Stock price direction prediction by directly using

prices data: an empirical study on the KOSPI and HSI

Yanshan Wang

School of Industrial Management Engineering,

Korea University,

Seoul, 136-713, Korea

E-mail: yansh.wang@gmail.com

Abstract: The prediction of a stock market direction may serve as an early

recommendation system for short-term investors and as an early financial

distress warning system for long-term shareholders. Many stock prediction

studies focus on using macroeconomic indicators, such as CPI and GDP, to

train the prediction model. However, daily data of the macroeconomic

indicators are almost impossible to obtain. Thus, those methods are difficult to

be employed in practice. In this paper, we propose a method that directly uses

prices data to predict market index direction and stock price direction. An

extensive empirical study of the proposed method is presented on the Korean

Composite Stock Price Index (KOSPI) and Hang Seng Index (HSI), as well as

the individual constituents included in the indices. The experimental results

show notably high hit ratios in predicting the movements of the individual

constituents in the KOSPI and HIS.

Keywords: stock direction prediction; co-movement; principal component

analysis; PCA; support vector machine; SVM; Korean composite stock price

index; KOSPI; Hang Seng index; HSI.

Reference to this paper should be made as follows: Wang, Y. (2014) ‘Stock

price direction prediction by directly using prices data: an empirical study on

the KOSPI and HSI’, Int. J. Business Intelligence and Data Mining, Vol. 9,

No. 2, pp.145–160.

Biographical notes: Yanshan Wang received his BE degree in Computer

Science from Harbin Institute of Technolo

gy and a ME degree in Management

Engineering from Korea University, in 2010 and 2012, respectively. He is

currently working towards his PhD degree in the Department of

Management Engineering at the Korea University. His research interests

include financial engineering, nonlinear programming, information retrieval

and machine learning.

1 Introduction

Nowadays, investors have been more keenly aware of risk than any time in the past due

to the non-stationary and chaotic stock markets under the impact of the US subprime

crisis. Simultaneously, they hope to gain a great profit from the investments. But, it is

extraordinarily difficult to perform better than skilled and knowledgeable competitors in

a stock market. Better stock prices direction prediction is a key reference for better

trading strategy and decision-making by ordinary investors and financial experts (Kao

et al., 2013). Apart from the stock price direction prediction, the stock market index

direction prediction is regarded as one of the crucial issues in recent financial analysis

studies. The stock market index measures overall market behaviour through selected

stocks representing the market. Accurate index direction prediction provides investors

with information regarding the expectations about the movement behaviour of the

economy and return obtained by a specific investing portfolio (Pathak et al., 2011). Also

it is an early warning system for investors, notably for short-term investors, against

sudden drops in the market.

The emergence of machine learning and artificial intelligence algorithms has made it

possible to tackle computationally demanding mathematical models in stock price

direction prediction. Frequently adopted methods include artificial neural networks

(ANNs), Bayesian networks, and support vector machine (SVM). Amongst them, ANNs

have drawn significant interests from several researchers in the stock price forecasting in

the past decades. The ANNs are robust in model specification compared to parametric

models, which makes it frequently applied in forecasting stock prices and financial

derivatives. Guresen et al. (2011) reported the validity of ANNs in stock market index

prediction. Cheng et al. (1996) forecasted US treasury bond with a ANNs-based system.

Grudnitski and Osburn (1993) applied ANNs to predict gold futures prices. The

drawback of the price prediction is that the price is highly volatile so as to result

in large regression errors. Compared to the price prediction, the stock direction

prediction is less complex and more accurate (Ou and Wang, 2009). The stock direction

prediction has been recently addressed in several research articles, which consider

different variants of ANNs (Saad et al., 1998). However, one drawback of ANNs is that

the efficiency of predicting unexplored samples decreases rapidly when the neural

network model is too over-fitted by available observations. In other words, the noisy

stock information may lead ANNs to a complex model, which might result in the

over-fitting problem.

The predominant methods in the stock market direction prediction are the approaches

based on SVM (Huang et al., 2005; Kim, 2003; Tay and Cao, 2001). Since the SVM

implements the structural risk minimisation principle, it often achieves better

generalisation performance and lower risk of overfitting than the ANNs (Cortes and

Vapnik, 1995). This point in regard to stock prediction is well braced by Kim (2003). His

experiment showed that the SVM outperformed the ANNs in predicting future direction

of a stock market and yet reported that the best prediction performance that he could

obtain with SVM was 57.8% in the experiment with the Korean composite stock price

index 200 (KOSPI 200). Huang et al. (2005) reported remarkable performance of 75% hit

ratio by using a SVM-based model to predict Nihon Keizai Shimbun Index 225 (NIKKEI

225) in a single period. However, the shortcoming in the most of literature is that the

testing used was conducted within the in-sample datasets, or that the out-of-sample

testing was on small data sets which were unlikely to represent the full range of market

behaviours. Thus it is difficult to assess the average performances of their models in

multiple periods such as Kim nor Huang et al. conducted the experiment in that setting.

