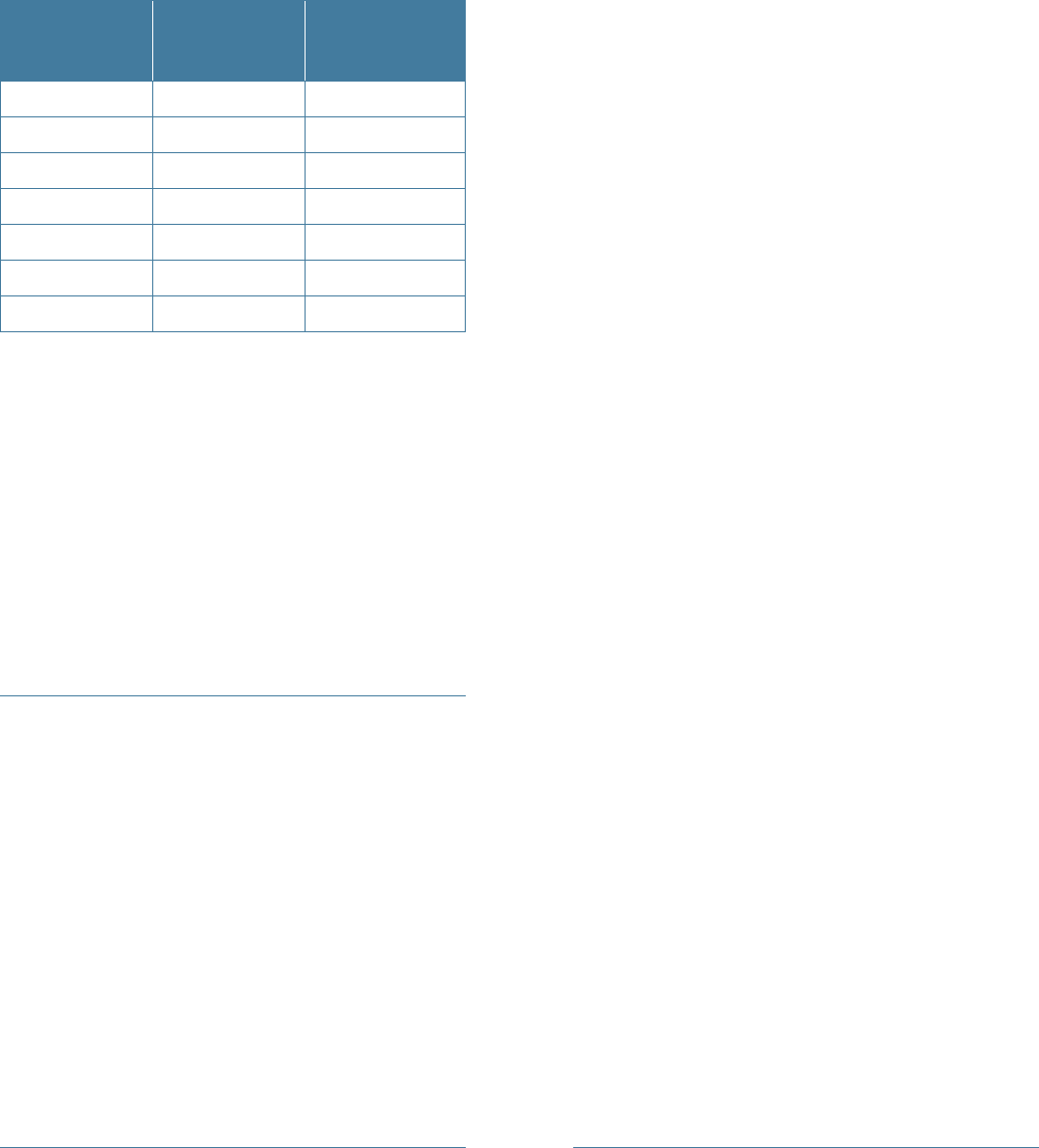

An investor who wants to lock in a price now for an

anticipated sale of the underlying security at a later

date can do so by hedging with security futures. For

example, assume an investor owns 1,000 shares of

ABC that have appreciated since he bought them. The

investor would like to sell them at the current price of

$50 per share, but there are tax or other reasons for

holding them until September. The investor could sell

ten 100- share ABC futures contracts and then buy

back those contracts in September when he sells the

stock. Assuming the stock price and the futures price

change by the same amount, the gain or loss in the

stock will be offset by the loss or gain in the futures

contracts.

Price in

September

Value of

1,000 Shares

of ABC

Gain or Loss

on Futures

Effective

Selling Price

$40 $40,000 $10,000 $50,000

$50 $50,000 $0 $50,000

$60 $60,000 - $10,000 $50,000

Hedging can also be used to lock in a price now for

an anticipated purchase of the stock at a later date.

For example, assume that in May a mutual fund

expects to buy stocks in a particular industry with

the proceeds of bonds that will mature in August.

The mutual fund can hedge its risk that the stocks

will increase in value between May and August by

purchasing security futures contracts on a narrow-

based index of stocks from that industry. When the

mutual fund buys the stocks in August, it also will

liquidate the security futures position in the index.

If the relationship between the security futures

contract and the stocks in the index is constant, the

profit or loss from the futures contract will offset the

price change in the stocks, and the mutual fund will

have locked in the price that the stocks were selling

at in May.

Although hedging mitigates risk, it does not eliminate

all risk. For example, the relationship between the

price of the security futures contract and the price

of the underlying security traditionally tends to

remain constant over time, but it can and does vary

somewhat. Furthermore, the expiration or liquidation

of the security futures contract may not coincide with

the exact time the hedger buys or sells the underlying

stock. Therefore, hedging may not be a perfect

protection against price risk.

Risk Management

Some institutions also use futures contracts to

manage portfolio risks without necessarily intending

to change the composition of their portfolio by buying

or selling the underlying securities. The institution

does so by taking a security futures position that

is opposite to some or all of its position in the

underlying securities. This strategy involves more

risk than a traditional hedge because it is not meant

to be a substitute for an anticipated purchase or sale.

