International Research Journal of Engineering and Technology (IRJET) e-ISSN: 2395-0056

Volume: 07 Issue: 03 | Mar 2020 www.irjet.net p-ISSN: 2395-0072

© 2020, IRJET | Impact Factor value: 7.34 | ISO 9001:2008 Certified Journal | Page 803

FORECASTING STOCK MARKET MOVEMENT DIRECTION

USING SENTIMENT ANALYSIS AND SUPPORT VECTOR

MACHINE

SK. MUBEENA

1

, M. ANIL KUMAR

2

, U. RAMYA

3

, P. SUJATHA

4

1,2,3,4

B. Tech Students, Dept of CSE, Tirumala Engineering College, Narasaropet, Guntur, A.P., India

---------------------------------------------------------------------***----------------------------------------------------------------------

Abstract - Investor sentiment plays an important role on the stock market. User-generated textual content on the Internet

provides a precious source to reflect investor psychology and predicts stock prices as a complement to stock market data. This

paper integrates sentiment analysis into a machine learning method based on SVM. Furthermore, we take the day-of-week effect

into consideration and construct more reliable and realistic sentiment indexes. Empirical results illustrate that the accuracy of

forecasting the movement direction of the SSE 50 Index can be as high as 89.93% with a rise of 18.6% after introducing sentiment

variables. And, meanwhile, our model helps investors make wiser decisions. These findings also imply that sentiment probably

contains precious information about the asset fundamental values and can be regarded as one of the leading indicators of the stock

market.

Key Words: Support vector machine

1. INTRODUCTION:

F

ORECASTING stock market trends has been treated as one of the most challenging but important tasks. Stock market is a

nonlinear and dynamic system, and investor sentiment constitutes key factor of the financial market[1]. With the proliferation

of news, blogs, forums, and social networking websites, textual content on the Internet provides a precious source to reflect

investor sentiment and predicts stock prices as a complement to traditional stock market time series data. Hence an automated

approach is required to distill knowledge from alarge number of textual documents [2], [3]. Sentiment analysis is used to

automatically extract views, attitudes, and emotions from the opinionated contents [4]. So, we employ sentiment analysis to

construct sentiment indexes, and then aggregate them with stock market data to forecast movement direction.

1.1 RELATED WORK:

Sentiment Analysis in Finance Industry Sentiment is an opinion or feeling you have about something according to the Longman

Dictionary. Sentiment analysis is the method to transfer unstructured textual contents to structured data, and distill views,

attitudes, and emotions by language processing, data mining, and computational linguistics [11], [12]. Investor sentiment

constitutes a key factor of the financial market [1]. Baker and Wurgler [13] employ the equity share in new issues, the dividend

premium and some other variables as sentiment proxies, and point out that investor sentiment affects the cross section of stock

returns. Edmans et al. [14] use international soccer results as a mood variable and document a significant market decline after

each loss. Afterward, with the development of the sentiment analysis, researchers start to deal with written text that is a more

direct way to express ideas and emotions. Tetlock [15] generates a pessimistic media factor in terms of the Wall Street Journal’s

“Abreast of the Market” column and finds that high pessimism has a negative effect on market prices followed by a subsequent

reversion. Bollen et al. [16] present evidence that tweets posted on Twitter are a predictive factor of the Dow Jones Industrial

Average (DJIA) values and find an accuracy of 86.7% in predicting the daily up and down changes in the closing values of the

DJIA. Gillam et al. [17] concentrate on the volume of news to quantify the information incorporated in textual data and discover

that it enhances earnings forecasting. Moreover, sentiment analysis is superior to the bag-of-words model at individual stock,

sector, and index levels in predicting stock prices [12]. Oliveira et al. [18] propose an automated method to build a stock market

sentiment lexicon to facilitate the research in the area. Nevertheless, the day-of-week effect is rarely mentioned in the study of

investor sentiment.