In order to refrain from limited sample selection, our experiments computed the

one-day-ahead predictions using rolling windows of data to ensure that the predictions

are made using all the information available at that time, while not incorporating old data

that are probably no longer relevant in the context of a dynamic, rapidly evolving stock

market.

A major drawback of SVM for the direction prediction is that the input variables lie

in a high-dimensional feature space, ranging from hundreds to thousands. The storage of

the variables requires a lot of memory and computation time. Specifically, a stock market

consists of several hundreds of stocks, which leads to the high dimensionality of the

variables. Therefore, it is of considerable importance to conduct dimension reduction to

acquire an efficient and discriminative representation before classification. Under the

dimensionality reduction, curse of dimensionality could be effectively managed (Cortes

and Vapnik, 1995). A common unsupervised feature extraction method is principal

component analysis (PCA) (Pearson, 1901) by which principal components are obtained

through the manipulation of original data. The PCA has been widely used to deal with

high dimensional data sets in many areas, such as protein dynamics reduction, spectral

data reduction, and face patterns reduction. Interestingly, the adaptation of the PCA

feature selection to stock prices data analysis is rarely found, to the best of our

knowledge.

In stock prices data, there exits a common phenomenon that is called co-movement

between stocks due to the institutional investors¡¯ common ownership of subsets of

stocks in their portfolios (Pindyck and Rotemberg, 1993). Shiller (1989) showed the

co-movements of returns between the USA and UK markets using simple regression tests.

The same phenomenon may also exist between the US stock market the Asian markets,

as reported by Liu et al. (1998). However, these methods are not explicit to verify the

co-movements and find the co-moved stocks. The co-movement implies that the utilisation

of PCA is essential for finding co-moved stocks among highly correlated stocks. We are

the first to verify the co-movement phenomenon by showing the principal components, to

the best of our knowledge.

As a matter of fact, the co-movement exits not only between stocks in a domestic

market (internal) but also between two tightly connected stock markets (external). This

facts stimulate us to consider both internal and external factors for predicting individual

stocks and market index directions. The macroeconomic indicators [such as consumer

price index (CPI), gross national product (GNP) and gross domestic product (GDP)] may

be high internal impact factors for the prediction. However, daily data of those

macroeconomic factors are impossible to obtain and analyse in reality. For simplicity and

generality, we only handle stock prices data which are timely and easy to access. As for

the external factors, we take daily S&P 500 index values and exchange rates (EXR) into

account. Both factors can be obtained and managed easily. Thus, the method in this

article secondly contributes to the stock prediction in practical aspect compared with

most of the state-of-the-art approaches.

This paper is organised as follows. In the next section, we provide a brief overview of

PCA and SVM and describe how they are integrated in our model. In Section 3, we

present detail descriptions on the empirical experiment, which includes the detailed

design of experimental data and experiment results. The last section concludes this paper

with some discussions.

2 An integrated model

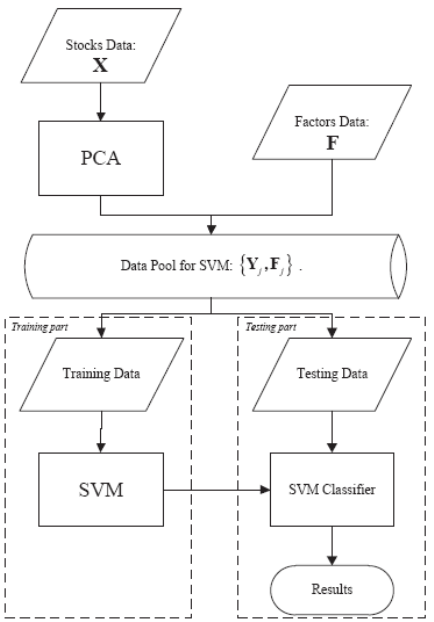

The structure of the proposed model is shown below in Figure 1. Let

p

i

x ∈ denote a

column vector of the daily rates of return of stock i, i = 1, …, n, which is obtained from p

daily market observations. The matrix X = (x

i

)

T

can be reduced to the principal

component matrix Y = (y

k

)

T

, k = 1, …, m, mn by minimising the variance of the linear

transformation of X. Define the contribution rate of the k

th

principal component as

1

k

n

i

i

λ

λ

=

∑

where λ

k

represents the variance of y

k

. The cumulative rate of the first m

principal components is

1

1

.

m

i

i

n

i

i

λ

λ

=

=

∑

∑

Along with these principal components, internal factors and external factors

F = (

F

1

, F

2

, …, F

h

)

T

are utilised as input data, i.e., {Y, F}. Considering the co-movement

property in a market, we find that the

co-moved stocks are informative as internal factors.