2.3. Where Security Futures Trade

By law, security futures contracts must trade on

a regulated U.S. exchange. Each regulated U.S.

exchange that trades security futures contracts is

subject to joint regulation by the Securities and

Exchange Commission (SEC) and the Commodity

Futures Trading Commission (CFTC). A person holding

a position in a security futures contract who seeks

to liquidate the position must do so either on the

regulated exchange where the original trade took

place or on another regulated exchange, if any, where

a fungible security futures contract trades. (A person

may also seek to manage the risk in that position by

taking an opposite position in a comparable contract

traded on another regulated exchange.)

14 15

TOC TOC

Security futures contracts traded on one regulated

exchange might not be fungible with security futures

contracts traded on another regulated exchange

for a variety of reasons. Security futures traded on

different regulated exchanges may be non-fungible

because they have different contract terms (e.g., size,

settlement method), or because they are cleared

through different clearing organizations. Moreover,

a regulated exchange might not permit its security

futures contracts to be offset or liquidated by an

identical contract traded on another regulated

exchange, even though they have the same contract

terms and are cleared through the same clearing

organization. You should consult your broker about

the fungibility of the contract you are considering

purchasing or selling, including which exchange(s),

if any, on which it may be offset.

Regulated exchanges that trade security futures

contracts are required by law to establish certain

listing standards. Changes in the underlying security

of a security futures contract may, in some cases,

cause such contract to no longer meet the regulated

exchange’s listing standards. Each regulated exchange

will have rules governing the continued trading of

security futures contracts that no longer meet the

exchange’s listing standards. These rules may, for

example, permit only liquidating trades in security

futures contracts that no longer satisfy the listing

standards.

2.4. How Security Futures Differ from the

Underlying Security

Shares of common stock represent a fractional

ownership interest in the issuer of that security.

Ownership of securities confers various rights that

are not present with positions in security futures

contracts. For example, persons owning a share of

common stock may be entitled to vote in matters

affecting corporate governance. They also may be

entitled to receive dividends and corporate disclosure,

such as annual and quarterly reports.

The purchaser of a security futures contract, by

contrast, has only a contract for future delivery of

the underlying security. The purchaser of the security

futures contract is not entitled to exercise any voting

rights over the underlying security and is not entitled

to any dividends that may be paid by the issuer.

Moreover, the purchaser of a security futures contract

does not receive the corporate disclosures that are

received by shareholders of the underlying security,

although such corporate disclosures must be made

publicly available through the SEC’s EDGAR system,

which can be accessed at www.sec.gov. You should

review such disclosures before entering into a security

futures contract. See Section 8.1 for further discussion

of the impact of corporate events on a security futures

contract.

All security futures contracts are marked-to-market

at least daily, usually after the close of trading, as

described in Section 3 of this document. At that time,

the account of each buyer and seller is credited with

the amount of any gain, or debited by the amount of

any loss, on the security futures contract, based on

the contract price established at the end of the day

for settlement purposes (the “daily settlement price”).

By contrast, the purchaser or seller of the underlying

instrument does not have the profit and loss from

his or her investment credited or debited until the

position in that instrument is closed out.

Naturally, as with any financial product, the value of

the security futures contract and of the underlying

security may fluctuate. However, owning the

underlying security does not require an investor to

settle his or her profits and losses daily. By contrast,

as a result of the mark-to-market requirements

discussed above, a person who is long a security

futures contract often will be required to deposit

additional funds into his or her account as the price

of the security futures contract decreases. Similarly, a

person who is short a security futures contract often

will be required to deposit additional funds into his

or her account as the price of the security futures

contract increases.

16 17

TOC TOC

Another significant difference is that security futures

contracts expire on a specific date. Unlike an owner of

the underlying security, a person cannot hold a long

position in a security futures contract for an extended

period of time in the hope that the price will go up.

If you do not liquidate your security futures contract,

you will be required to settle the contract when

it expires, either through physical delivery or cash

settlement. For cash-settled contracts in particular,

upon expiration, an individual will no longer have an

economic interest in the securities underlying the

security futures contract.

2.5. Comparison to Options

Although security futures contracts share some

characteristics with options on securities (options

contracts), these products are also different in a

number of ways. Below are some of the important

distinctions between equity options contracts and

security futures contracts.

If you purchase an options contract, you have the

right, but not the obligation, to buy or sell a security

prior to the expiration date. If you sell an options

contract, you have the obligation to buy or sell a

security prior to the expiration date. By contrast, if

you have a position in a security futures contract

(either long or short), you have both the right and

the obligation to buy or sell a security at a future

date. The only way that you can avoid the obligation

incurred by the security futures contract is to liquidate

the position with an offsetting contract.

A person purchasing an options contract runs the risk

of losing the purchase price (premium) for the option

contract. Because it is a wasting asset, the purchaser

of an options contract who neither liquidates

the options contract in the secondary market nor

exercises it at or prior to expiration will necessarily

lose his or her entire investment in the options

contract. However, a purchaser of an options contract

cannot lose more than the amount of the premium.

Conversely, the seller of an options contract receives

the premium and assumes the risk that he or she will

be required to buy or sell the underlying security on

or prior to the expiration date, in which event his or

her losses may exceed the amount of the premium

received. Although the seller of an options contract

is required to deposit margin to reflect the risk of its

obligation, he or she may lose many times his or her

initial margin deposit.

By contrast, the purchaser and seller of a security

futures contract each enter into an agreement to buy

or sell a specific quantity of shares in the underlying

security. Based upon the movement in prices of the

underlying security, a person who holds a position in a

security futures contract can gain or lose many times

his or her initial margin deposit. In this respect, the

benefits of a security futures contract are similar to

the benefits of purchasing an option, while the risks

of entering into a security futures contract are similar

to the risks of selling an option.

Both the purchaser and the seller of a security futures

contract have daily margin obligations. At least once

each day, security futures contracts are marked-to-

market and the increase or decrease in the value of

the contract is credited or debited to the buyer and

the seller. As a result, any person who has an open

position in a security futures contract may be called

upon to meet additional margin requirements or may

receive a credit of available funds.