1.2 SVM in Predicting Stock Market

SVM was proposed by Vapnik [19] and is a supervised learning method that can partially address the overfitting problem

directly and formally [20]. With the help of kernel functions, such as radical basis function (RBF) kernel and polynomial kernel,

it is able to solve the nonlinear problem by projecting it onto the high-dimensional feature space

2. METHODOLOGY

International Research Journal of Engineering and Technology (IRJET) e-ISSN: 2395-0056

Volume: 07 Issue: 03 | Mar 2020 www.irjet.net p-ISSN: 2395-0072

© 2020, IRJET | Impact Factor value: 7.34 | ISO 9001:2008 Certified Journal | Page 804

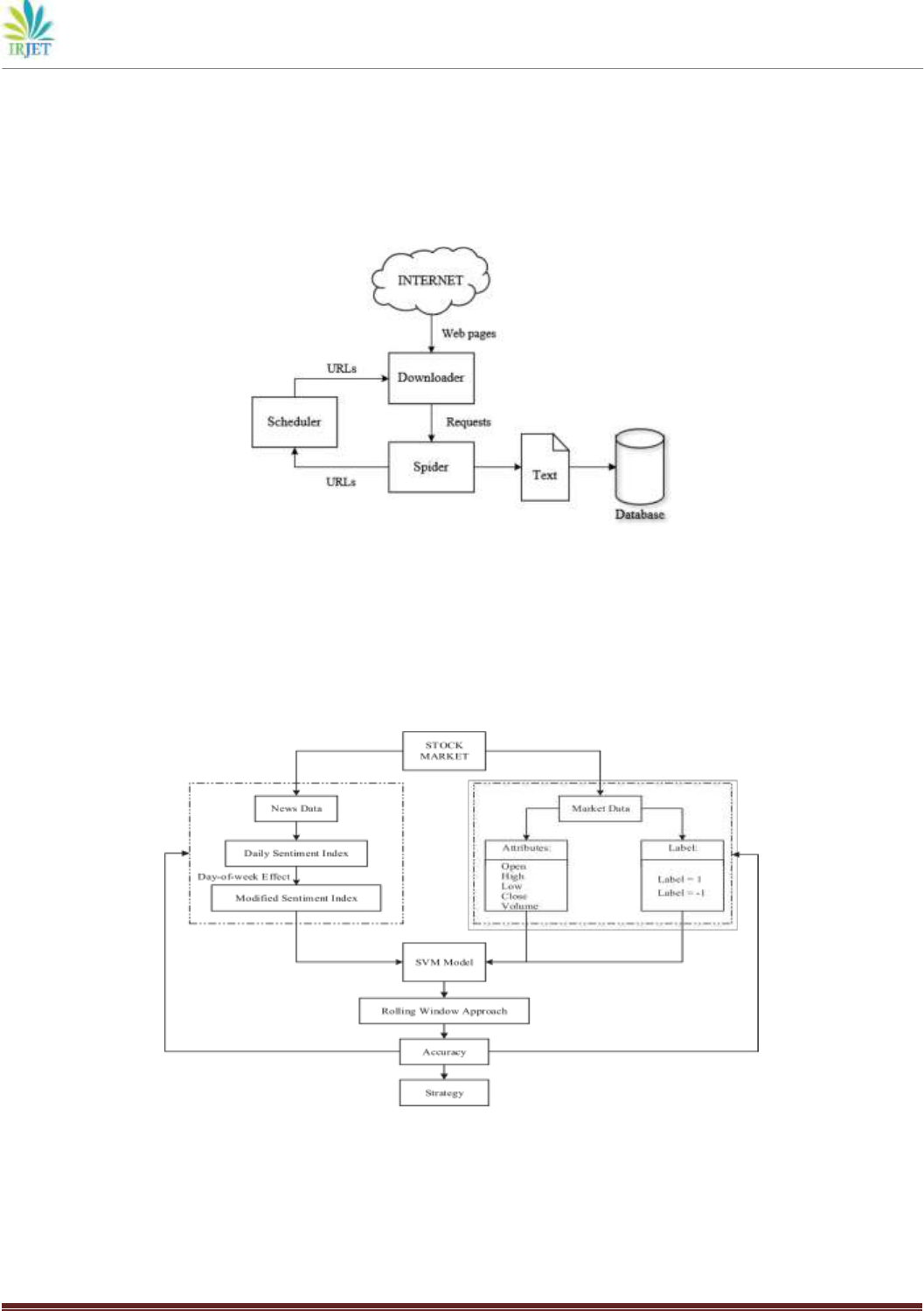

This paper aims to forecast stock market movement direction by not only using financial market data, but also combining them

with sentiment features that incorporate investor psychology. The features are extracted from unstructured news data

automatically and then are expressed as sentiment indexes. In order to make the indexes more realistic and reliable, we take

the day-of-week effect into consideration. Next, we employ SVM to forecast stock market trends, and make an adjustment to

real market situations by use of a rolling window approach, and then compare the accuracy with the baseline method.