Besides, since the market index itself is a beacon of the domestic economy and tread, it is

also informative for forecasting. In addition to the internal factors, external factors also

play important role in the Asia stock markets. Here we consider two foremost economic

phenomena. The USA is the largest cooperative partner for Asian countries, including

Korea and Hong Kong, thus the conditions of the US financial market have significant

impacts on Asian stock market. The other is the EXR that also has strong influence on the

imports and exports of products. The changes of trading relations in turn affect the

domestic stock markets. Thus, the external factors used in our study include the S&P 500

index in the US stock market, the best representation of the US economy, and the

exchange rate, the symbol of trades between countries. Details of the data are explained

in Section 3.

The input to SVM is the data set R = (r

j

, w

j

), where r

j

= (Y

j

, Fj) (j = 1, …, p) is a row

vector denoting

j

th

daily data in p observation days. 0,1

j

w

∈

is a binary variable that

represents the upward or downward direction of the stock market movement of the

j

th

day. The downward direction is represented by 0 and the upward by 1. The input data is

carefully divided into two parts, i.e., training data and testing data. As addressed by

financial analysis recently, the data periods in most computer technique related articles

are selected limitedly. In order to refrain from limited sample selection, the training data

and testing data are goes parallel using rolling windows of ten years data to ensure that

the predictions are made using all the information available at that time. Besides, unlike

several studies testing in-sample data, we compute the one-day-ahead predictions, i.e.,

out-sample data. The details of data periods and how they are divided into training and

testing data are explained in the next section.

The training data is utilised to acquire a classifier by training SVM. The classifier

function of stock movement directions is defined as

**

1

dir ( ) sgn ,

p

T

jjj

j

fwν

=

⎛⎞

== +

⎜⎟

⎜⎟

⎝⎠

∑

rr

α

(1)

Figure 1 Procedure of the proposed PCA-SVM integrated model

where

*

¡¯s

α

and

*

¡¯sν

are optimal values of Lagrange multipliers and intercepts of the

corresponding hyperplanes, respectively. By introducing kernel tricks, the nonlinear

decision function for a stock direction prediction becomes

()

**

1

dir ( ) sgn , .

p

jj j

j

fwν

=

⎛⎞

== +

⎜⎟

⎜⎟

⎝⎠

∑

rKrr

α

(2)

Th

e selection of kernel function is addressed in Section 3.

The testing data is used to test the model according to the classifier

f(r). In reality, the

training model can be designed to update real-timely so as to make full use of the present

information.

3 Empirical experiment

In this section, we present the empirical stock price data sets, time periods and data

designs for the proposed method. In order to avoid the fact that some markets are less

efficient than others, we test empirical experiments on two representative Asia stock

markets: the Korean stock market and the Hong Kong stock market. The experiments aim

to forecast the directions of daily movements of the stock price indices and of individual

stocks.

3.1 Experiment data

3.1.1 Stock market indices

The Korea composite stock prices index 200 (KOSPI 200) and the Hang Seng index

(HSI) are utilised since they represent the overall performance of the Korean and the

Hong Kong stock market. As an underlying index for stock index futures and options,

KOSPI 200 consists of the 200 companies chosen from all stocks in the KRX-Stock

Market. The KOSPI 200 represents a broad cross-section of Korean industries and

provides an effective means for investors to avoid potential market risks. Thus, the 200

individual stocks¡¯ daily rates of return are utilised. Similarly, the HSI is the main

indicator of the overall market performance in Hong Kong and the 48 constituents are

processed in our empirical approach. We note that all the data are collected from publicly

available sources in the internet. The KOSPI 200 data set are collected from KRX Korea

Exchange (http://eng.krx.co.kr). HIS data set are collected from YAHOO! Finance

(http://finance.yahoo.com).

3.1.2 Factors

As addressed in the preceding and the structure of the method (Figure 1), internal factors

co-movement stocks considered amongst the stock market and the market index. For

forecasting indices, we use the lagged daily prices for indices and the overall

constituents. As for individual stock prediction, we use the lagged daily prices for the

target-excluded constituents besides indices. The external factors used in our study

include the S&P 500 index in the US stock market and the exchange rate of US dollars

to Korean Won (USDKRW) or Hong Kong Dollar (USDHKD). The S&P 500 index

data and USDKRW (USDHKD) data are downloaded from YAHOO! Finance

(http://finance.yahoo.com) and International Monetary Fund (http://www.imf.org),

respectively. Because the opening days of the markets in Asia markets and the USA are

different, the data are aligned based on the Asia markets¡¯ timeline. The dealing strategy

is that redundant daily data are deleted while missing daily data are filled by the previous

closing price.