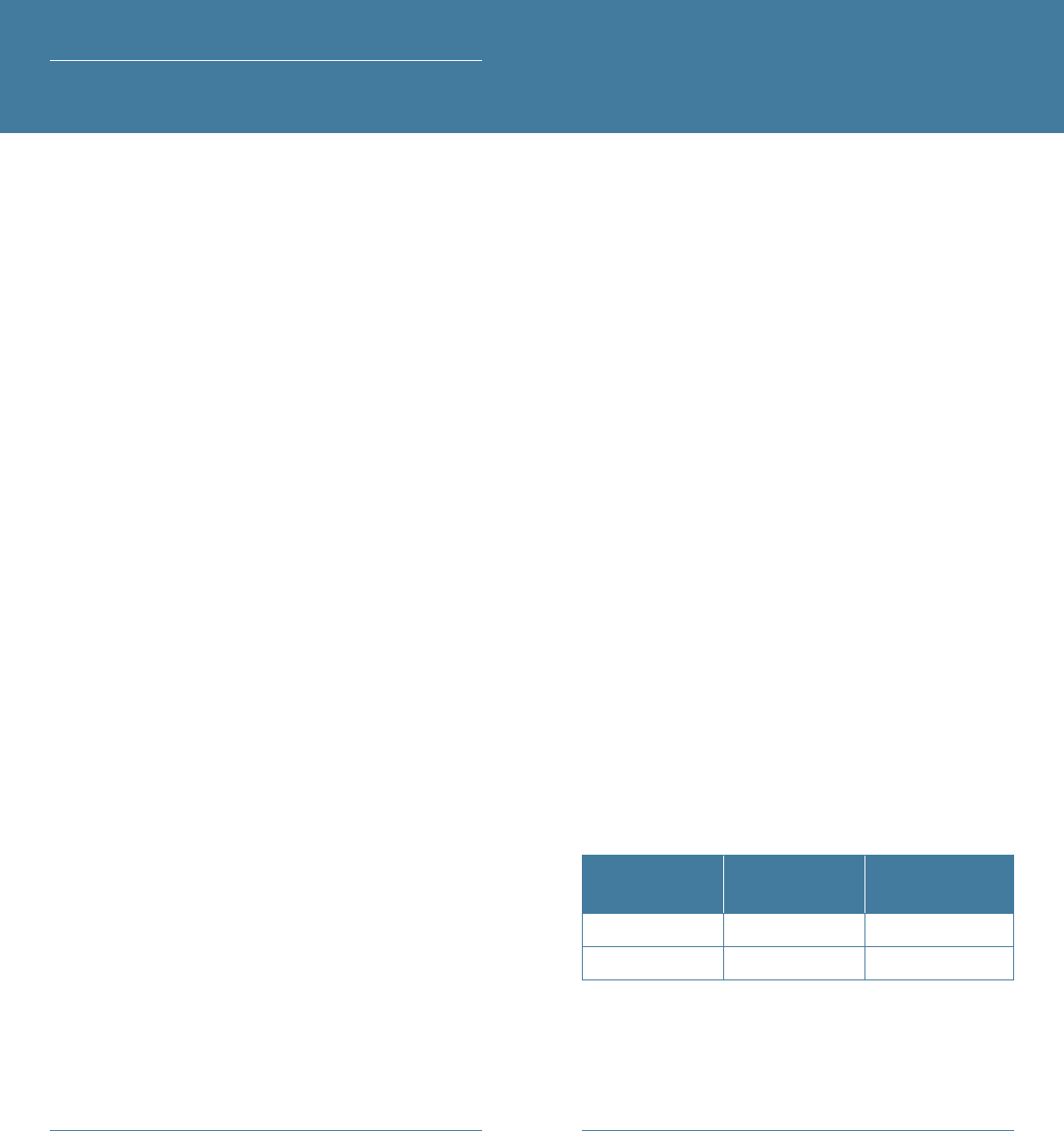

Example:

Assume that Customers A and B each anticipate

an increase in the market price of XYZ stock, which

is currently $50 a share. Customer A purchases

an XYZ 50 call (covering 100 shares of XYZ at a

premium of $5 per share). The option premium

is $500 ($5 per share X 100 shares). Customer

B purchases an XYZ security futures contract

(covering 100 shares of XYZ). The total value of

the contract is $5000 ($50 share value X 100

shares). The required margin is $1000 (or 20%

of the contract value).

18 19

TOC TOC

Price of XYZ

at Expiration

Customer A

Profit/Loss

Customer B

Profit/Loss

65 $1000 $1500

60 $500 $1000

55 $0 $500

50 - $500 $0

45 - $500 - $500

40 - $500 - $1000

35 - $500 - $1500

The most that Customer A can lose is $500, the option

premium. Customer A breaks even at $55 per share,

and makes money at higher prices. Customer B may

lose more than his initial margin deposit. Unlike the

options premium, the margin on a futures contract

is not a cost but a performance bond. The losses for

Customer B are not limited by this performance bond.

Rather, the losses or gains are determined by the

settlement price of the contract, as provided in the

example above. Note that if the price of XYZ falls to

$35 per share, Customer A loses only $500, whereas

Customer B loses $1500.

2.6. Components of a Security Futures Contract

Each regulated exchange can choose the terms of

the security futures contracts it lists, and those terms

may differ from exchange to exchange or contract to

contract. Some of those contract terms are discussed

below. However, you should ask your broker for a

copy of the contract specifications before trading a

particular contract.

2.6.1. Each security futures contract has a set size. The

size of a security futures contract is determined by the

regulated exchange on which the contract trades. For

example, a security futures contract for a single stock

may be based on 100 shares of that stock. If prices are

reported per share, the value of the contract would

be the price times 100. For narrow-based security

indices, the value of the contract is the price of the

component securities times the multiplier set by the

exchange as part of the contract terms.

2.6.2. Security futures contracts expire at set times

determined by the listing exchange. For example, a

particular contract may expire on a particular day,

e.g., the third Friday of the expiration month. Up

until expiration, you may liquidate an open position

by offsetting your contract with a fungible opposite

contract that expires in the same month. If you do

not liquidate an open position before it expires,

you will be required to make or take delivery of the

underlying security or to settle the contract in cash

after expiration.