Moreover, the prediction results are used to instruct investment decisions, and the performance of three different trading

strategies are evaluated and compared. The overview of the stock market prediction architecture is illustrated in Fig. 1.

2.1. Investor Sentiment:

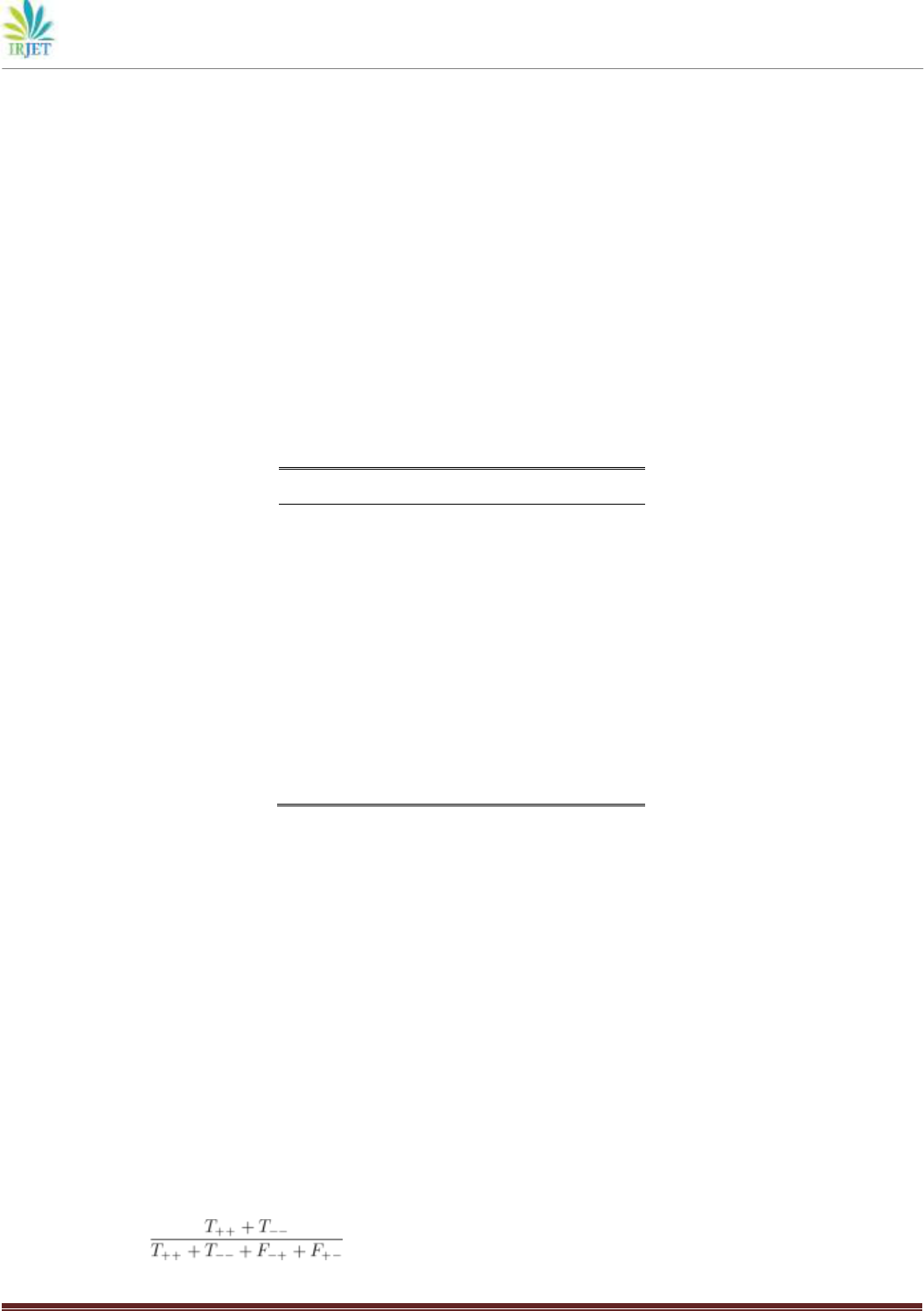

Step1 Web crawler In this step, we aim to build a web crawler to automatically download the targeted textual documents from

the Internet and store them to a database for further processing. The framework is clarified in Fig. 2. The web crawler begins

with the seeds in the form of a list of URLs. The scheduler manages the queue of URLs, deciding the priority and eliminating

duplicate parts. Next, the downloader is responsible for acquiring the web pages from the Internet and providing them to the

spider, which is used to parse the pages and extract the targeted contents. What we need to obtain is comprised of two sections:

one is the textual news with the date from the websites, and

This section is made up of three steps. We first build a web crawler to download news documents automatically from the