3.1.3 Time periods

In order to avoid limited sample selection, the data sets tested in our empirical

experiment are gathered for the time periods of 2002 to 2011. Unlike most of the studies

that tested machine learning methods within in-sample data, we tested the proposed

method using out-sample data. Besides, a rolling window design of data was used so as to

fully check the performance of the method and ensure that the predictions were made

using all the information available at that time. The time periods of the rolling window

data are shown in Table 1. In short, we treat three years¡¯ training data and the following

year¡¯s testing data as a window which slides from the first year until the end of the ten

years period.

3.1.4 Data pre-process

Instead of using the daily rate of return directly, we transform it into an n-day relative

difference in percentage of price (RDP). The advantage of the transformation is that the

distribution of the transformed data will be more symmetrical and close to a normal

distribution (Tay and Cao, 2001).

In this paper, the RDP values are determined based on three-day-lagged (RDP-3)

values for the indices and EXR, and one-day-lagged (RDP-1) for the constituents of

KOSPI and HSI. The reason of choosing RDP-3 values for the formers is that market

indices and EXR changes always have delayed-effects on the index values (Shiller,

1989). Since the constituents serve as market comprising elements, the

co-movements

between the elements affect the market itself immediately. Therefore, a shorter lagged

period is selected. The direction to forecast is the sign of one-day-ahead RDP, which is

denoted as RDP+1. The detailed calculations for all the indicators are given in Table 2.

Table 1 Corresponding time period of training and testing data

Round Training period Testing period

1 2002-1-1 2005-1-1 2005-1-1 2006-1-1

2 2003-1-1 2006-1-1 2006-1-1 2007-1-1

3 2004-1-1 2007-1-1 2007-1-1 2008-1-1

4 2005-1-1 2008-1-1 2008-1-1 2009-1-1

5 2006-1-1 2009-1-1 2009-1-1 2010-1-1

6 2007-1-1 2010-1-1 2010-1-1 2011-1-1

7 2008-1-1 2011-1-1 2011-1-1 2012-1-1

Table 2 Input and output indicators

Indicator Calculation

Input indicators:

RDP-1

1

1

100%

jj

j

−

−

−

×

rr

r

RDP-3

3

3

100%

jj

j

−

−

−

×

rr

r

Output indicators:

RDP+1

1

100%

jj

j

+

−

×

rr

r

3.2 Direction forecasting for indices and individual stocks

Our task is to forecast the daily direction of KOSPI (or HSI) and the movement directions

of the constituent stocks in KOSPI (or HSI). Based on equation (2), the direction function

can be written as follows

()

RDP+1 RDP-3 RDP-3 RDP-3 RDP-1 RDP-1 RDP-1

Index S&P500 EXR 1 2

dir , , ,,, ,

k

fF F F Y Y Y= … (3)

whe

re

RDP-3

Index

,F

RDP-3

S&P500

,F

RDP-3

EXR

F are the RDF-3 values of the KOSPI (or HSI), the S&P

500 Index and the exchange rates of USD against KRW (or HKD), respectively.

RDP-1 RDP-1 RDP-1

12

,,,

k

YY Y… are principal components of all the constituents with the input

defined by RDF-1 value of the stocks in KOSPI (HSI). dir

RDP+1

is a categorical variable

that is obtained from the SVM classifier and represents the movement directions of the

prices, i.e.

RDP 1

1, price increases,

dir

0, price decreases,

+

⎧

=

⎨

⎩

(4)

Note that the direction is assigned to 1 if the closing value is the sa

me as the previous

closing value.

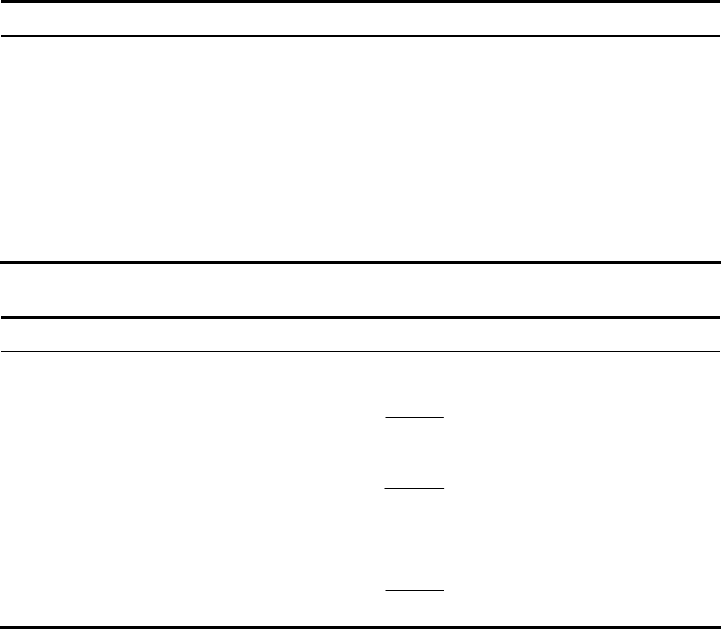

Figure 2 Contribution rates of principle components for the KOSPI (see online version

for colours)