2.6.3. Although security futures contracts on a

particular security or a narrow-based security index

may be listed and traded on more than one regulated

exchange, the contract specifications may not be the

same. Also, prices for contracts on the same security

or index may vary on different regulated exchanges

because of different contract specifications.

2.6.4. Prices of security futures contracts are usually

quoted the same way prices are quoted in the

underlying instrument. For example, a contract for

an individual security would be quoted in dollars and

cents per share. Contracts for indices would be quoted

by an index number, usually stated to two decimal

places.

2.6.5. Each security futures contract has a minimum

price fluctuation (called a tick), which may differ from

product to product or exchange to exchange. For

example, if a particular security futures contract has

a tick size of 1¢, you can buy the contract at $23.21 or

$23.22 but not at $23.215.

20 21

TOC TOC

2.7. Trading Halts

The value of your positions in security futures

contracts could be affected if trading is halted in

either the security futures contract or the underlying

security. In certain circumstances, regulated

exchanges are required by law to halt trading in

security futures contracts. For example, trading

on a particular security futures contract must be

halted if trading is halted on the listed market for

the underlying security as a result of pending news,

regulatory concerns, or market volatility. Similarly,

trading of a security futures contract on a narrow-

based security index must be halted under such

circumstances if trading is halted on securities

accounting for at least 50 percent of the market

capitalization of the index. In addition, regulated

exchanges are required to halt trading in all security

futures contracts for a specified period of time when

the Dow Jones Industrial Average (“DJIA”) experiences

one-day declines of 10-, 20- and 30-percent. The

regulated exchanges may also have discretion under

their rules to halt trading in other circumstances–

such as when the exchange determines that the halt

would be advisable in maintaining a fair and orderly

market.

A trading halt, either by a regulated exchange that

trades security futures or an exchange trading the

underlying security or instrument, could prevent

you from liquidating a position in security futures

contracts in a timely manner, which could prevent

you from liquidating a position in security futures

contracts at that time.

2.8. Trading Hours

Each regulated exchange trading a security futures

contract may open and close for trading at different

times than other regulated exchanges trading security

futures contracts or markets trading the underlying

security or securities. Trading in security futures

contracts prior to the opening or after the close of the

primary market for the underlying security may be

less liquid than trading during regular market hours.

Every regulated U.S. exchange that trades security

futures contracts is required to have a relationship

with a clearing organization that serves as the

guarantor of each security futures contract

traded on that exchange. A clearing organization

performs the following functions: matching trades;

effecting settlement and payments; guaranteeing

performance; and facilitating deliveries.

22 23

TOC TOC

Throughout each trading day, the clearing

organization matches trade data submitted by

clearing members on behalf of their customers or

for the clearing member’s proprietary accounts. If an

account is with a brokerage firm that is not a member

of the clearing organization, then the brokerage firm

will carry the security futures position with another

brokerage firm that is a member of the clearing

organization. Trade records that do not match, either

because of a discrepancy in the details or because

one side of the transaction is missing, are returned to

the submitting clearing members for resolution. The

members are required to resolve such “out trades”

before or on the open of trading the next morning.

When the required details of a reported transaction

have been verified, the clearing organization assumes

the legal and financial obligations of the parties to

the transaction. One way to think of the role of the

clearing organization is that it is the “buyer to every

seller and the seller to every buyer.” The insertion

or substitution of the clearing organization as the

counter-party to every transaction enables a customer

to liquidate a security futures position without

regard to what the other party to the original security

futures contract decides to do.

The clearing organization also effects the settlement

of gains and losses from security futures contracts

between clearing members. At least once each day,

clearing member brokerage firms must either pay

to, or receive from, the clearing organization the

difference between the current price and the trade

price earlier in the day, or for a position carried over

from the previous day, the difference between the

current price and the previous day’s settlement price.

Whether a clearing organization effects settlement of

gains and losses on a daily basis or more frequently

will depend on the conventions of the clearing

organization and market conditions. Because the

clearing organization assumes the legal and financial

obligations for each security futures contract, you

should expect it to ensure that payments are made

promptly to protect its obligations.

Gains and losses in security futures contracts are also

reflected in each customer’s account on at least a

daily basis. Each day’s gains and losses are determined

based on a daily settlement price disseminated by

the regulated exchange trading the security futures

contract or its clearing organization. If the daily

settlement price of a particular security futures

contract rises, the buyer has a gain and the seller a

loss. If the daily settlement price declines, the buyer

has a loss and the seller a gain. This process is known

as “marking-to-market” or daily settlement. As a

result, individual customers normally will be called on

to settle daily.

The one-day gain or loss on a security futures contract

is determined by calculating the difference between

the current day’s settlement price and the previous

day’s settlement price. For example, assume a security

futures contract is purchased at a price of $120. If the

daily settlement price is either $125 (higher) or $117

(lower), the effects would be as follows:

(1 contract representing 100 shares)

Daily Settlement

Value

Buyer’s

Account

Seller’s

Account

$125 $500 gain (credit) $500 loss (debit)

$117 $300 loss (debit) $300 gain (credit)

SECTION 3

Clearing Organizations And Mark-To-Market

Requirements

24 25

TOC TOC

The cumulative gain or loss on a customer’s open

security futures positions is generally referred to

as “open trade equity” and is listed as a separate

component of account equity on your customer

account statement.

A discussion of the role of the clearing organization

in effecting delivery is discussed in Section 5.

When a broker-dealer lends a customer part of the

funds needed to purchase a security such as common

stock, the term “margin” refers to the amount of cash,

or down payment, the customer is required to deposit.

By contrast, a security futures contract is an obligation

and not an asset. A security futures contract has no

value as collateral for a loan. Because of the potential

for a loss as a result of the daily marked-to-market

process, however, a margin deposit is required of each

party to a security futures contract. This required

margin deposit also is referred to as a “performance

bond.”

In the first instance, margin requirements for security

futures contracts are set by the exchange on which

the contract is traded, subject to certain minimums

set by law. The basic margin requirement is 20% of

the current value of the security futures contract,

although some strategies may have lower margin

requirements. Requests for additional margin are

known as “margin calls.” Both buyer and seller must

individually deposit the required margin to their

respective accounts.