Internet, and then construct daily sentiment indexes based on

step 2: Sentiment calculation: we can compute 51 sentiment indexes for 51 stocks. In Step 2, we first segment each document

into several sentences by identifying punctuations, such as “,” “.” and “!” Then sentences are divided into separate words, and if

there appears a negative word, it is treated as a whole with the word next to it. For example, if people say “(I’m not satisfied

with the stock),” after word segmentation, the sentence becomes four words “(I’m)” “(not)” “(satisfied with)” “(the)” “(stock).” If

International Research Journal of Engineering and Technology (IRJET) e-ISSN: 2395-0056

Volume: 07 Issue: 03 | Mar 2020 www.irjet.net p-ISSN: 2395-0072

© 2020, IRJET | Impact Factor value: 7.34 | ISO 9001:2008 Certified Journal | Page 805

we directly project the words to the sentiment space, the program will tell us the sentence is optimistic because of the positive

word “(satisfied with).” So, we need to treat “(not)” “(satisfied with)” as a whole “(not satisfied with)” so that we can find the

true meaning. Then, we need to categorize each document, assume there are p

i

positive sentences and n

i

negative sentences in

document i; if p

i

> n

i

, the document is positive; if p

i

= n

i

, the document is neutral; if p

i

< n

i

, the document is negative. And, then we

find on the day t, the number of positive comments is M

t

bull

and the number of negative comments is M

t

bear

, so a daily sentiment

index is calculated by using formula (1), with the value ranging from –1 to 1, where 0 means people hold a neutral position.

And, if the value is between 0 and 1, it means people hold a positive view; if the value is between –1 and 0, it means people take

a negative view. Then, by considering the day-of-week effec

Step 3 Modified sentiment: The day-of-week effect is one of the most well-known financial anomalies [5], which means that the

average return on a Monday is much lower than that on the other days of the week. The reason includes that large amount of

news is reported on the weekend or on Friday just after the market is closed. With such considerable and valuable information

to deal with, investors are very likely to change their mind and take actions on Mondays. Furthermore, corporations also tend

to release important news on the weekend to ensure the stability of the stock and boost the public image. If it is bad news,

investors will have enough time to digest and accept it, whereas if it is good news, companies can continuously spread out news

to make it known by more and more people and expand their coverage.