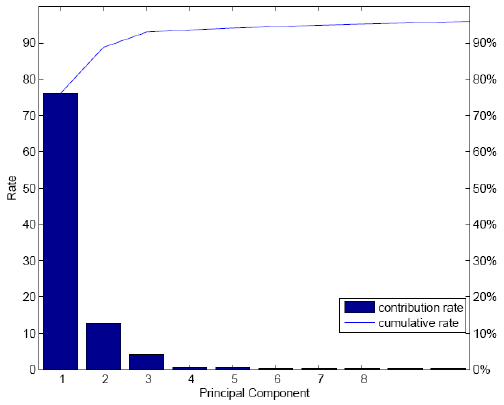

Figure 3 Contribution rates of principle components for the HIS (see online version for colours)

3.3 Experiment results

3.3.1 Results of the PCA

Figures 2 and 3 depict the contribution rate (histogram) and cumulative distribution (line)

of the first several components of the constituents in KOSPI and HSI over the whole time

period respectively. The cumulative contribution is plotted by accumulating the

contribution rate. From the following figures we find that the first component has over

70%contribution for the KOSPI and the first ten components have over 70% for the HSI.

Thus, the first 1 while the first ten components are chosen as principal components for

the KOSPI and HIS to predict the dir

RDP+1

, respectively.

3.3.2 Verification of the co-movement

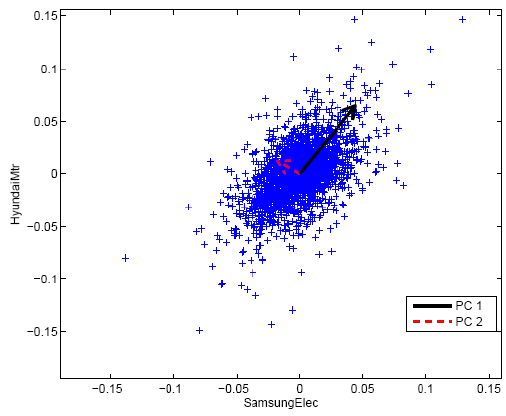

In this subsection, a two-dimensional illustrative example of the PCA is given for

visualising the principal components, as shown in Figure 4. The first two stocks in

KOSPI, Samsung Elec. and Hyundai Mtr., are selected under observations over the whole

periods. All the data are scaled to have a mean of zero. So, the principal components can

be represented by two orthogonal arrows passing through the origin with greatest

variance. The thick line represents the first principal component and the dashed line

represents the second principal component. Both arrows are the vectors that are derived

from the eigenvectors of the covariance matrix that are scaled by the corresponding

eigenvalue. Then, the space is rotated so that principal components are aligned with the

coordinate axes. In doing so, the data are uncorrelated in the principal component space.

Figure 4 The plots of the first two principal components in KOSPI: SamsungElec and

HyundaiMtr (see online version for colours)

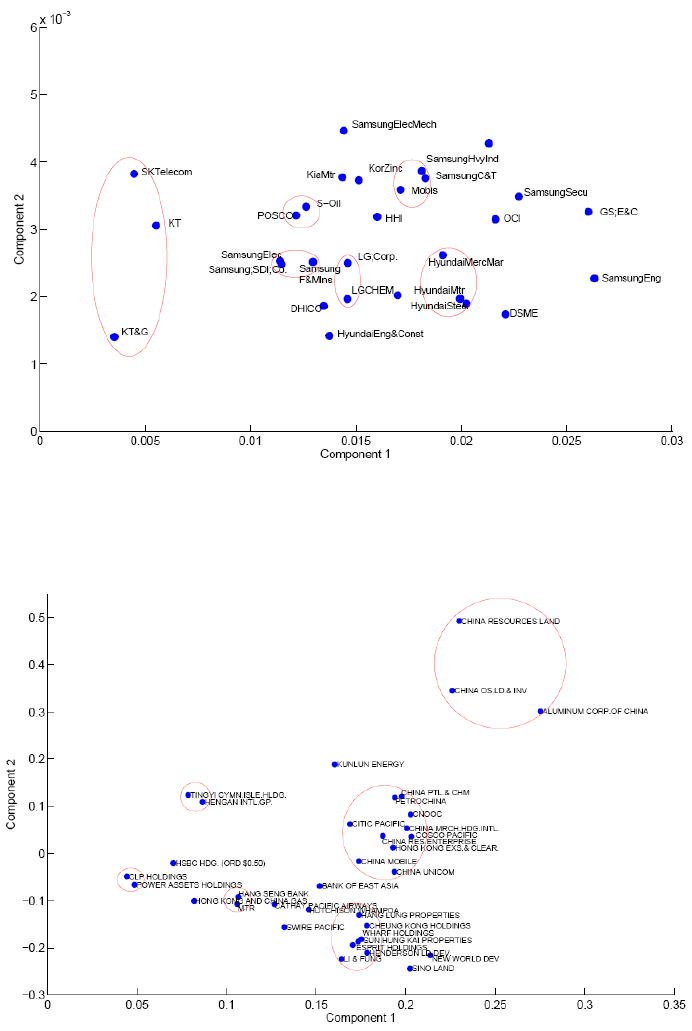

A biplot is helpful in digging some hints of the PCA. The biplot plots the projection of