It is important to understand that individual

brokerage firms can, and in many cases do,

require margin that is higher than the exchange

requirements. Additionally, margin requirements

may vary from brokerage firm to brokerage firm.

Furthermore, a brokerage firm can increase its

“house” margin requirements at any time without

providing advance notice, and such increases could

result in a margin call.

For example, some firms may require margin to be

deposited the business day following the day of a

deficiency, or some firms may even require deposit

on the same day. Some firms may require margin to

be on deposit in the account before they will accept

an order for a security futures contract. Additionally,

SECTION 4

Margin And Leverage

26 27

TOC TOC

brokerage firms may have special requirements as

to how margin calls are to be met, such as requiring

a wire transfer from a bank, or deposit of a certified

or cashier’s check. You should thoroughly read and

understand the customer agreement with your

brokerage firm before entering into any transactions

in security futures contracts.

If through the daily cash settlement process, losses in

the account of a security futures contract participant

reduce the funds on deposit (or equity) below the

maintenance margin level (or the firm’s higher

“house” requirement), the brokerage firm will require

that additional funds be deposited.

If additional margin is not deposited in accordance

with the firm’s policies, the firm can liquidate your

position in security futures contracts or sell assets in

any of your accounts at the firm to cover the margin

deficiency. You remain responsible for any shortfall in

the account after such liquidations or sales. Unless

provided otherwise in your customer agreement or by

applicable law, you are not entitled to choose which

futures contracts, other securities or other assets are

liquidated or sold to meet a margin call or to obtain

an extension of time to meet a margin call.

Brokerage firms generally reserve the right to

liquidate a customer’s security futures contract

positions or sell customer assets to meet a margin

call at any time without contacting the customer.

Brokerage firms may also enter into equivalent

but opposite positions for your account in order

to manage the risk created by a margin call. Some

customers mistakenly believe that a firm is required

to contact them for a margin call to be valid, and that

the firm is not allowed to liquidate securities or other

assets in their accounts to meet a margin call unless

the firm has contacted them first. This is not the case.

While most firms notify their customers of margin

calls and allow some time for deposit of additional

margin, they are not required to do so. Even if a firm

has notified a customer of a margin call and set a

specific due date for a margin deposit, the firm can

still take action as necessary to protect its financial

interests, including the immediate liquidation

of positions without advance notification to the

customer.

Here is an example of the margin requirements for a

long security futures position.

A customer buys 3 July EJG security futures at 71.50.

Assuming each contract represents 100 shares, the

nominal value of the position is $21,450 (71.50 x 3

contracts x 100 shares). If the initial margin rate is

20% of the nominal value, then the customer’s initial

margin requirement would be $4,290. The customer

deposits the initial margin, bringing the equity in the

account to $4,290.

First, assume that the next day the settlement price

of EJG security futures falls to 69.25. The marked-to-

market loss in the customer’s equity is $675 (71.50

– 69.25 x 3 contacts x 100 shares). The customer’s

equity decreases to $3,615 ($4,290 – $675). The new

nominal value of the contract is $20,775 (69.25 x 3

contracts x 100 shares). If the maintenance margin

rate is 20% of the nominal value, then the customer’s

maintenance margin requirement would be $4,155.

Because the customer’s equity had decreased to

$3,615 (see above), the customer would be required to

have an additional $540 in margin ($4,155 – $3,615).

Alternatively, assume that the next day the

settlement price of EJG security futures rises to 75.00.

The mark-to-market gain in the customer’s equity

is $1,050 (75.00 – 71.50 x 3 contacts x 100 shares).

The customer’s equity increases to $5,340 ($4,290 +

$1,050). The new nominal 33 value of the contract

is $22,500 (75.00 x 3 contracts x 100 shares). If the

maintenance margin rate is 20% of the nominal

value, then the customer’s maintenance margin

requirement would be $4,500. Because the customer’s

equity had increased to $5,340 (see above), the

customer’s excess equity would be $840.

28 29

TOC TOC

The process is exactly the same for a short position,

except that margin calls are generated as the

settlement price rises rather than as it falls. This

is because the customer’s equity decreases as the

settlement price rises and increases as the settlement

price falls.

Because the margin deposit required to open a

security futures position is a fraction of the nominal

value of the contracts being purchased or sold,

security futures contracts are said to be highly

leveraged. The smaller the margin requirement in

relation to the underlying value of the security futures

contract, the greater the leverage. Leverage allows

exposure to a given quantity of an underlying asset

for a fraction of the investment needed to purchase

that quantity outright. In sum, buying (or selling) a

security futures contract provides the same dollar and

cents profit and loss outcomes as owning (or shorting)

the underlying security. However, as a percentage of

the margin deposit, the potential immediate exposure

to profit or loss is much higher with a security futures

contract than with the underlying security.

For example, if a security futures contract is

established at a price of $50, the contract has a

nominal value of $5,000 (assuming the contract is for

100 shares of stock). The margin requirement may be

as low as 20%. In the example just used, assume the

contract price rises from $50 to $52 (a $200 increase

in the nominal value). This represents a $200 profit to

the buyer of the security futures contract, and a 20%

return on the $1,000 deposited as margin. The reverse

would be true if the contract price decreased from

$50 to $48. This represents a $200 loss to the buyer,

or 20% of the $1,000 deposited as margin. Thus,

leverage can either benefit or harm an investor.

Note that a 4% decrease in the value of the contract

resulted in a loss of 20% of the margin deposited. A

20% decrease would wipe out 100% of the margin

deposited on the security futures contract.

If you do not liquidate your position prior to the end

of trading on the last day before the expiration of the

security futures contract, you are obligated to either

1) make or accept a cash payment (“cash settlement”)

or 2) deliver or accept delivery of the underlying

securities in exchange for final payment of the final

settlement price (“physical delivery”). The terms of

the contract dictate whether it is settled through

cash settlement or by physical delivery.

The expiration of a security futures contract is

established by the exchange on which the contract

is listed. On the expiration day, security futures

contracts cease to exist. Typically, the last trading day

of a security futures contract will be the third Friday

of the expiring contract month, and the expiration

day will be the following Saturday. This follows the

expiration conventions for stock options and broad-

based stock indexes. Please keep in mind that the

expiration day is set by the listing exchange and may

deviate from these norms.