TABLE II DESCRIPTION OF EIGHT FEATURES

Features

Description

s1

The average of modified sentiment

indexes

s2

The highest of modified sentiment

indexes

s3

The lowest of modified sentiment

indexes

s4

The median of modified sentiment

indexes

s5

The value between the highest and the

lowest

s6

The change of the average

s7

The percentage of the average change

s8

The standard deviation of modified

sentiment indexes

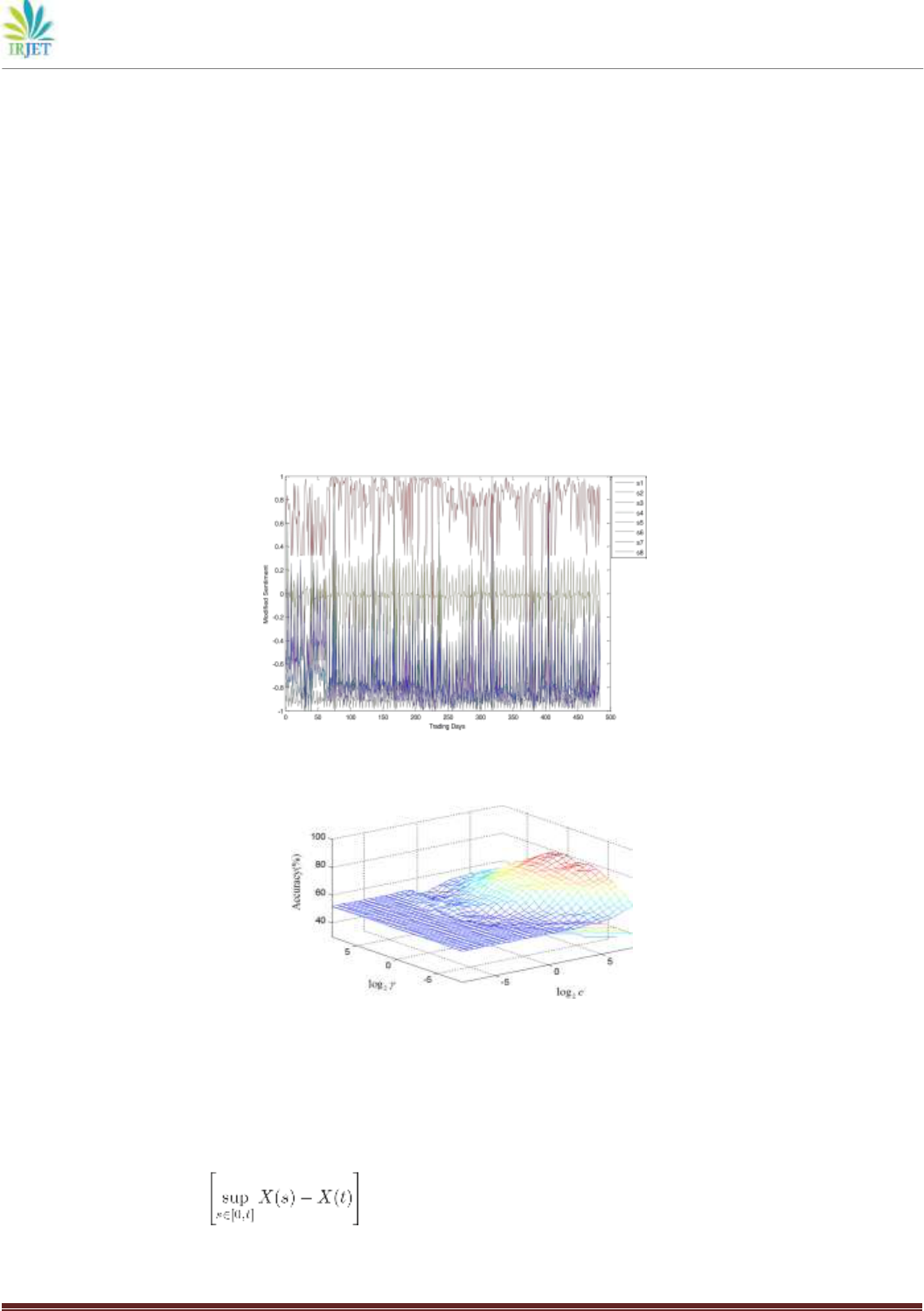

sentiment indexes, the median of modified sentiment indexes, the average of modified sentiment indexes, the difference

between the highest and the lowest, the change of the average (a certain day’s average minus the last day’s average), the

percentage of the average change (a certain day’s average minus the last day’s average and divided by the last day’s average),

and the standard deviation of 51 modified sentiment indexes. Table II describes eight selected features. Fig. 3 sheds light on the

trend of the 8 variables after standardization in 484 trading days.

2.2 Prediction:

First, we need to label the data according to the following equation:

Label = 1, Close

t−

1 <Close

t (16)

−1, Close

t

−1 >Close

t

where Close

t

denotes the close price of the SSE 50 Index, and Close

t

−1 stands for the close price on the previous day. Besides, 1

also means buy order as it indicates the increase, whereas −1 means sell order as it implies the decline.

Next, we implement two experiments to predict the index movement direction. Experiment 1 is to use market data, which

include opening price, closing price, high for the day, low for the day, trading volume in number of shares, trading volume in

RMB, change in RMB, and change in percentage. And then, we combine them with sentiment features for Experiment 2. We

employ classification accuracy Acc to assess the performance, as shown in the following equation:

Acc = (17)

International Research Journal of Engineering and Technology (IRJET) e-ISSN: 2395-0056

Volume: 07 Issue: 03 | Mar 2020 www.irjet.net p-ISSN: 2395-0072

© 2020, IRJET | Impact Factor value: 7.34 | ISO 9001:2008 Certified Journal | Page 806

where T

++

denotes that the true value is +1 and the prediction value is also +1; T−−denotes that the true value is −1 and the

prediction value is also −1;F

+

−denotes that the true value is +1, whereas the prediction value is –1;F−+ denotes that the true

value is −1, whereas the prediction value is +1.