the loadings of the stocks on to the first two principal components. The biplot figure for

the KOSPI and HIS are shown in Figures 5 and 6, respectively. The plots reflect the

phenomenon of co-movements, because the co-moved constituent stocks are near to each

other and construct to a cluster. Empirically, we observe that those highly correlated

stocks in one cluster are from the companies in a similar domain area (e.g., SKTelecom,

KT and KT&G) or that some of the correlated companies are sub-companies and

sub-branches of the other companies (e.g., Samsung braches and Samsung Co., LG

branches and LG Co.).

3.3.3 Results of the direction forecasting on the KOSPI and HSI

There are two decisions to make for SVM classifier. One is the choice of a kernel

function to use, i.e., linear, polynomial or radial basis function (RBF). The other is the

selection of parameter C. Several studies have suggested the RBF kernel function (Huang

et al., 2005; Kim, 2003; Tay and Cao, 2001) which is also used in our experiment. As for

the parameter C, a small value causes under-fitting of the training data and a large value

causes over-fitting. Therefore, a value between 0.1 and 1,000 is known to be the

appropriate choice for the parameter C. In our experiment, C = 100 is used since it is

tested in the previous studies (Kim, 2003; Tay and Cao, 2001).

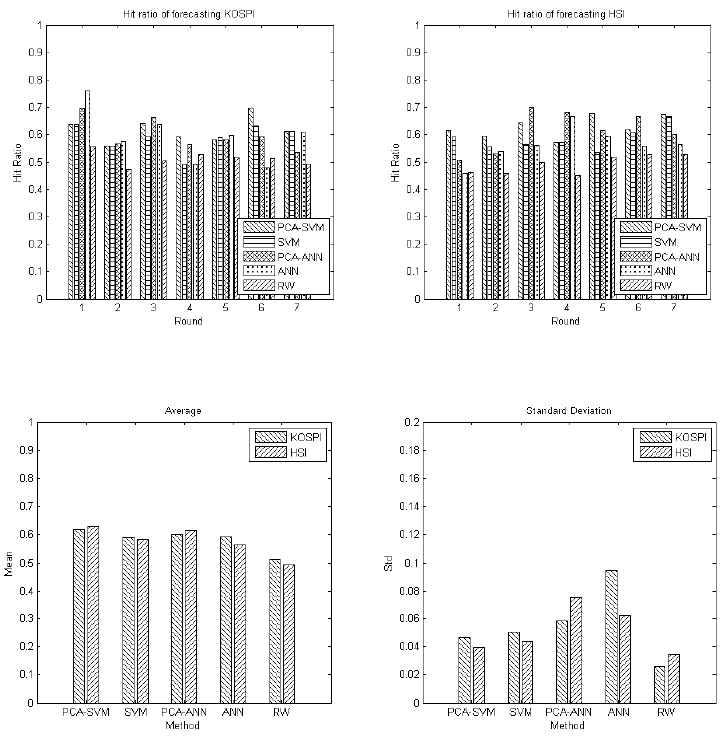

Given the RBF kernel and C = 100 for the SVM classifier, we examine the

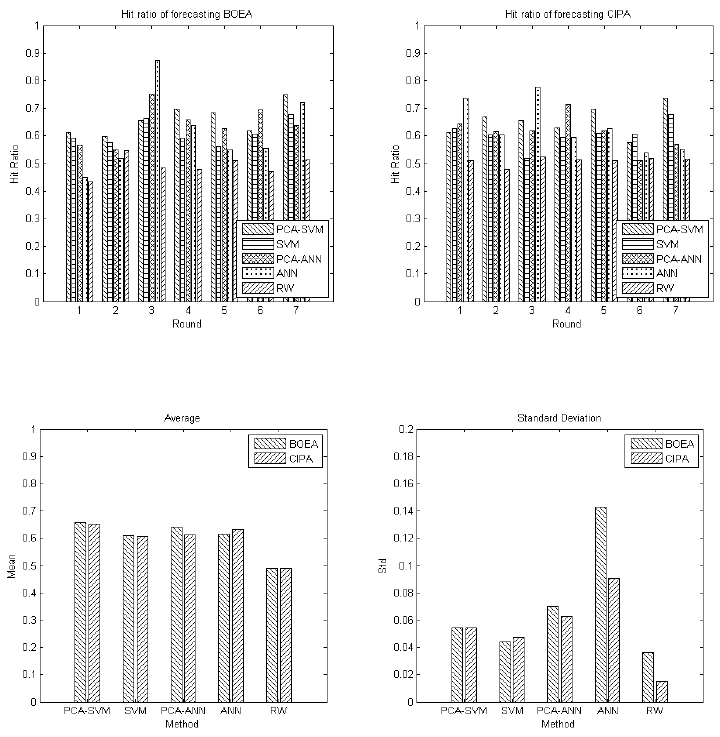

effectiveness of the proposed method in forecasting indices. Comparisons of the hit ratios