5.1. Cash Settlement

In the case of cash settlement, no actual securities

are delivered at the expiration of the security

futures contract. Instead, you must settle any open

positions in security futures by making or receiving

a cash payment based on the difference between

the final settlement price and the previous day’s

settlement price. Under normal circumstances, the

final settlement price for a cash-settled contract will

reflect the opening price for the underlying security.

SECTION 5

Settlement

30 31

TOC TOC

Once this payment is made, neither the buyer nor the

seller of the security futures contract has any further

obligations on the contract.

5.2. Settlement by Physical Delivery

Settlement by physical delivery is carried out by

clearing brokers or their agents with National

Securities Clearing Corporation (NSCC), an SEC-

regulated securities clearing agency. Such settlements

are made in much the same way as they are for

purchases and sales of the underlying security.

Promptly after the last day of trading, the regulated

exchange’s clearing organization will report a

purchase and sale of the underlying stock at the

previous day’s settlement price (also referred to as the

“invoice price”) to NSCC. If NSCC does not reject the

transaction by a time specified in its rules, settlement

is effected pursuant to the rules of NSCC within the

normal clearance and settlement cycle for securities

transactions, which currently is three business days.

If you hold a short position in a physically settled

security futures contract to expiration, you will be

required to make delivery of the underlying securities.

If you already own the securities, you may tender

them to your brokerage firm. If you do not own the

securities, you will be obligated to purchase them.

Some brokerage firms may not be able to purchase

the securities for you. If your brokerage firm cannot

purchase the underlying securities on your behalf

to fulfill a settlement obligation, you will have to

purchase the securities through a different firm.

Positions in security futures contracts may be held

either in a securities account or in a futures account.

Your brokerage firm may or may not permit you to

choose the types of account in which your positions in

security futures contracts will be held. The protections

for funds deposited or earned by customers in

connection with trading in security futures contracts

differ depending on whether the positions are carried

in a securities account or a futures account. If your

positions are carried in a securities account, you

will not receive the protections available for futures

accounts. Similarly, if your positions are carried in a

futures account, you will not receive the protections

available for securities accounts. You should ask your

broker which of these protections will apply to your

funds.

You should be aware that the regulatory protections

applicable to your account are not intended to insure

you against losses you may incur as a result of a

decline or increase in the price of a security futures

contract. As with all financial products, you are solely

responsible for any market losses in your account.

Your brokerage firm must tell you whether your

security futures positions will be held in a securities

account or a futures account. If your brokerage firm

gives you a choice, it must tell you what you have to

do to make the choice and which type of account will

be used if you fail to do so. You should understand

that certain regulatory protections for your account

will depend on whether it is a securities account or a

futures account.

SECTION 6

Customer Account Protections

32 33

TOC TOC

6.1. Protections for Securities Accounts

If your positions in security futures contracts are

carried in a securities account, they are covered by

SEC rules governing the safeguarding of customer

funds and securities. These rules prohibit a broker/

dealer from using customer funds and securities to

finance its business. As a result, the broker/dealer is

required to set aside funds equal to the net of all its

excess payables to customers over receivables from

customers. The rules also require a broker/dealer to

segregate all customer fully paid and excess margin

securities carried by the broker/dealer for customers.

The Securities Investor Protection Corporation (SIPC)

also covers positions held in securities accounts.

SIPC was created in 1970 as a nonprofit, non-

government, membership corporation, funded by

member broker/dealers. Its primary role is to return

funds and securities to customers if the broker/

dealer holding these assets becomes insolvent. SIPC

coverage applies to customers of current (and in

some cases former) SIPC members. Most broker/

dealers registered with the SEC are SIPC members;

those few that are not must disclose this fact to their

customers. SIPC members must display an official

sign showing their membership. To check whether

a firm is a SIPC member, go to www.sipc.org, call the

SIPC Membership Department at (202) 371-8300, or

write to SIPC Membership Department, Securities

Investor Protection Corporation, 805 Fifteenth Street,

NW, Suite 800, Washington, DC 20005-2215.

SIPC coverage is limited to $500,000 per customer,

including up to $100,000 for cash. For example, if

a customer has 1,000 shares of XYZ stock valued at

$200,000 and $10,000 cash in the account, both the

security and the cash balance would be protected.

However, if the customer has shares of stock valued

at $500,000 and $100,000 in cash, only a total of

$500,000 of those assets will be protected.

For purposes of SIPC coverage, customers are persons

who have securities or cash on deposit with a SIPC

member for the purpose of, or as a result of, securities

transactions. SIPC does not protect customer funds

placed with a broker/ dealer just to earn interest.

Insiders of the broker/ dealer, such as its owners,

officers, and partners, are not customers for purposes

of SIPC coverage.

6.2. Protections for Futures Accounts

If your security futures positions are carried in a

futures account, they must be segregated from the

brokerage firm’s own funds and cannot be borrowed

or otherwise used for the firm’s own purposes. If

the funds are deposited with another entity ( e.g., a

bank, clearing broker, or clearing organization), that

entity must acknowledge that the funds belong to

customers and cannot be used to satisfy the firm’s

debts. Moreover, although a brokerage firm may carry

funds belonging to different customers in the same

bank or clearing account, it may not use the funds of

one customer to margin or guarantee the transactions

of another customer. As a result, the brokerage firm

must add its own funds to its customers’ segregated

funds to cover customer debits and deficits. Brokerage

firms must calculate their segregation requirements

daily.

You may not be able to recover the full amount of

any funds in your account if the brokerage firm

becomes insolvent and has insufficient funds to

cover its obligations to all of its customers. However,

customers with funds in segregation receive

priority in bankruptcy proceedings. Furthermore, all

customers whose funds are required to be segregated

have the same priority in bankruptcy, and there is

no ceiling on the amount of funds that must be

segregated for or can be recovered by a particular

customer.