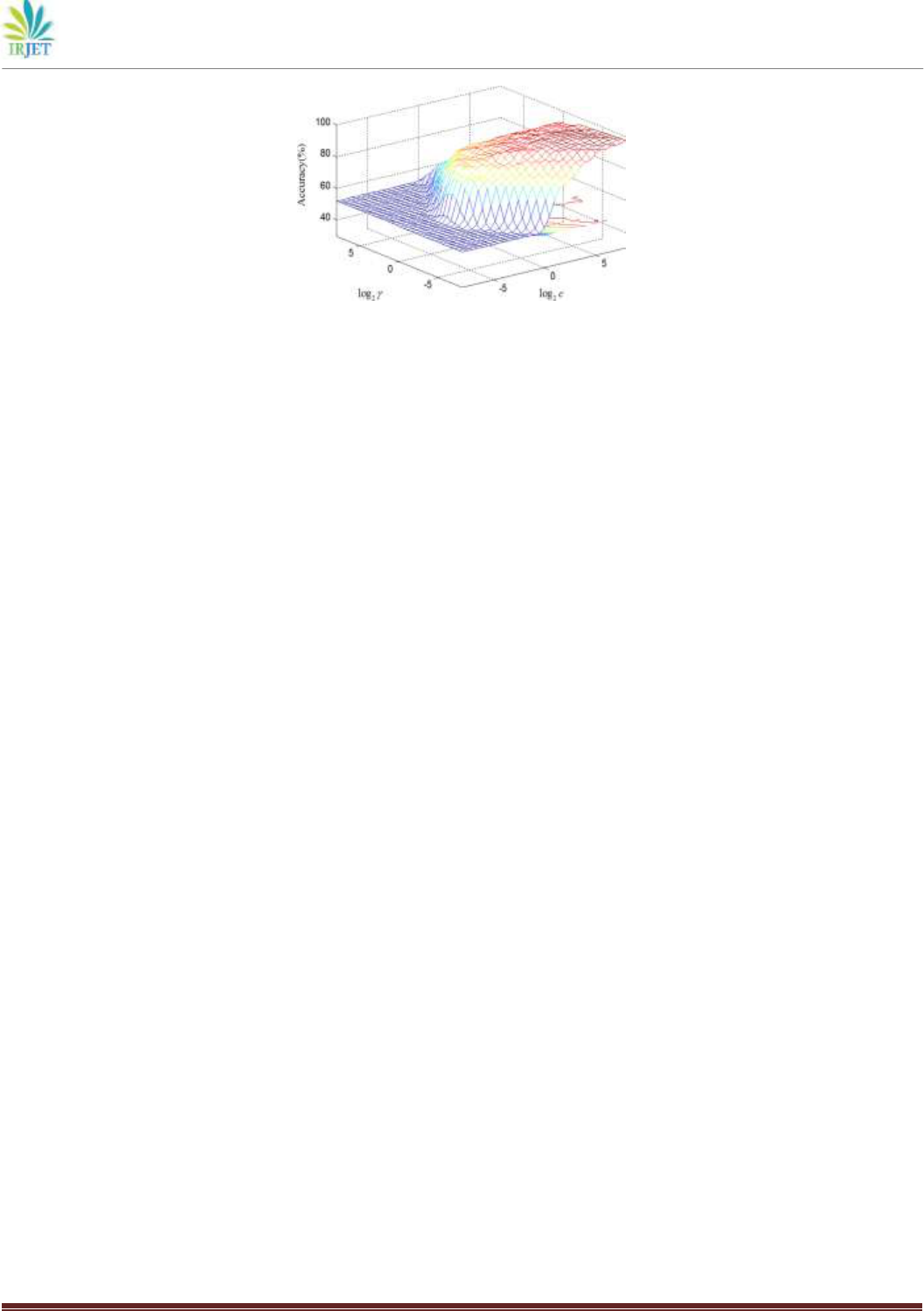

A fivefold cross-validation approach is adapted to train an SVM model. Eventually, we find the proper parameters and the

kernel functions to achieve the best performance. Figs. 4 and 5 document the processes of parameter selection. Panel A of Table

III sheds light on the prediction results. For Experiment 1, the accuracy can be 79.96%, and we use RBF kernel function, C =

256,γ = 0.9942; for Experiment 2, the accuracy can be as high as 97.73%, and we employ RBF kernel function, C = 181.0193,γ =

0.005524.