are shown in Figure 7 for the KOSPI and HIS. To compare with the performance of the

SVM, we also test the ANN and random walk (RW) as the benchmark. Besides, we input

identical principal components for both the SVM and ANN to verify the influence of the

PCA.

Figure 5 Biplot of the KOSPI (

see online version for colours)

Notes: Th

e horizontal and vertical axes represent the first and the second principal

components, respectively. The co-moved stocks are circled by the red ellipses.

Figure 6 Biplot of the HIS (see online version for colours)

Notes: Th

e horizontal and vertical axes represent the first and the second principal

components, respectively. The co-moved stocks are circled by the red ellipses.

Figure 7 Hit ratios of forecasting KOSPI and HIS

Figure 8

Average value and standard derivation of the hit ratios

From the tables, the RW model performs moderately. The influence of the PCA is

obvious positive since both the PCA-SVM and PCA-ANN outperforms the original SVM

and ANN respectively. The average hit ratios of the proposed PCA-SVM on forecasting

the KOSPI and HIS are minorly better than the PCA-ANN, as shown in Figure 8.

However the derivations of the ANN-based methods are bigger than the SVM. This fact

reflects the drawbacks of the ANN that refer to the volatility and over-fitting problems,

which is clearer from the tables. On the other hand, we emphasise that the at round 4, the

period of 2008 when the subprime crisis occurred, the PAC-SVM performs moderately

during that period but still better than the RW model. However, the ANN is

untrustworthy because of the enormous difference between two indices forecasting

results.

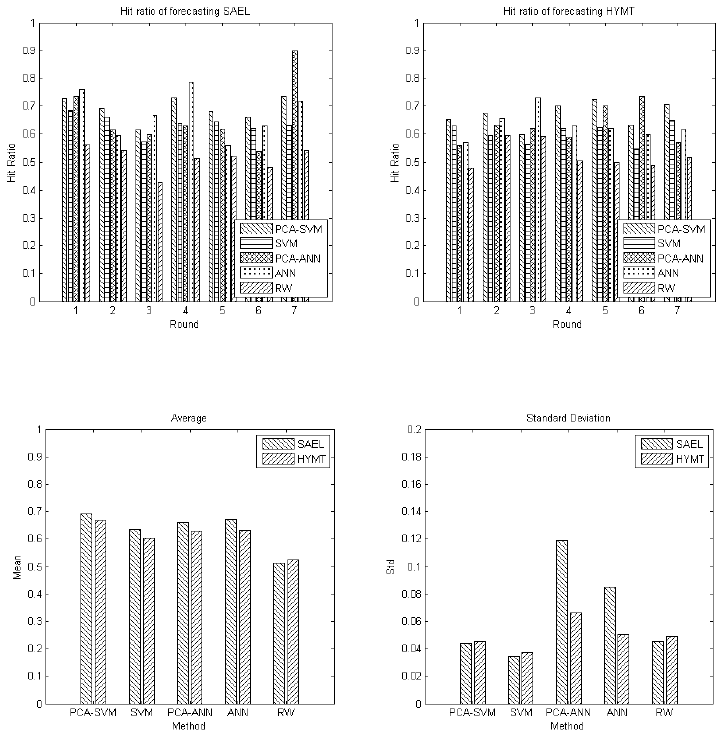

3.3.4 Results of the direction forecasting on the constituents

The second experiment of forecasting directions of the constituents of the KOSPI and

HSI is carried out with the proposed PCA-SVM, ANN and RW. In this paper, we report

four sample constituents from the KOSPI [SamsungElec (SAEL), HyundaiMtr (HYMT)]

and the HIS [BANK OF EAST ASIA (BOEA), CITIC PACIFIC (CIPA)] shown in

Figures 9 and 11, as well as the average values and standard derivations in Figures 11 and

12.

Unlike the market indices direction prediction, the hit ratios of forecasting individual

constituents are averagely better. The influence of the PCA is also noticeable as well as

that of the previous section. The PCA-SVM gives higher average hit ratios with lower

standard derivation compared with the PCA-ANN. All the testing experiments show that

the methods using the PCA perform better. To summarise, the proposed method are

considerably trustworthy in forecasting movement directions.