34 35

TOC TOC

Your brokerage firm is also required to separately

maintain funds invested in security futures contracts

traded on a foreign exchange. However, these funds

may not receive the same protections once they are

transferred to a foreign entity ( e.g., a foreign broker,

exchange or clearing organization) to satisfy margin

requirements for those products. You should ask your

broker about the bankruptcy protections available

in the country where the foreign exchange (or other

entity holding the funds) is located.

Certain traders who pursue a day trading strategy

may seek to use security futures contracts as part

of their trading activity. Whether day trading in

security futures contracts or other securities, investors

engaging in a day trading strategy face a number of

risks.

Day trading in security futures contracts requires

in-depth knowledge of the securities and futures

markets and of trading techniques and strategies.

In attempting to profit through day trading, you

will compete with professional traders who are

knowledgeable and sophisticated in these markets.

You should have appropriate experience before

engaging in day trading.

Day trading in security futures contracts can result

in substantial commission charges, even if the per

trade cost is low. The more trades you make, the

higher your total commissions will be. The total

commissions you pay will add to your losses and

reduce your profits. For instance, assuming that

a round-turn trade costs $16 and you execute an

average of 29 round-turn transactions per day each

trading day, you would need to generate an annual

profit of $111,360 just to cover your commission

expenses.

Day trading can be extremely risky. Day trading

generally is not appropriate for someone of limited

resources and limited investment or trading

experience and low risk tolerance. You should be

prepared to lose all of the funds that you use for

day trading. In particular, you should not fund day

trading activities with funds that you cannot afford

to lose.

SECTION 7

Special Risks For Day Traders

36 37

TOC TOC

8.1. Corporate Events

As noted in Section 2.4, an equity security represents

a fractional ownership interest in the issuer of that

security. By contrast, the purchaser of a security

futures contract has only a contract for future

delivery of the underlying security. Treatment of

dividends and other corporate events affecting the

underlying security may be reflected in the security

futures contract depending on the applicable clearing

organization rules. Consequently, individuals should

consider how dividends and other developments

affecting security futures in which they transact will

be handled by the relevant exchange and clearing

organization. The specific adjustments to the terms

of a security futures contract are governed by the

rules of the applicable clearing organization. Below

is a discussion of some of the more common types of

adjustments that you may need to consider.

Corporate issuers occasionally announce stock splits.

As a result of these splits, owners of the issuer’s

common stock may own more shares of the stock,

or fewer shares in the case of a reverse stock split.

The treatment of stock splits for persons owning a

security futures contract may vary according to the

terms of the security futures contract and the rules

of the clearing organization. For example, the terms

of the contract may provide for an adjustment in

the number of contracts held by each party with a

long or short position in a security future, or for an

adjustment in the number of shares or units of the

instrument underlying each contract, or both.

Corporate issuers also occasionally issue special

dividends. A special dividend is an announced

cash dividend payment outside the normal and

customary practice of a corporation. The terms of a

security futures contract may be adjusted for special

dividends. The adjustments, if any, will be based upon

the rules of the exchange and clearing organization.

In general, there will be no adjustments for ordinary

dividends as they are recognized as a normal and

customary practice of an issuer and are already

accounted for in the pricing of security futures.

Corporate issuers occasionally may be involved in

mergers and acquisitions. Such events may cause

the underlying security of a security futures contact

to change over the contract duration. The terms of

security futures contracts may also be adjusted to

reflect other corporate events affecting the underlying

security.

8.2. Position Limits and Large Trader Reporting

All security futures contracts trading on regulated

exchanges in the United States are subject to position

limits or position accountability limits. Position limits

restrict the number of security futures contracts that

any one person or group of related persons may hold

or control in a particular security futures contract.

In contrast, position accountability limits permit

the accumulation of positions in excess of the limit

without a prior exemption. In general, position limits

and position accountability limits are beyond the

thresholds of most retail investors. Whether a security

futures contract is subject to position limits, and the

level for such limits, depends upon the trading activity

and market capitalization of the underlying security

of the security futures contract.

SECTION 8

Other

38 39

TOC TOC

Position limits apply are required for security futures

contracts that overlie a security that has an average

daily trading volume of 20 million shares or fewer.

In the case of a security futures contract overlying a

security index, position limits are required if any one

of the securities in the index has an average daily

trading volume of 20 million shares or fewer. Position

limits also apply only to an expiring security futures

contract during its last five trading days. A regulated

exchange must establish position limits on security

futures that are no greater than 13,500 (100 share)

contracts, unless the underlying security meets

certain volume and shares outstanding thresholds,

in which case the limit may be increased to 22,500

(100 share) contracts.

For security futures contracts overlying a security

or securities with an average trading volume of

more than 20 million shares, regulated exchanges

may adopt position accountability rules. Under

position accountability rules, a trader holding a

position in a security futures contract that exceeds

22,500 contracts (or such lower limit established

by an exchange) must agree to provide information

regarding the position and consent to halt increasing

that position if requested by the exchange.

Brokerage firms must also report large open positions

held by one person (or by several persons acting

together) to the CFTC as well as to the exchange on

which the positions are held. The CFTC’s reporting

requirements are 1,000 contracts for security futures

positions on individual equity securities and 200

contracts for positions on a narrow-based index.

However, individual exchanges may require the

reporting of large open positions at levels less than

the levels required by the CFTC. In addition, brokerage

firms must submit identifying information on the

account holding the reportable position (on a form

referred to as either an “Identification of Special

Accounts Form” or a “Form 102”) to the CFTC and to

the exchange on which the reportable position exists

within three business days of when a reportable

position is first established.

8.3. Transactions on Foreign Exchanges

U.S. customers may not trade security futures on

foreign exchanges until authorized by U.S. regulatory

authorities. U.S. regulatory authorities do not regulate

the activities of foreign exchanges and may not,

on their own, compel enforcement of the rules of a

foreign exchange or the laws of a foreign country.

While U.S. law governs transactions in security futures

contracts that are effected in the U.S., regardless of

the exchange on which the contracts are listed, the

laws and rules governing transactions on foreign

exchanges vary depending on the country in which

the exchange is located.

8.4. Tax Consequences

For most taxpayers, security futures contracts are

not treated like other futures contracts. Instead, the

tax consequences of a security futures transaction

depend on the status of the taxpayer and the type

of position (e.g., long or short, covered or uncovered).