However, the two kinds of methods cannot be applied in forecasting stock market movement direction for the reason that they

lead to look-ahead bias, which is created by the use of information or data that would not have been known or available during

the period being analyzed. For example, we have some data from January to May, and implement the fivefold cross validation

approach. When we use the data from February to May as training set and the data in January as testing set, it is impossible

because in January, we will never know what will happen from February to May. On the other hand, that does not mean the

method is useless, and it is an important procedure to select the proper kernel functions and parameters as well as address the

overfitting problem. In other words, the purpose of the procedure is not to forecast but select the proper kernel functions and

parameters.

3. Sentiment features in trading days:

4. Investment Performance:

This section tries to discover if the prediction results are of benefit to the investment. Some measures are employed to evaluate

and compare the performance of the methods. AI is computed based on the stock points. For example, if we buy a stock at the

price of 100 and sell it at 150, then we earn 50 stock points and AI is 50 stock points; after that, we short the equity at 150 and

liquidate the position at 120, then we make 30 stock points and AI becomes 80 stock points. Maximum drawdown (MDD) is the

maximum decline of a series from a peak to a trough over a specified time period [26]. MDD at

time T is expressed as

MDD = sup(18)

t∈[0,T ]

International Research Journal of Engineering and Technology (IRJET) e-ISSN: 2395-0056

Volume: 07 Issue: 03 | Mar 2020 www.irjet.net p-ISSN: 2395-0072

© 2020, IRJET | Impact Factor value: 7.34 | ISO 9001:2008 Certified Journal | Page 807

5. CONCLUSION AND FUTURE WORK

In this paper, we aim to exploit investor sentiment to forecast stock market movement direction by emphasizing the role of

investors. Investor psychology drives the stock market [1] and it matters for our research. Accordingly, user-generated content

on the Internet provides a precious source to reflect investor psychology. Sentiment analysis is used to convert unstructured

textual documents into daily sentiment indexes. Furthermore, the financial anomaly day-of-week effect that means the average

return on Mondays is much lower than that on the other days of the week probably influences the precision of the sentiment

indexes, so we adjust the indexes by introducing an exponential function on past sentiment changes on weekends and then

generalize to holidays. Correspondingly, Sina Finance and Eastmoney, two typical financial websites, were selected as

experimental platforms to obtain a corpus of financial review data. Then, the machine learning model SVM is employed to

predict a very important index in China, the SSE 50 Index, by implementing fivefold cross validation and a realistic rolling

window approach. Empirical results illustrate that combining sentiment features with stock market data can achieve a much

better performance than just using stock

REFERENCES

1. R. J. Shiller, Irrational Exuberance. Princeton, NJ, USA: Princeton Univ. Press, 2000.

2. I. Perikos and I. Hatzilygeroudis, “Recognizing emotions in text using ensemble of classifiers,” Eng. Appl. Artif. Intell., vol.

51, pp. 191–201, 2016.

3. B. Wu, X. Zhou, Q. Jin, F. Lin, and H. Leung, “Analyzing social roles based on a hierarchical model and data mining for

collective decisionmaking support,” IEEE Syst. J., vol. 11, no. 1, pp. 356–365, Mar. 2017.

4. B.LiuandL.Zhang,“Asurveyofopinionminingandsentimentanalysis,” Mining Text Data. New York, NY, USA: Springer, 2012.

5. R. J. Shiller, “From efficient markets theory to behavioral finance,” J. Econ. Perspectives, vol. 17, no. 1, pp. 83–104, 2003.

6. F. C. Kelly, Why You Win or Lose: The Psychology of Speculation. North Chelmsford, Massachusetts, USA: Courier Corp.,

2003.

7. E. D. Maberly, “Eureka! Eureka! Discovery of the monday effect belongs to the ancient scribes,” Financial Anal. J., vol. 51, pp.

10–11, 1995.

8. J. Zhang, Y. Lai, and J. Lin, “The day-of-the-week effects of stock markets in different countries,” Finance Res. Lett., vol. 20,

pp. 47–62, 2017.