Figure 9 Hit ratios of forecasting SAEL and HYMT in KOSPI

Figure 10

Average value and standard derivation of the hit ratios

Fig

ure 11 Hit ratios of forecasting BOEA and CIPA in HIS

Figure 12 Average valu

e and standard derivation of the hit ratios

The accuracy of forecasting directions of constituent is significantly higher (at confidence

level 0.05) than index, which is distinct from the general understanding that index

forecasting is easier. We can account for this observation by analysing the stock price

data. Since the constituent stocks prices are more volatile than index values, it is easier

for classifiers to find patterns. Thus, the forecasting the constituent stocks gives better

accuracy.

4 Conclusions and future research

In this paper, we have proposed a PCA-SVM integrated model to forecast the directions

of the stock market indices and the individual stock prices. In the model, the principal

components identified by the PCA are used along with internal and external financial

factors in SVM for forecasting. We have also presented an extensive empirical

experiment based on the KOSPI and HSI. The results of the empirical experiments show

that the proposed method provides markedly high hit ratios for forecasting m

ovement

directions of the constituents in the KOSPI and HSI. Since our experiments computed the

one-day-ahead predictions using rolling windows data of a long period, the results are not

the product of limited sample selection but reliable with all the available information at

that time. Our results also verifies the co-movement effect between the Korean (or

Hong Kong) stock market and the US stock market because of the usage of S&P 500 and

exchange rates.

As a future study, a theoretical study on the performance of the proposed method is of

worth. The clustering of the co-moved stocks according to the biplot needs a further

investigation. The theoretical analysis of the better performance on forecasting the

constituents is also worth studying. Moreover, other feature selection methods, for

example, deep belief networks (DBN), may be also efficient to extract the features of the

stock prices for classifiers, which is subject to another future research.

References

Cheng, W., Wagner, W. and Lin, C-H. (1996) ‘Forecasting the 30-year us treasury bond with a

system of neural networks’, Journal of Computational Intelligence in Finance, Vol. 1, No. 4,

pp.10–16.

Cortes, C. and Vapnik, V. (1995) ‘Support-vector networks’, Machine Learning, Vol. 20, No. 3,

pp.273–297.

Grudnitski, G. and Osburn, L. (1993) ‘Forecasting S&P and gold futures prices: an application of

neural networks’, Journal of Futures Markets, Vol. 13, No. 6, pp.631–643.

Guresen, E., Kayakutlu, G. and Daim, T.U. (2011) ‘Using artificial neural network models in

stockmarket index prediction’, Expert Systems with Applications, Vol. 38, No. 8,

pp.10389–10397.

Huang, W., Nakamori, Y. and Wang, S-Y. (2005) ‘Forecasting stock market movement direction

with support vector machine’, Computers & Operations Research, Vol. 32, No. 10,

pp.2513–2522.

Kao, L-J., Chiu, C-C., Lu, C-J. and Yang, J-L. (2013) ‘Integration of nonlinear independent

component analysis and support vector regression for stock price forecasting’,

Neurocomputing, Vol. 99, No. 1, pp.534–542.

Kim, K-J. (2003) ‘Financial time series forecasting using support vector machines’,

Neurocomputing, Vol. 55, No. 1, pp.307–319.

Liu, Y.A., Pan, M.S. and Shieh, J.C.P. (1998) ‘International transmission of stock price

movements: evidence from the US and five Asian-Pacific markets’, Journal of Economics and

Finance, Vol. 22, No. 1, pp.59–69.

Ou, P. and Wang, H. (2009) ‘Prediction of stock market index movement by ten data mining

techniques’, Modern Applied Science, Vol. 3, No. 12, p.28.

Pathak, B.V. et al. (2011) The Indian Financial System: Markets, Institutions and Services, Pearson

Education India.

Pearson, K. (1901) ‘LIII: on lines and planes of closest fit to systems of points in space’, The

London, Edinburgh, and Dublin Philosophical Magazine and Journal of Science, Vol. 2,

No. 11, pp.559–572.

Pindyck, R.S. and Rotemberg, J.J. (1993) ‘The comovement of stock prices’, The Quarterly

Journal of Economics, Vol. 108, No.4, pp.1073–1104.

Saad, E.W., Prokhorov, D.V. and Wunsch, D.C. et al. (1998) ‘Comparative study of stock trend

prediction using time delay, recurrent and probabilistic neural networks’, IEEE Transactions

on Neural Networks, Vol. 9, No. 6, pp.1456–1470.

Shiller, R.J. (1989) ‘Comovements in stock prices and comovements in dividends’, The Journal of

Finance, Vol. 44, No. 3, pp.719–730.

Tay, F.E.H. and Cao, L. (2001) ‘Application of support vector machines in financial time series

forecasting’, Omega, Vol. 29, No. 4, pp.309–317.