Because of the importance of tax considerations

to transactions in security futures, readers should

consult their tax advisors as to the tax consequences

of these transactions.

40 41

TOC TOC

This glossary is intended to assist customers in

understanding specialized terms used in the futures

and securities industries. It is not inclusive and is not

intended to state or suggest the legal significance or

meaning of any word or term.

Arbitrage

Taking an economically opposite position in a security

futures contract on another exchange, in an options

contract, or in the underlying security.

Broad-based security index

A security index that does not fall within the statutory

definition of a narrow-based security index (see

Narrow-based security index). A future on a broad-

based security index is not a security future. This

risk disclosure statement applies solely to security

futures and generally does not pertain to futures on a

broad-based security index. Futures on a broad-based

security index are under exclusive jurisdiction of

the CFTC.

Cash settlement

A method of settling certain futures contracts by

having the buyer (or long) pay the seller (or short) the

cash value of the contract according to a procedure

set by the exchange.

Clearing broker

A member of the clearing organization for the

contract being traded. All trades, and the daily profits

or losses from those trades, must go through a

clearing broker.

Clearing organization

A regulated entity that is responsible for settling

trades, collecting losses and distributing profits,

and handling deliveries.

Contract

1. the unit of trading for a particular futures contract

(e.g., one contract may be 100 shares of the

underlying security);

2. the type of future being traded (e.g., futures on

ABC stock).

Contract month

The last month in which delivery is made against

the futures contract or the contract is cash-settled.

Sometimes referred to as the delivery month.

Day trading strategy

An overall trading strategy characterized by the

regular transmission by a customer of intra-day orders

to effect both purchase and sale transactions in the

same security or securities.

EDGAR

The SEC’s Electronic Data Gathering, Analysis, and

Retrieval system maintains electronic copies of

corporate information filed with the agency. EDGAR

submissions may be accessed through the SEC’s

Web Site, www.sec.gov.

SECTION 9

Glossary Of Terms

42 43

TOC TOC

Futures contract

A futures contract is:

1. an agreement to purchase or sell a commodity

for delivery in the future;

2. at a price determined at initiation of the contract;

3. that obligates each party to the contract to fulfill

it at the specified price;

4. that is used to assume or shift risk; and

5. that may be satisfied by delivery or offset.

Hedging

The purchase or sale of a security future to reduce or

offset the risk of a position in the underlying security

or group of securities (or a close economic equivalent).

Illiquid market

A market (or contract) with few buyers and/or sellers.

Illiquid markets have little trading activity and those

trades that do occur may be done at large price

increments.

Liquidation

Entering into an offsetting transaction. Selling a

contract that was previously purchased liquidates a

futures position in exactly the same way that selling

100 shares of a particular stock liquidates an earlier

purchase of the same stock. Similarly, a futures

contract that was initially sold can be liquidated by

an offsetting purchase.

Liquid market

A market (or contract) with numerous buyers and

sellers trading at small price increments.

Long

1. the buying side of an open futures contact;

2. a person who has bought futures contracts that

are still open.

Margin

The amount of money that must be deposited by

both buyers and sellers to ensure performance of

the person’s obligations under a futures contract.

Margin on security futures contracts is a performance

bond rather than a down payment for the underlying

securities.

Mark-to-market

To debit or credit accounts daily to reflect that day’s

profits and losses.

Narrow-based security index

In general, and subject to certain exclusions, an index

that has any one of the following four characteristics:

1. it has nine or fewer component securities;

2. any one of its component securities comprises

more than 30% of its weighting;

3. the five highest weighted component securities

together comprise more than 60% of its weighting;

or

4. the lowest weighted component securities

comprising, in the aggregate, 25% of the index’s

weighting have an aggregate dollar value of

average daily trading volume of less than $50

million (or in the case of an index with 15 or

more component securities, $30 million).

A security index that is not narrow-based is a

“broad based security index.” (See Broad-based

security index).

Nominal value

The face value of the futures contract, obtained by

multiplying the contract price by the number of

shares or units per contract. If XYZ stock index futures

are trading at $50.25 and the contract is for 100

shares of XYZ stock, the nominal value of the futures

contract would be $5025.00.

44 45

TOC TOC

Offsetting

Liquidating open positions by either selling fungible

contracts in the same contract month as an open long

position or buying fungible contracts in the same

contract month as an open short position.

Open interest

The total number of open long (or short) contracts in

a particular contract month. Open position – a futures

contract position that has neither been offset nor

closed by cash settlement or physical delivery.

Performance bond

Another way to describe margin payments for

futures contracts, which are good faith deposits to

ensure performance of a person’s obligations under a

futures contract rather than down payments for the

underlying securities.

Physical delivery

The tender and receipt of the actual security

underlying the security futures contract in exchange

for payment of the final settlement price.

Position

A person’s net long or short open contracts.

Regulated exchange

A registered national securities exchange, a national

securities association registered under Section 15A(a)

of the Securities Exchange Act of 1934, a designated

contract market, a registered derivatives transaction

execution facility, or an alternative trading system

registered as a broker or dealer.

Security futures contract

A legally binding agreement between two parties

to purchase or sell in the future a specific quantify

of shares of a security (such as common stock, an

exchange-traded fund, or ADR) or a narrow-based

security index, at a specified price.

Settlement price

1. the daily price that the clearing organization uses

to mark open positions to market for determining

profit and loss and margin calls,

2. the price at which open cash settlement contracts

are settled on the last trading day and open

physical delivery contracts are invoiced for delivery.

Short

1. the selling side of an open futures contract,

2. a person who has sold futures contracts that are

still open.

Speculating

Buying and selling futures contracts with the hope

of profiting from anticipated price movements.

Spread

1. holding a long position in one futures contract

and a short position in a related futures contract

or contract month in order to profit from an

anticipated change in the price relationship

between the two,

2. the price difference between two contracts or

contract months.

Stop limit order

An order that becomes a limit order when the market

trades at a specified price. The order can only be filled

at the stop limit price or better.

Stop loss order

An order that becomes a market order when the

market trades at a specified price. The order will