9. W.Huang,Y.Nakamori,andS.-Y.Wang,“Forecastingstockmarketmovement direction with support vector machine,” Comput.

Oper. Res., vol. 32, no. 10, pp. 2513–2522, 2005.

10. L. Yu, H. Chen, S. Wang, and K. K. Lai, “Evolving least squares support vector machines for stock market trend mining,” IEEE

Trans. Evol. Comput., vol. 13, no. 1, pp. 87–102, 2009.

11. C. C. Aggarwal and C. Zhai, Mining Text Data. New York, NY, USA: Springer, 2012.

12. X. Li, H. Xie, L. Chen, J. Wang, and X. Deng, “News impact on stock price return via sentiment analysis,” Knowl.-Based Syst.,

vol. 69, pp. 14–23, 2014.

13. M. Baker and J. Wurgler, “Investor sentiment and the cross-section of stock returns,” J. Finance, vol. 61, no. 4, pp. 1645–

1680, 2006.

International Research Journal of Engineering and Technology (IRJET) e-ISSN: 2395-0056

Volume: 07 Issue: 03 | Mar 2020 www.irjet.net p-ISSN: 2395-0072

© 2020, IRJET | Impact Factor value: 7.34 | ISO 9001:2008 Certified Journal | Page 808

14. A. Edmans, D. Garcia, and Ø. Norli, “Sports sentiment and stock returns,” J. Finance, vol. 62, no. 4, pp. 1967–1998, 2007.

15. P. C. Tetlock, “Giving content to investor sentiment: The role of media in the stock market,” J. Finance, vol. 62, no. 3, pp.

1139–1168, 2007.

16. J. Bollen, H. Mao, and X. Zeng, “Twitter mood predicts the stock market,” J. Comput. Sci., vol. 2, no. 1, pp. 1–8, 2011.

17. R. A. Gillam, J. B. Guerard, and R. Cahan, “News volume information: Beyond earnings forecasting in a global stock selection

model,” Int. J. Forecast., vol. 31, no. 2, pp. 575–581, 2015.

18. N. Oliveira, P. Cortez, and N. Areal, “Stock market sentiment lexicon acquisition using microblogging data and statistical

measures,” Decis. Support Syst., vol. 85, pp. 62–73, 2016.

19. V. Vapnik, The Nature of Statistical Learning Theory. New York, NY, USA: Springer, 2013.

20. M. Cecchini, H. Aytug, G. J. Koehler, and P. Pathak, “Detecting management fraud in public companies,” Manage. Sci., vol. 56,

no. 7, pp. 1146–1160, 2010.

21. Y. Kara, M. A. Boyacioglu, and O. K. Baykan, “Predicting direction of¨ stock price index movement using artificial neural

networks and support vector machines: The sample of the Istanbul stock exchange,” Expert Syst. Appl., vol. 38, no. 5, pp.

5311–5319, 2011.

22. P.-F. Pai and C.-S. Lin, “A hybrid ARIMA and support vector machines model in stock price forecasting,” Omega, vol. 33, no.

6, pp. 497–505, 2005.

23. D. D. Wu, L. Zheng, and D. L. Olson, “A decision support approach for online stock forum sentiment analysis,” IEEE Trans.

Syst., Man, Cybern., Syst., vol. 44, no. 8, pp. 1077–1087, Aug. 2014.

24. Z. Dong, Q. Dong, and C. Hao, “HowNet and its computation of meaning,” in Proc. 23rd Int. Conf. Comput. Linguistics,

Demonstrations, 2010, pp. 53–56.

25. N. Barberis, R. Greenwood, L. Jin, and A. Shleifer, “X-CAPM: An extrapolative capital asset pricing model,” J. Financial Econ.,

vol. 115, no. 1, pp. 1–24, 2015.

26. M. Magdon-Ismail, A. F. Atiya, A. Pratap, and Y. S. Abu-Mostafa, “On the maximum drawdown of a Brownian motion,” J. Appl.

Probab., vol. 41, no. 1, pp. 147–161, 2004.

27. W. F. Sharpe, “The sharpe ratio,” J. Portfolio Manage., vol. 21, no. 1, pp. 49–58, 1994.

28. V. Shukla, G. Auriol, and K. W. Hipel, “Multicriteria decision-making methodology for systems engineering,” IEEE Syst. J., vol.

10, no. 1, pp. 4–14, Mar. 2016.